In a Nutshell: Since the COVID-19 pandemic began, the British government and the British Business Bank have designed loans to mitigate the impact on businesses. Small businesses can access government-guaranteed loans that help them keep their operations running — even if not physically. Larger organizations also have access to working capital to maintain operations and help the economy as a whole. In the future, businesses will have access to more funding based on pre-pandemic performance.

The COVID-19 pandemic had an unprecedented economic impact around the world — especially on small businesses. Goldman Sachs reported in September 2020 that nearly two-thirds of SMBs in the UK saw a drop in revenue but remained stable.

During the first months of the crisis, many SMBs found the support they needed through government assistance.

The majority of businesses respondents in the Goldman Sachs report had access to government support programs, and 98% of them said those programs had a positive impact. Another 80% of respondents said that the support helped them weather the economic turmoil of the pandemic.

The United Kingdom was at the forefront of the business support movement and got assistance programs up and running quickly.

“The first thing that happened was Budget 2020 by the Chancellor of the Exchequer, and he announced that we’d be launching a new Coronavirus Business Interruption Loan Scheme less than a fortnight later,” said Scott Shearer, Senior Manager of Corporate Communications at the British Business Bank. “It normally takes about six months to launch one of these schemes, and we launched four schemes over a six-week period.”

That fast rollout ensured small businesses received the support they needed to deal with pressing financial concerns. Thanks to the government-guaranteed loans, entrepreneurs not only enjoyed a safety net against hardship, but some are now well-positioned for growth as the economy begins to rebound.

And the economic future looks bright in the UK with additional recovery and small business loans becoming available post-pandemic.

Risk-Sharing Approach Expands Eligibility for SMBs

Before the pandemic, the UK Government had in place a loan program, the Enterprise Finance Guarantee, designed to support businesses that may have been turned down by a traditional bank. For example, some may have lacked long financial histories, or they didn’t have the required amount of collateral for a loan.

The government helped those businesses by sharing the risk with the lending bank, providing a 75% guarantee on individual loans. The objective was to tip decisions in favor of struggling operations.

“The first pandemic scheme, Coronavirus Business Interruption Loan Scheme, was set up on very similar rails,” Shearer said. “It was an 80% guarantee. The government would also effectively pay the businesses’ interest and fees for the first year.”

At the term’s conclusion, the business is still liable for the loan. But in the case of inability to repay, the government will cover 80% of the outstanding amount for the bank. While it was a helpful safety net for businesses and banks, it wasn’t without some issues.

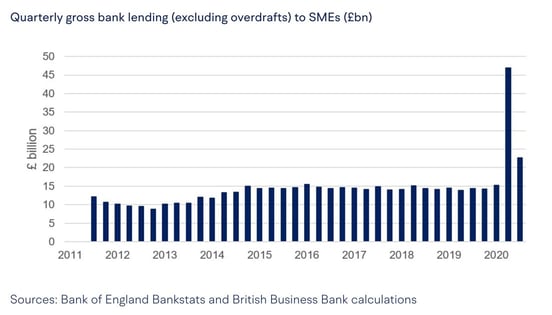

Business lending in the UK skyrocketed in early 2020 as the COVID-19 pandemic began.

“It was a good scheme, and it has introduced some relief for some businesses,” Shearer said. “The main issue was that it wasn’t as quick as the government needed it to be. So having learned the lesson of that, the government then produced a second scheme called the Bounce Back Loan Scheme.”

The CBILS scheme involved traditional commercial loans, and the banks had to assess applicant history, risk, and ability to repay. Under the Bounce Back Loans Scheme, however, all loans were self-certified by the business to expedite the lending process, and the application only included seven questions.

“That was to inject money straight in,” Shearer said. “The government was prepared to accept the risk involved to get the money out to businesses quickly. This has been very successful. Of the £75 billion provided across all the schemes, around £56 billion has gone through that scheme.”

Shearer said the loans had benefited some 1.6 million businesses — about a quarter of the UK’s business population. And many of those would have had nowhere else to turn for funding.

“I think it gave people a fighting chance,” he said.

Government Guarantees Also Assist Large Businesses

Ensuring the stability and viability of small businesses extends beyond supporting them directly. All companies exist within the larger economy, which also felt the negative impact of the COVID-19 pandemic. That’s why the UK government-directed aid to larger enterprises as well.

“There are two other schemes that we launched,” Shearer said. “One was the CBILS, which was a larger version of the Coronavirus Business Interruption Loan Scheme.”

Although the scheme didn’t include interest payments made by the government, it did offer an 80% guarantee. That helped companies qualify for a loan from their bank that they might otherwise have struggled to access.

“We also produced the Future Fund, and those are convertible loans,” Shearer said. “A lead investor would need to provide match funding alongside the Bank and the company needed to have had a significant previous investment, and we’d lend the money to get you through, in terms of working capital. And if you didn’t pay back the loan, the state, via the bank, would have an equity share in your business at the end of it.”

The UK government helped stabilize businesses of various sizes amid an uncertain market and difficult-to-predict future. Many of those organizations have remained solvent and viable during the pandemic, giving the government time to devote more attention to the anticipated economic recovery.

Recovery Lending Overlooks Poor Pandemic Performance

An essential part of that recovery is the aptly named Recovery Loan Scheme, designed to help businesses rebound after the economic disruption caused by COVID-19.

“If people can afford to take out additional debt for cash flow or investment, they might still be turned down by a bank because they’re not taking into account the effects of COVID-19,” Shearer said. “Then they’re going to be unable to get that type of lending again.”

The fact that banks consider business performance during the pandemic is addressed by the recovery loan scheme’s eligibility criteria. As a result, difficulties experienced due to external, uncontrollable stressors won’t count against these businesses trying to qualify for a loan.

The Recovery Loan Scheme aims to help businesses weather the pandemic and emerge stronger.

“They will look at you how you were, or how you might be, rather than just how you are,” Shearer said. “So the effects of the pandemic can be discounted when the lender is making its commercial decision about whether to lend.”

Those loans will be capped at £10 million with varying terms depending on how businesses plan to use the funds. The British Business Bank has seen thousands of organizations apply as lenders under this scheme, ensuring that the industry can handle the volume of applicants.

“We are rapidly accrediting lenders,” Shearer said. “And they will be all familiar names from the loan schemes they were operating due to the pandemic.”

British Business Bank Encourages Economic Growth

According to Goldman Sachs’ report, 78% of small business owners said they are optimistic about their futures, and 54% said they anticipate growth in turnover within the next 12 months.

“Ultimately, growth is going to be our way out of the downturn from COVID-19,” Shearer said. “And that’s what you need to get the economy back on track. You need to grow again.”

British Business Bank supports that growth in various areas through programs including peer-to-peer finance and venture investment.

The bank plans to continue catering to businesses of all sizes and need levels. One of those growing needs is the availability of private debt.

“We’ve had the market develop here,” Shearer said. “So the more complex debt funding that people might need, rather than just going into a bank and getting something off the shelf, is something we support. We’ve been a catalyst to help develop that sector in the UK.”

Beyond existing businesses, new businesses can also look forward to financial assistance through the Start Up Loan Program. It provides loans of up to 25,000 pounds at a fixed interest rate to entrepreneurs who might have been turned down by banks and need some additional help with their launch.

“We mentor them and provide that initial bit of money that some people would get from friends and family,” Shearer said. “But if you can’t draw on that, we step in to provide the capital you need. I think that kind of entrepreneurial spirit is really important. People who can spot opportunities to set up a business will be critical to the recovery, and we want to support them as much as we can.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.