In a Nutshell: In less than 15 minutes, you can apply for and receive pre-approved loan options from a nearby dealership through Auto Credit Express. It has built out the nation’s largest network of dealerships and lenders that specialize in bad credit auto financing to provide new and used cars to people who otherwise might not be able to finance them. With customer service at the forefront of the experience, Auto Credit Express makes car buying pleasurable and fun like it is supposed to be.

Finding the car of your dreams can be hard enough, but finding it within your budget can be even more difficult. When you have less than stellar credit, getting financing for any car can be nearly impossible.

Luckily, Auto Credit Express bridges the gap between special financing and dealerships to provide individuals with a solution to their car-buying woes.

After a quick and easy 3-minute application online, a dealership nearby receives and reviews the application before calling the customer as early as 10 minutes later with pre-approved financing options, said Julie Costa, Director of Business Development for Auto Credit Express at its headquarters in Auburn Hills, Michigan.

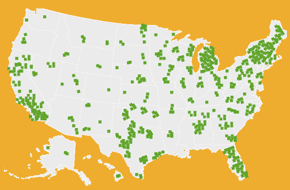

Auto Credit Express offers the largest source of subprime options with more than 1200 dealership and lender partners across the U.S. and Canada that it has specifically trained in bad credit lending to ensure the best fit for any credit situation.

Truly Committed to Top-Notch Customer Service

Since 1999, the company has operated on four core values: to help others, to do the right thing, to bring the right energy, and to win the fight fairly. Based on those principles, Auto Credit Express works to provide the best option for every subprime credit situation.

“They did everything they could do to get me in that car, and they did,” Thomas said of his experience working with an Auto Credit Express dealership partner in Southgate, Michigan.

Julie has been with the company for 13 years, and in that time the customer feedback she has received cites how friendly, helpful, and easy to work with the Auto Credit Express team is, attributes that are especially relevant when working with bad credit customers who are so frequently rejected.

After working with a Detroit Auto Credit Express team, Thelma was just thankful to be treated “like a customer, not a number.”

Auto Credit Express boasts an A+ rating with the Better Business Bureau and holds a 9.1/10 with nearly 140 reviews on TrustPilot, all while maintaining steady growth to remain the largest special financing option in the auto Auto Credit Express.

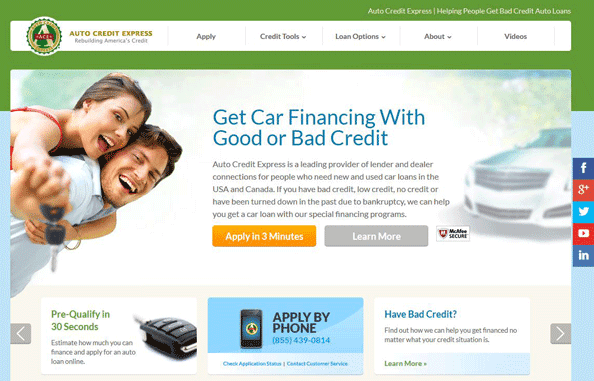

How the Auto Credit Express Loan-Matching Service Works

Auto Credit Express was founded by Rich LaLonde, who as a CPA, tried to help people make the most of their money. He began working as a dealership accountant, and it wasn’t long before he worked his way up to VP of the dealership.

Once Rich realized he had a real company on his hands, he wanted to make sure it was as seamless as possible.

A Simple 3-Step Application Process

- Potential customers can fill out a short and secure application online in just three minutes or call in to the Auto Credit Express customer care line to speak with a real person.

- Instantaneously, a nearby dealership partner with the best pre-approved loan match for the credit situation calls the customer, a process that takes less than 10 minutes.

- The customer is invited to meet with their personal Special Finance expert to review the best loan options for their needs. The customers are often able to secure financing and drive away the same day.

Auto Credit Express allows consumers to check for nearby loan options from the comfort of their home.

Since different lenders are matched with different dealerships in each area, customers are sure to have the best choice in nearby lending options.

Humble Beginnings Rooted in Helping Others

Along the way, Rich noticed a severe lack of help for those seeking special financing as is the case for people with subprime credit, typically a credit score of less than 630.

Auto Credit Express has proudly expanded well beyond its headquartered office in Auburn Hills, Michigan.

Rich knew the best practices for special financing scenarios, so he built out a small team to take on the road in order to train other dealerships to handle subprime credit cases.

These training teams became so important to the dealerships that the dealerships themselves asked Rich to keep some of his team members on staff. Knowing that it would end up helping even more people, Rich agreed, and the concept of Auto Credit Express was born.

Expanded Locations Provide More Choices for Customers

At almost 20 years later, Auto Credit Express’s passion for helping others has attributed to their growing network of more than 1200 dealerships, with locations in every U.S. state and Canadian province. Plus, more dealerships and lending partners are reviewed, trained, and added regularly, which means Auto Credit Express can offer the largest selection of subprime car dealers and lending options.

Auto Credit Express boasts the largest network of subprime credit dealerships across the country.

Throughout its explosive trajectory, Auto Credit Express is still owned and operated by Rich and his family along with assistance from those who share his vision to aid in the credit repair process through properly matched vehicle financing.

Auto Credit Express helps, on average, about 130,000 customers a month get into a vehicle they never thought possible thanks to the partnered relationships it has fostered with dealers and lenders.

Auto Credit Express Wants to Help Rebuild Subprime Credit

The ultimate goal of Auto Credit Express is to give the consumer another chance at getting into a reliable car and repairing their credit.

“We actually care about the consumer,” said Julie of why she’s proud to be an Auto Credit Express employee. “We want to help them get through their credit issues and be able to walk into a dealership one day and purchase a vehicle on their own.”

Nearly 2 million people have been able to purchase new and used cars by using the loan and dealership matching service Auto Credit Express provides consumers. A statistic Julie and Auto Credit Express expect to grow as the company seeks to “rebuild America’s credit.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.