In a Nutshell: Step gives parents a way to teach positive financial habits to their children while also building up their credit scores. Its dedicated card works like a secured card in that the child can only spend what has been deposited in the account. Step uses the deposited funds to automatically pay off the card every month, helping children build a steady payment history. The company provides innovative educational lessons through different mediums to teach children the importance of saving and credit. Step’s platform also allows children to invest in cryptocurrencies, with parent approval, and starting in February 2023, aims to do the same with stocks.

It’s hard to really feel like you are prepared for the world after leaving home and heading off to college. After 18 years of not having to worry about rent, bills, or credit, many young adults are thrust into a financial system that they need to learn fast, or risk making mistakes that follow them for years.

Some inexperienced college students will find themselves opening up multiple credit cards just to get by. Irresponsible use of credit cards can lead to high interest payments or derogatory marks on a credit report through collections notices.

Those marks can stay for up to seven years, creating roadblocks when you want to rent an apartment, lease a car, or buy a house. It’s a common issue the Step CEO and Founder wanted to solve.

CJ MacDonald launched Step as a way to encourage parents to think about finances before sending their children off into adulthood. As he was growing up, MacDonald never gained the financial literacy to understand what he should or should not be doing.

MacDonald took out credit cards because he thought that was what adults did. This led to MacDonald’s idea of wanting to build something to help teenagers develop their skills, through tools and hands-on learning while they’re still at home.

Step’s concept is simple: improve the financial future of the next generation. That also means involving parents in their childrens’ financial journey.

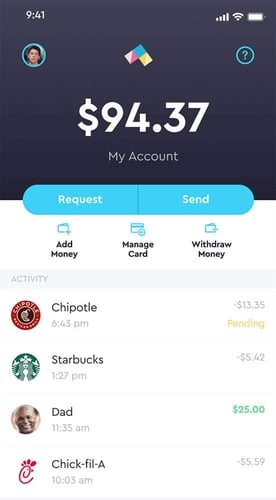

Step provides children with a spending card that works similarly to a secured credit card. Children can only spend what is in the account, and the company automatically pays off the card with the deposited amount every month, which allows users to build their credit history with Step’s Smart Pay technology.

Parents can monitor spending and set permissions on the card. Step’s technology allows teens to build a credit history before they even hit 18 years of age. The company said some teens go off to college with credit scores surpassing 700.

“Think about the impact their score has on their lives as they’re applying for student loans, taking up car insurance, or trying to rent in their apartment at school,” said Carter Hansen, Step’s Head of Marketing. “They stand to save a substantial amount of money because of what they’ve achieved with Step.”

Teaching Critical Financial Lessons Early

Step’s tools are designed for teens between the ages of 13 and 17, but parents can sign their children up for accounts even earlier than that. Step’s platform operates just like a credit card, but with protections.

Children make purchases on the Step Visa card, and at the end of the month, Step automatically pays off the balance using the funds in their deposit accounts. Because children can only spend what’s in the account, parents never have to worry about overdraft fees.

Kids are able to grow up with Step and learn about finances, credit, and budgeting. Parents can feel confident that when they send their child off to college, they won’t make the major financial mistakes so many young adults make.

As children use Step products to learn about finances and budgeting, they are also building their credit history. Step shares financial lessons through several mediums, including within its app, on social media.

Step makes it a point to teach financial literacy and sends ambassadors to multiple high schools each day to teach its financial literacy curriculum, Money 101, which is free and available to all. The company also holds school events that encourage children to sign up and learn about the card and win entry into StepFest, a one day music festival hosted at the winning high school. Last year the event was hosted by Charli D’Amelio and headlined by The Chainsmokers.

Teens saving up for a big purchase such as shoes or a video game, can use the Step app to monitor their savings and see how close they are to their goal. After saving the amount for the purchase, the teen gets to celebrate with family, and Step will be launching high-yield savings accounts within the next couple of months.

“Being able to have those tools and work with your parents at a young age allows families to grow with it,” Hansen said. “Those training wheels come off with every step they’re taking. And then at 18, they have a good foundation to understand all of the implications that go with being a financial adult.”

Creating a Card That Evolves With Families

Step created its products with teens between the ages of 13 and 17 in mind, but the company is looking to expand its lineup to reach people in age groups at either end of that demographic. Step wants its products to evolve with cardholders, which means supporting teens going off to college through new products and features that fit their lifestyle.

Parents can sign their children up for a card before they turn 13 to get a head start on building a foundation of financial literacy. Parents manage the account and control their childrens’ finances, including the card’s limit.

After their child turns 13, parents have the option of transitioning the account to allow the child to access the app and finances with parental supervision. The family system allows family members to transfer money into the child’s account even after the transition.

“We try to give them a safe environment to learn about finances as they grow,” Hansen said. “When they hit 18, they will have financial freedom alongside the foundation they built with their parents.”

Step said it constantly talks to users and sets up one-on-one interviews to gain insights on the company. The customer support team shares what it learns across the company, and the feedback helps improve its products and spurs the creation of new features.

The company said it makes sure to listen to new and old customers, as well as customers at different age ranges to understand how they can best accommodate cardholders and their parents.

“Parents are life instructors and we’re here to help facilitate that and give them a safe platform where children can learn about their finances,” Hansen said. “Parents can take the training wheels off as soon as they think their child is financially responsible.”

Educating Children on Investing and Cryptocurrencies

Step is trying to end the stigma of talking about finances among family members. The company said some parents don’t want to talk to their children about finances because they don’t have the education themselves.

As important as it is to teach children financial literacy, it is equally important to educate parents as well. Step makes it easy for parents to learn alongside their children by going through the process of obtaining and using the card.

Step also features an investing platform for children to use. The platform currently only has support for trading cryptocurrencies, but users will be able to invest in stocks starting in February.

When it comes to cryptocurrencies, Step’s tools help teens and their parents who may not know how they work. The company provides lessons that educate users about where crypto comes from, how to mine for cryptocurrency, and the impact mining has on the economy and the environment.

Step said it is very important to teach young people about the risks that come with investing early on. Children cannot start trading automatically, parents have to allow their child to invest in cryptocurrencies and stocks. Parents also determine how much they can invest and the risk level they are comfortable with.

Step also allows cardholders to earn cash back rewards through its cryptocurrency program. All of its products lead to Step’s goal of fostering conversations between parents and children so they can learn more about an ever-evolving financial world through several mediums.

“Learning something from a video or social content is more effective than just reading pages and sitting in a classroom,” Hansen said. “We’re trying to connect with all different types of learners and make it available for everyone.”