In a Nutshell: Payoff is a lender that adds a personal element to helping its customers out of credit card debt. Applying psychological principles to finances, Payoff’s team of PhDs used their analytic expertise to create an online quiz that breaks people into 10 Financial Personalities. Assessing the strengths and weaknesses of each personality type, the results of this quiz offers insight into how innate traits can impact behavior. Payoff then uses its understanding of your individual perspective to empower you to reach financial wellness.

Whether it’s “What Disney Villain Are You” or “Who’s Your Celebrity Chef Soulmate,” online personality quizzes are just plain fun. We share them with friends, post our results on social media, and then forget about them. But what if the results of an online quiz could help us in our daily lives? What if self-knowledge could better our finances?

That question intrigued Payoff, a lender aimed at customers carrying between $5,000 and $25,000 in credit card debt. This company believes that it can teach people to have better financial habits.

Where the study of psychology and finances meet, you’ll find Payoff’s Empowerment Science team. These highly educated neuroscientists, statisticians, astrophysicists, linguists and other specialists come together under the direction of Chief Science Officer Galen Buckwalter.

Now at Payoff, Dr. Buckwalter got his start by inventing the algorithm that eHarmony uses to match couples.

Dr. Buckwalter got his PhD in psychology and dedicated his life to using psychological principles to help people. He made his name by inventing the “Love Patent,” the algorithm that eHarmony uses to match couples online.

From eHarmony to Payoff, Galen says the thread that follows throughout his career is metric assessment. Basically, he measures latent traits and applies them to behavioral patterns. In the realm of finance, his research culminated in the Financial Personality Quiz currently taking the website by storm. Through this quiz, Payoff can personalize how it handles its members.

“People don’t think about the brain when they think about money,” Galen says, but he believes that they should.

Galen Solves Problems Like Couple Compatibility and Financial Stress Using Psychology

Galen’s passion for human psychology has taken him from academic research on Alzheimer’s disease all the way to heading up a science team interested in how financial stress affects the brain.

Decades back, Galen got into metric analysis in the private industry through a colleague’s dilemma. A couples therapist found many personality mismatches in marriages and wondered if there was anything that could be done. Galen’s solution: If couples could be matched systematically through innate compatibility, successful relationships would be more likely.

“Long story short, I developed an instrument for him that assessed and predicted marital satisfaction and then we applied that to singles and voila: eHarmony was born.” He reflects, “So that was a great way to get introduced to doing research on the internet.”

The metric analysis of personalities has a lot of potential online, even beyond relationships. Such data can provide insight on a variety of topics, with applications for consumers and companies. “In the case of Payoff, it can really help what I’ve come to see as one of the foundational problems that’s confronting us in Western culture: financial stress.”

The balloons in Payoff’s logo represent the freedom, optimism, and celebration that this empowerment company brings its members.

The Empowerment Science team analyzes not just what causes stress, but what that stress looks like and how people cope with it. Galen says this is a new frontier in psychology, largely neglected in psychological research.

“It’s profound what people are going through, and I think we have a real opportunity to use psychometrics in this context to help people,” he says.

Rather than the one-size-fits all approach of most banks and financial institutions, Payoff takes individual personality differences into account. In this way it’s very different from the average lender.

Personality Meets Money in 10 Financial Personality Types

From how tidy, how loving, or how extroverted a person claims to be, Payoff puts together a complete profile of financial tendencies.

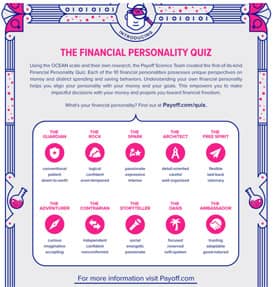

With only five questions, this quiz might seem simple, but it’s the result of years of research. Based on well-known psychological principles, the test uses the “Big Five” personality traits, also known as the OCEAN model: openness, conscientiousness, extroversion, agreeableness, neuroticism. These five dimensions are stable and consistent, serving as an ideal foundation for the 10 Financial Personalities.

After only five questions, the Financial Personality Quiz can determine which of 10 personality types fits you.

One of the ways the test distinguishes the test-taker is by assessing what makes that individual distinct, what trait stands out. If you are uncommonly calm, outrageously energetic, or incredibly loving, such above-average results tell the Payoff science team which financial personality best describes you.

“That has proven to be incredibly valuable and very robust in the research that we’ve done,” Galen says. “We see really large and consistent differences between these groups.”

Your core values, the unique way of thinking that makes you you, influences your financial decisions. The results of the quiz aim to help individuals map out their behaviors, finding patterns and offering solutions to get them to a better financial state.

“By helping people understand their personalities we’ve given them a new way of understanding their financial strengths and weaknesses,” he explains.

Payoff’s advice varies from personality to personality. Describing how personality traits translate to finances, Galen tells us that he’s an Adventurer, high in openness, not a spendthrift, and eager for new ideas or experiences.

