In a Nutshell: The three bureaus reporting credit scores in the US don’t always use the same data, which can hurt consumers applying for loans and leases or purchasing insurance and other essentials. ScoreSense® puts all three credit scores in one place and offers insights so consumers have everything they need to make the best financial decisions. The ScoreSense app alerts users when scores change, helps protect against identity theft with credit alerts, and provides access to tools and live support from credit specialists. The infrastructure around credit scores is complex and ScoreSense helps educate consumers on credit scores and reports. ScoreSense proves for credit scores that knowledge is power.

Consider this common scenario: You did all the right things financially and put yourself in a position to make a significant purchase using credit. You didn’t expect anything out of the ordinary when the time came for the loan officer to communicate with a credit bureau and receive your report. Yet that credit pull revealed a negative surprise that bumped you to a higher interest rate or disqualified you for a loan or lease.

It turns out that understanding the numbers from a single credit bureau often isn’t enough. In the US, three bureaus — Equifax, Experian, and TransUnion — compete to funnel information to financial providers, consumers, and resellers. They receive and process data differently.

One in five credit reports has an error on at least one of the three bureaus. Lenders don’t have to report to them, and discrepancies can result in significant score inconsistencies. In the above example, maybe your credit card had been reported monthly to one or two of the bureaus correctly, but it couldn’t account for an error appearing in another report.

In this case, you may have to delay getting the loan or lease until you can dispute the error on your credit report and get it resolved. But if you had used the ScoreSense app, you could have learned about the error on your report sooner and gone through the dispute process with the three bureaus before ever applying for new credit.

ScoreSense is the flagship product of Texas-based One Technologies, which began focusing on the consumer credit industry in 2006. The company introduced ScoreSense in 2010 as a robust experience for understanding and interacting with credit files.

“Since launch, we’ve had over 1 million consumers come to ScoreSense for a comprehensive view of their credit report,” said Brian Sullivan, VP of Marketing at One Technologies. “Our users are well aware of their reports across all three bureaus, and when they go to their financial institutions, they’re prepared.”

Comprehensive Credit View Provides Peace of Mind

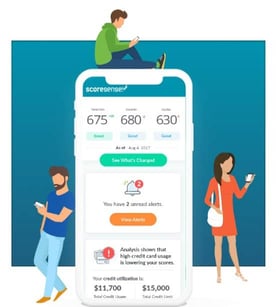

ScoreSense fills in the gaps to help consumers make sense of their credit scores and reports. Members instantly receive their credit history with monthly updates. Signup is seamless, and a seven-day free trial allows consumers to access and use the full product before continuing with a monthly subscription.

The first step to access ScoreSense is to provide your personal information, including your name, address, Social Security number, and date of birth. For security purposes, ScoreSense sends that info to the bureaus where you will then have to answer some authentication questions to verify that you are who you say you are. Then it’s time to input credit information to start the trial.

The ScoreSense app allows you to update your scores and reports monthly with updated information from the credit bureaus, and there are a lot of use cases for checking credit reports frequently. Users contemplating large credit purchases such as home and auto loans may wish to keep frequent tabs on their ups and downs. Others may monitor their data to protect against errors and discrepancies, which can exert positive and negative effects.

Daily credit report monitoring contributes an almost real-time awareness of credit status through app alerts. Monitoring informs users about suspicious activity and changes, with early detection critical to minimizing damage from reporting errors, delinquent payments, and account fraud.

ScoreSense notifies via email and also has push notifications, or text options, when reported accounts change or new financial information enters the public record. Quick checks can help guard against identity theft and fraud to ensure users make the best purchasing decisions.

“If a new account opens, you miss a payment, or a credit bureau just pulls an inquiry on you to check your credit, all of those will cause an alert,” Sullivan said. “You’ll understand what changed and the financial institution responsible for it.”

Tools and Insights Empower Users

Identity theft monitoring is an additional part of the package, with ScoreSense probing the far reaches of the web, including public records and the dark web, to discover illegal use of personal information.

Insurance coverage of up to $1 million handles out-of-pocket expenses if reputational damage occurs and there’s a restoration cost due to lost time or wages.

ScoreSense also offers an additional feature that informs families when registered sex offenders live near them and can alert them to nearby sex offenders registered in and out of state.

“We’re giving our members peace of mind that whatever happens, we’ve got a product that can help you,” Sullivan said.

ScoreSense gleans credit insights from members’ credit reports, which are based on five factors: payment history, outstanding debt, credit mix, credit age, and credit inquiries. It highlights differences among the three bureaus and the factors affecting the numbers.

“One report could have an error on it that might affect the interest rate you could get on loans, or a credit score that’s not what it should be,” Sullivan said. “If one of the bureaus records a missed payment in error, you need to dispute that right away because that one error could affect your credit score.”

Tools within ScoreSense provide access to credit scores anytime and help users track progress toward their credit goals. ScoreSense can help you take the steps to do a credit freeze, which blocks creditors from pulling reports. The tool also provides a learning center with more than 100 articles and checklists to help guide best practices.

A tool for achieving more credit predictability is ScoreCast™. This simulator charts what may happen to credit scores when the unexpected happens or a user reaches a goal or milestone. ScoreCast can simulate the potential credit consequences of a mortgage payment going missing and help users anticipate how their score will change when they pay down debt.

“The simulator goes through various scenarios for paying down debt or achieving a certain level of credit utilization and figures out how this could possibly affect your credit score,” Sullivan said.

Live Credit Specialists Handle Issues More Efficiently

ScoreSense prides itself on its technology and its ability to continually monitor users’ financial data so they can go about their business. Alerts within the ScoreSense app automate how users interact with their data, and tools and insights help them understand potential problems.

But all the automation in the world can’t replace what may be ScoreSense’s most differentiating feature: live credit specialists available seven days a week, Monday-Friday from 8 a.m. to 8 p.m., Saturday from 8 a.m. to 5 p.m., and Sundays from noon to 6 p.m. Central time.

They’re crucial because understanding credit, credit scores, and reports is one thing, but understanding the specific steps necessary to correct errors on credit reports is another. ScoreSense’s live credit specialists can’t instigate actions on behalf of users, but they can talk them step by step through the process at the bureaus from beginning to end.

“We’ve found that people just need someone to talk to about credit,” Sullivan said. “Our credit specialists can deal with anything from basic questions to understanding complex credit questions.”

Access to ScoreSense credit specialists is available to members at no extra charge, and they’re prepared to spend as much time as necessary with each user to ensure they resolve each question entirely.

The idea for including dedicated credit specialists on the ScoreSense team came during a consumer focus group event when a participant mentioned they ask their tax attorney about credit because that person was the smartest they knew regarding finances. Not everybody has that advantage, but ScoreSense live agents are the next best thing.

Meanwhile, One Technologies continues to add content and functionality to the ScoreSense app to maintain it as a leading credit score monitoring tool for millions. Overwhelmingly positive reviews attest to that.

“Much of the positive feedback we receive is about our call center and how much time our experts spend with customers,” Sullivan said. “It’s a point of pride for us.”