In a Nutshell: The truth the old-school debt collection industry doesn’t understand is that most people want to pay their debts. TrueAccord counters debt collection industry stereotypes of threats and intimidation with a consumer-friendly, solutions-oriented approach that produces better results for everyone. The platform uses machine learning to deliver scalable yet personalized omnichannel outreach with actionable self-service solutions. TrueAccord is a recovery and collection solution that achieves the desired outcome without harming the business’s reputation and is a fit for any firm lending money to consumers directly or through business processes.

Life happens, and people who owe money need acceptance and flexibility to meet their obligations. That’s the mantra at TrueAccord, a full-service digital-first debt collection agency that puts consumers first.

TrueAccord uses sophisticated machine-learning algorithms plus a human touch to meet consumers where they are on their debt-payback journey with understanding and options. It turns out that using technology to treat people professionally and respectfully achieves better results for everyone.

CEO Mark Ravanesi said TrueAccord’s philosophy contrasts significantly with the threats and intimidation characterizing the old-school approach to debt collection.

“One of our cofounders had a bad experience with a balance collection issue, was getting hounded by the collection agencies, and realized there should be a better way to do this,” Ravanesi said. “We’ve pioneered doing collections digitally to build the industry’s leading consumer-centric brand.”

The thought behind the philosophy is that most people want to pay back their debts. Acknowledging that people occasionally fall on hard times busts obsolete debt-collection stigmas and shows consumers there’s a better way.

Success also depends on reaching people at scale, and omnichannel communications enable that. Machine learning capabilities then enable TrueAccord to offer solutions, not threats, to help more people resolve their debt constructively.

“If we engage someone via email or the web and then offer a payment program they can’t afford, we didn’t help them,” Ravanesi said. “We use our patented technology to create the best outcome for consumers.”

Hundreds of monthly reviews attest to TrueAccord’s effectiveness.

“People say they can’t believe they’re writing a thank you note to a debt collector, but we provided a great experience,” Ravanesi said. “We’re here obviously to provide a return to our investors, but at the end of the day, we’re helping millions of people.”

Content and Delivery Methodologies Drive Engagement

Ravanesi said the key is knowing what to say and when and where to say it. TrueAccord looks at solving the debt collection challenge as an email marketer would.

HeartBeat, the platform’s patented machine learning engine, creates a personalized journey for every consumer, optimizing the content, delivery time, and even the tone to optimize performance.

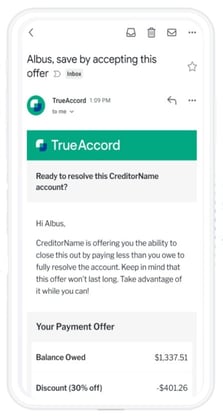

The first step focuses on getting the consumer’s attention. HeartBeat drives engagement by putting the company’s message front and center in the email inbox or other preferred channel. Email is the most commonly used channel because email messages are spacious and graphic, which makes them more effective.

“People are comfortable with email, so we use a lot of it,” Ravanesi said. “Our technology ensures messages land in the consumer’s inbox and we get the best chance that they open them.”

The second step is around content. TrueAccord has tested thousands of pieces of content to tailor messages based on response. HeartBeat doesn’t use demographic information, so canned and scripted communication becomes a thing of the past.

It works intuitively. For example, if TrueAccord sends a customer five emails and they open two, the platform then chooses emails they’re more likely to respond positively to. The system uses content tested over time to continue to refine how TrueAccord speaks to individual consumers.

Putting the right message in front of the consumer at the right time and on the right channel encourages self-service debt resolution. Ninety-six percent of TrueAccord consumers resolve their debts without interacting with a human being.

“The experience I would have would not be like yours,” Ravanesi said. “We’re different people, and we’re going to pick up on that and communicate in ways that will resonate with both of us.”

Repayment Plans Offer Consumers the Best Chance at Success

The third step is getting the consumer onto a repayment program that works and then helping them stay on it when they show they need the support.

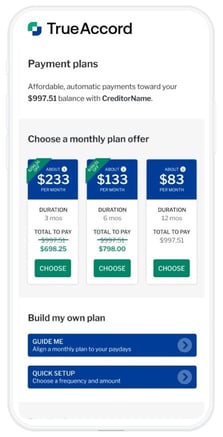

The platform often starts with three offers based on the consumer’s account balance. For smaller balances, the system offers an option with low payments over a more extended period, an offer to pay it all at a discount in one or two months, and an option somewhere in the middle.

The idea in every scenario is to offer multiple options and allow the consumer to choose what works best.

After a consumer signs up for a program, capabilities within the system can detect signs of stress that might indicate the consumer is about to fall off. The platform then reaches out with a revised solution to ensure they can continue paying off their debt.

“Depending on how the consumer interacts with payment programs on the website and how much time they’re spending there, we can further refine them or even offer them the ability to provide a custom amount,” Ravanesi said.

A successful outcome for a TrueAccord client aligns with a successful outcome for the consumer. Debt collection is a commission-based business. TrueAccord clients gain more bottom-line earnings when TrueAccord achieves a successful consumer resolution.

Consumers emerge from their debt collection experience recharged and ready to rebuild their credit. TrueAccord wins when both parties succeed. TrueAccord prides itself on its transparency and ownership in seeing consumers through to successfully resolving a situation that may have seemed hopeless.

“Our goal is to get consumers to engage with their financial situation,” Ravanesi said. “Making our consumers’ lives better improves the entire financial world.”

Supporting Consumer Financial Recovery

Consumer debt collection is a highly regulated industry, and clients flock to TrueAccord because they feel sure the company has compliance at its core.

TrueAccord is licensed, bonded, and insured. Its legal team stays abreast of regulatory change and case law to ensure policies and procedures remain within established bounds. It pledges complete compliance control and auditability in a constantly changing regulatory environment.

That commitment works in the consumer’s favor, too. That’s welcome, given the industry’s past reliance on strong-arm tactics. TrueAccord invests in that commitment as a pioneer in code-driven compliance.

“There’s no room for non-compliant solutions — our clients have a very low-risk appetite regarding their collection agency,” Ravanesi said. “We built code-driven compliance into the system to keep everything in line with federal, state, and local regulations.”

Regulations don’t necessarily change much on a high level, but there are many tweaks, evolutions, and state-level nuances. Meanwhile, data privacy is highly significant at the state level.

“We’ve invested a lot and continue to invest in our legal audit and compliance functions,” Ravanesi said. “We have what we believe to be the best team in the industry that keeps apprised of consumer and commercial regulation.

ROI suffers when companies use an agency that isn’t as compliance-oriented as TrueAccord. Success rates aren’t as high. Legal costs can skyrocket. Consumer complaints increase. The biggest hit companies take relates to business reputation. Ravanesi said that makes TrueAccord the clear choice for a growing number of compliance- and customer-focused clients.

“When companies work with a collection agency like ours that provides a great experience and helps people get back on their feet, consumers remember that fair treatment and are more likely to become customers again,” Ravanesi said.