“I lose all track of money if I get excited about something. That’s me to a tee.” He laughs, “I hate to go shopping, but don’t let me in a bookstore!”

The Science Team Crunches Data to Discover Patterns and Draw Conclusions About Financial Stability

It’s difficult to measure aspects of the mind, but with a systematic, rigorous, and creative approach, Galen and his team came up with 10 Financial Personality profiles.

Payoff’s science team are hardcore data crunchers, using technology to find associations, analyze raw data, and form increasingly refined predictive algorithms. On the backend of the website, data is constantly being taken in and evaluated.

Data from thousands of respondents was quantified to form the Financial Personality Quiz.

Galen is interested in looking at exactly how people take the quiz online, how long they take on a question, if they go back, if they change their answers, etc. “The test taking style is very informative to us about the personalities,” he says. As technology advances, their methods evolve to stay on the forefront of data collection.

Over time, Payoff hopes to further implicit methods of assessing personality so that instead of being asked questions, a customer can be categorized through more normal interactions on the site. This means using advanced techniques to analyze things like word choice.

“Even a couple years from now, most of personality assessment is going to be taken from the text that people produce,” Galen predicts, adding, “The words we generate are very much a reflection of our personality.”

What the Empowerment Science team does is by no means simple, but Galen chalks it all up to seeking self-knowledge. “It all boils down to understanding the brain and how the brain interacts with money.”

Galen Dives Into His Work with Passion and Curiosity

“I’m so fortunate because the CEO has really been generous in giving me the freedom to think,” Payoff’s Chief Science Officer says. Besides some light administrative duties, he spends his hours pondering research questions and forming cogent arguments.

Dr. Buckwalter loves developing new theories and assessments every day for his job.

“We’re very excited to be doing what we’re doing. It feels very much like it’s all our purpose right now, which makes it a whole lot more enjoyable to go into work.”

His new project focuses on the interaction between emotional intelligence and finances. Eager to learn, Galen immerses himself in existing literature and comes up with tests centered around emotional intelligence.

His Adventurer nature comes out when he gushes about this latest endeavor and its potential for Payoff.

“Emotional intelligence is a hugely important predictor of how people handle and how well they do with finances,” Galen says. “But the really cool thing about EQ is how trainable it is.”

This opens up a wealth of opportunity. Could teaching people emotional cues actually help them improve their finances? Theoretically, the Payoff science team thinks it’s very possible.

It’s no wonder Galen loves his job. “I get to sit around a read and start to put together arguments around this and see if I can convince both other scientists as well as the product people as to what’s going to be most useful in moving toward real products. So yeah I have the best job in the world.”

A Lender that Cares: Payoff’s Products and Services Usher You Toward Financial Wellness

The ultimate pay off is customer satisfaction and empowerment. Sarah Weissman, Content and Communications Director at Payoff, outlines the company’s goals: “What Galen and his team do here is focus on creating and really implementing pathways to financial wellness.”

Sarah asserts that financial problems are resolvable, and the Empowerment Science team has been tasked with discovering how to make that possible through understanding personality.

By increasing self-knowledge, Payoff hopes to help you reach healthy spending habits and stress-free finances.

“The broad picture at Payoff that really guides everything,” Galen explains, “is does it help people get out of debt and move them toward financial wellness.”

That’s the crux of the website’s every quiz, loan, and blog post. This dynamic team is intent upon training better spending habits and improving an individual’s relationship with money.

“We really encourage people to look at their finances in the context of who they are,” Galen comments, “through their personality, what their financial strengths and weaknesses are, and what their greater purpose is.”

By critically examining these constructs, Americans can start on a journey toward paying off credit card debt and becoming a better financier. The key is self-awareness, which Payoff provides using a rigorous research and a quick quiz.

“Our goal is to get people right with money,” Sarah says. “We are committed to making people’s lives better, and financial wellness is a very significant component to that. And without Galen’s team, frankly, it wouldn’t be possible.”

Bridging the Gap Between Psychology & Finances

Payoff’s services are based on the premise that financial health is a learned behavior. With the goal of widespread financial wellness, this company strives for better and better insight into how personality affects spending, saving, and debt. The application of psychology to the financial sector makes Payoff uniquely helpful and instructive for anyone battling credit card debt.

Even though society relies upon money, humans are not inborn with the ability to handle their finances. Money is still a new phenomenon in the course of human evolution, and our brains haven’t yet adapted to it. Because of that, we have to consciously train ourselves to keep our spending and saving on track.

“We can’t rely on our instincts, because our instincts haven’t caught up,” Galen tells us.

Payoff, with the backing of Galen’s team, aims to bridge the gap by connecting psychology to finances for its customers. With its holistic approach, this company gives you more than just a loan: it gives you greater self-knowledge and a pathway to financial well-being.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.