Many of us make resolutions heading into the New Year, with the majority aimed at improving our health and our wealth. We’re not exactly the resource to help your waistline, but we can certainly help you get your finances and credit in shape.

Here are three resolutions to kick-start your monetary goals:

1. Create a Budget (or Improve the One You Have)

If you are like most Americans, you probably don’t have a detailed budget. If you do, give yourself a big hand, because you are elite. In fact, from what Gallup says, two out of three of your friends are probably envious of you and your budgeting skills. Think about it — over 200 million Americans are admiring your budgeting prowess right now.

What if you’re one of the 200 admirers? Want to get rid of that envy? Want to join the cool kids club? Or become the budgeting board member of the cool club? Well, the cool kids are putting together a budget. They’re tracking where they spend the most, they’re planning for emergencies, and they’re preparing for their financial goals.

Joining the cool club is not only free, but the money you save by living conscious of your spending will mean joining the club pays you.

Whether your budget is zero-based, cash-based, goal-based, or even just napkin-based, you’ll need to start somewhere. You can even find 6 easy steps to get started by clicking here.

2. Pay Your Debts and Improve Your Credit Utilization Ratio

Debt utilization explained: While not necessarily glamorous, your Credit Utilization Ratio is pretty straight-forward. It’s how much of your credit limit you’re using. Imagine you have a single credit card with a limit of $100 and no other loans/debts. If you’ve got an outstanding bill of $90 for your credit card, you’ve used up 90 percent of your credit limit ($90 of the $100 available). Whether it’s true or not, a bank would consider 90 percent utilization a high risk. It signals that you’re not living within your means because you used up almost all of your available credit.

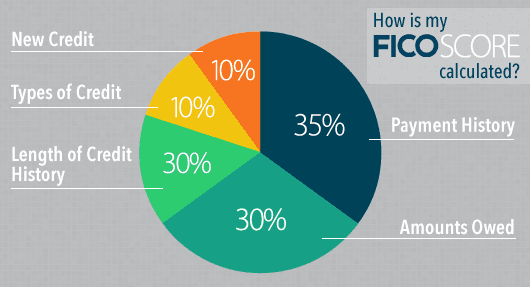

Banks (and most lenders) typically rely on a FICO Score to signal your credit worthiness, and this ratio is responsible for 30 percent of your FICO score.

Two of the quickest ways to improve this are to either pay down your debt or increase your credit limit.

Paying down your debt is the safe, prudent method. It’s the one most grandparents approve. It also can be the most difficult. It means trimming your expenses. In our scenario, if you were to trim your monthly bill from $90 to $50 a month, now you would have a 50 percent utilization rate. When the bank looks at your credit use, it thinks you’re much more on the ball.

Increasing your credit limit is another tool for improving this ratio, but it’s not without its own difficulties. First, before we go further, you should be aware that 10 percent of your credit score is impacted by what’s called “New Credit.” Opening a new line of credit may impact this enough to actually hurt your score (especially in the short term).

However, in terms of credit utilization, using our scenario, if you were to open up another credit card (or expand your credit limit), your credit utilization ratio would improve (provided you didn’t increase your spending). It works like this: You still spend $90 a month on your credit card, but instead of having $100 available, you increase your limit to $200. Now you have a credit utilization of 45 percent. You haven’t really changed what you spend; you’ve just changed what someone is willing to lend you.

However, in terms of credit utilization, using our scenario, if you were to open up another credit card (or expand your credit limit), your credit utilization ratio would improve (provided you didn’t increase your spending). It works like this: You still spend $90 a month on your credit card, but instead of having $100 available, you increase your limit to $200. Now you have a credit utilization of 45 percent. You haven’t really changed what you spend; you’ve just changed what someone is willing to lend you.

Once again, increasing your credit limit can improve this ratio, but if you’re apt to use up that new line of credit for a fancy scarf, avoid it. Stick with what your grandparents approve of — pay down the debt you owe.

3. Understand Your Credit Report and Repair the Negative Items on It

Understanding what makes up your credit report, what changes will impact your report, and how accurate your report is can be a full-time job. Many consumers don’t know their score, let alone what is creating that score.

Further, your report may be inaccurate. One in five credit reports is.

CreditRepair.com, the credit repair expert, specializes in helping you understand your credit score and working with the credit bureaus to ensure your score is both fair and accurate.

If you don’t want to dedicate the time, energy, and attention to ensuring you have a fair and accurate report, you can hire them to do it for you.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.