In a Nutshell: Rental property residents often regard the first of the month as that special time when all the bills come due at once. That’s not much of an exaggeration considering the traditional first-of-the-month due date for rent coincides with typical timelines for medical, educational, and other expenses. The Circa rent app helps properties put their best foot forward to residents with payment automation and flexible rent installments. Circa also reports on-time payments to the major US credit bureaus to help residents build stronger financial track records and higher credit scores.

Paying the rent always works the same old way despite all the digital transformation happening elsewhere. Virtual cards and contactless payments might be realities in certain financial circles, but cash, check, and money order still dominate rent payments. Properties receiving their checks by the fifth of the month is an industry standard.

It doesn’t make much sense because it works to no one’s advantage. It’s one of those situations where the status quo seems to endure out of inertia rather than reason.

At least that was the case until the Circa rent app arrived in 2020 to put the digital puzzle pieces together in the right way for the rental property industry. Circa is at the forefront of a transformation it hopes to extend to the very nature of the relationship between properties and residents.

Compared to convenient mobile payments that have become widespread for consumers and merchants, cash and checks are inconvenient and error-prone payment methods. Using Circa protects businesses from cash’s many adverse outcomes and extra costs.

Circa can also act as a communications buffer between properties and residents facing late rent payments due to unexpected financial setbacks or cash flow issues. Circa gives them a way to communicate that mirrors how they communicate with other financial services through mobile.

More than that, through flexible installment payments, Circa empowers residents to leverage how and when they pay their rent to their advantage. That advantage extends to the credit reporting the app offers. Residents gain a more affirming relationship, while properties gain data, insights, and tools to help with retention and management.

“The beauty of Circa is if you make paying easier for residents, it’s much better on the cash flow and NOI side for property owners,” said Leslie Hyman, Circa’s Co-Founder and CEO. “Flexible payments and credit reporting are win-wins for properties and residents.”

A Modern Way to Make the Rent

Hyman and her Co-Founder, Heman Duraiswamy, met when they both worked for the primary carrier insurance business at Swiss Re, one of the world’s top three reinsurance companies. As they sold life insurance to predominately lower-income Americans, they found a significant portion — in the neighborhood of 20% — could not pay their premiums when they came due on the first of the month.

Delving deeper into the sociology behind late payments, they realized many significant expenses hit lower-income consumers on the first of the month. Those included housing, transportation, and healthcare, typically the top three monthly recurring consumer payments. That could present an insurmountable financial obstacle to someone living paycheck to paycheck.

“All that before food, clothing, and education,” Hyman said. “When we did the work, the figure for the top three was $2,600 a month on average. It’s probably more like $2,800 now, which is pretty shockingly high.”

Hyman and Duraiswamy focused on the rental property industry because it presented the highest cost among the top three for most consumers. Duraiswamy, who had owned and rented apartments, recognized through personal experience that when he gave residents flexibility, they were much more likely to pay consistently and renew.

Residents gain a new level of flexibility. Circa allows properties to set up recurring options of one, two, or four monthly payments for a small fee. Residents may also make last-minute plan or payment method changes within their property’s preapproved options.

Circa earns revenue from those fees, which it shares with its properties. Residents benefit because they gain significant payment flexibility through a convenient mobile app.

“We brought payment platforms to the rental world,” Hyman said.

Supporting Residents’ Financial Health

On top of the added value of financial flexibility, Hyman and Duraiswamy added credit reporting to the mix because they believed in it. They discovered in their examination of the state of credit reporting that it’s not as easy as it should be.

Circa reports the positive-only reporting allowable through regulation to Transunion, Experian, and Equifax, the three major US credit bureaus responsible for generating credit scores. But residents must give explicit consent.

“I wish we could wave a magic wand and report every renter who pays on time,” Hyman said. “There’s just nothing negative about it for the residents, the property owners, or the bureaus, and every single one of those players wants the reporting.”

One of the big problems is that many consumers don’t appreciate the value of a good credit score until it’s too late. A good score is not only about applying for lower-rate credit cards. It can be critical to financial advantage in many purchasing scenarios, lower insurance bills, and even assist in qualifying for a rental lease.

Hyman said the credit reporting benefit helps residents request that their properties adopt Circa for rent payments. Thousands of residents make that request to Circa through a lab feature in the app that allows residents to comment or provide information to help bring Circa to their property.

“It’s an uncomfortable conversation for a resident to go to her manager and request Circa because it enables flexible payments — something the current system doesn’t allow,” Hyman said. “It’s much more palatable for a resident to request Circa because it can help improve her credit score and get her to renew.”

Transforming the Resident/Property Relationship

The reporting tool in the app offers the best means for residents to bring Circa’s advantages to new rental environments. Combining flexible payments and credit reporting creates wins for all parties and a healthier basis for relationships between properties and residents.

Properties gain a new model for rent collection. Circa increases on-time rent collection by 17%, according to internal research. Because Circa reduces delinquency, it also improves turnover, saving properties months of lost rent per eviction avoided.

That also translates into significant time savings. Circa reports that properties can recoup up to 30% of time spent on collections and save additional time by not having to scan checks, track money orders, or manage delinquencies.

Staff members report more enjoyable working conditions when they’re no longer required to devote most of their time to collections, with Circa integrating seamlessly into existing tech stacks and automating much of the process.

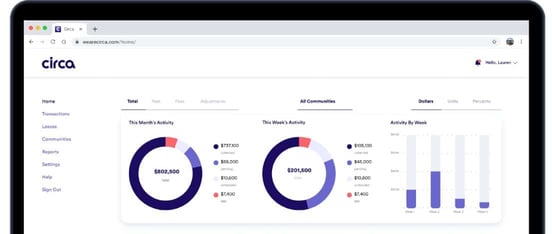

Residents gain the basis for a new relationship with properties. Many residents rent for years, sometimes decades, without leaping into property ownership. Circa streamlines those dealings and grants residents a more prominent voice, with the app keeping users up to date with reminders, offering visualizations of payment details and status, and making lease info and history more accessible.

A comprehensive support center keeps users current regarding app features, and a blog engages users in some issues around the rental economy.

Circa includes debit and credit payment options with appropriate warnings not to overspend on credit. A digital wallet allows residents to put some funds into an account in advance for future rent payments.

Meanwhile, Circa does its part to increase the small percentage of rent payments reported to the bureaus and transform those transactions into sounder financial health for residents.

“I find credit reporting such an underutilized service, and I struggle with how we can change that,” Hyman said. “There’s just no negative — we should all be doing it.”