In a Nutshell: Biz2Credit is more than an automated small business funding platform, it is also a thought leader in the digital lending industry. The company leverages data to help small businesses manage cash flow and show policymakers the issues entrepreneurs face. Businesses recovering from COVID-19 pandemic restrictions stand to benefit from additional government stimulus, though lawmakers will have to tread carefully when regulating small businesses to ensure opportunities for recovery and growth. That suggests a more positive outlook for SMBs, and many can start that growth process by securing alternative funding from Biz2Credit.

The number of active small business owners in the United States declined by 3.3 million or 22% over the two-month period from February to April 2020. That is the largest drop on record and affected nearly every industry, according to the National Center for Biotechnology Information.

The cause, of course, was the COVID-19 pandemic, and like the population at large, minority business owners found themselves disproportionately affected. African-American businesses experienced a 41% decline, Latinx business fell by 32%, Asian-owned business activity dropped by 26%, and immigrant-owned business activity decreased by 36%. Those declines continued as the pandemic wore on.

The National Academy of Sciences reported in July that median businesses with $10,000 worth of monthly expenses had, on average, less than two weeks’ worth of cash on hand to meet their costs. While the government made funding available to help business owners make ends meet, bureaucratic inefficiencies hampered access to financial support.

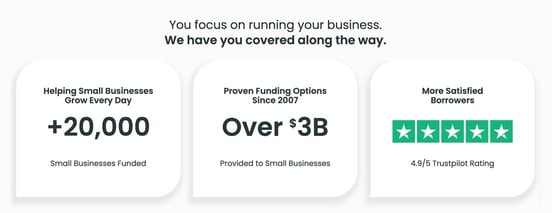

Biz2Credit is an automated small business funding platform and a pioneer in the fintech industry. Additionally, Biz2Credit is positioned to assist business owners in other strategic ways by offering advice and providing forecasts for the coming year. That can help small businesses make the most of the capital they have available.

“I think the democratization of credit and digital tools reducing fixed costs offer the best opportunities for small businesses going forward,” said Rohit Arora, CEO and Co-Founder of Biz2Credit.

Small business owners have had to turn to other sources to keep their operations going through shutdowns and safety measures. Bank loans aren’t always available to those who need them most, especially if they have credit issues. That lack of access jeopardizes small businesses and their employees across the United States.

Biz2Credit can provide those companies with the lifeline they need to survive now and thrive later.

Loans That Offer Benefits Beyond Traditional Borrowing

The apprehension on the part of traditional funding sources opens the door for fintech companies like Biz2Credit. The firm is positioned to provide better rates and terms in addition to specialized services.

“I think the demand is coming back,” Arora said. “The supply is still in shock, and I think the Paycheck Protection Program (PPP) has been the major driver this year for small business lending. I think next year is going to be very different.

As entrepreneurs try to rebuild their businesses, they need access to funding. Arora predicts the demand in 2021 will be high, and the supply will be normalized.

“There has been so much disruption this year,” he said. “A lot of the investors and credit firms and others who normally invest money in this space have been just shy.”

Biz2Credit’s services include assisting businesses with working capital, which can be valuable when their cash flow has slowed to a trickle. The company collects and leverages data — while keeping it secure and private — to help owners manage their businesses more efficiently. Biz2Credit also uses data to educate policymakers on the needs of small businesses.

“That has been our philosophy from the time we set up the company, and as we have grown bigger, we have more data,” Arora said. “Recession gives you one of the largest sets of data because you can see how businesses change over time. I think that’s been interesting and very focused on not just being a lender but also being a thought leader in this space.”

Cash Flow-Based Lending Assesses Risk in Real Time

Banks are understandably reluctant to issue loans during recessions, so the situation during the COVID-19 pandemic is not unique.

“During the last recession, 2009 was the worst year for small businesses, and banks didn’t start lending money until 2011 or 2012 because they just waited to see good financials,” Arora said.

The same may be true of the current recession. And while businesses need funds for day-to-day operations and to invest and adapt to a digitally oriented market, banks are unlikely to be the source of that funding.

“The digital revolution that’s happening is also going to change overall dynamics because a lot of small businesses still want to go to their banks,” Arora said. “That’s going to happen less and less.”

Biz2Credit is part of a digital lending revolution that can help small businesses grow.

The reason is that banks base lending decisions on the borrower’s historical earnings. Due to losses in 2020, banks are likely to judge many small businesses as high risks.

But Biz2Credit takes a different view. Unlike banks, the company evaluates businesses based on their real-time cash flow, which is trending positive as of early 2021. Arora attributes this in no small part to the PPP.

“I think the good thing with PPP is small businesses are going to be awash in a lot of liquidity,” Arora said. “We can look at sectors which are going to come back and start focusing on that. In my view of the credit quality of many businesses, despite the fact that their revenues have dipped significantly in 2020, it’s going to be much better.

He added that the best lending is often after a recession because then businesses have cut their costs. And those businesses will also receive more financial support from the government.

Legislation Promotes Positive Change for Small Businesses

The PPP was not the end of government influence on small business recovery. Other stimulus packages could be on the way, and Arora is optimistic about their potential to have a positive impact.

“I think the new stimulus package is well designed, well thought out,” Arora said. “And I think a lot of things they did last time helped with COVID-19. I think the PPP program has been very successful because, when we compare it to the mainstream lending program and some of the other programs, it gets people their money at an adequate pace.”

Rohit Arora, CEO and Co-Founder of Biz2Credit

He said the new package has promising changes, including abolishing the prior stipulation that 60% of funds go toward payroll. This requirement hurt more than helped certain businesses due to social restrictions that limited the number of employees who could work at any given time. Without that limitation, companies can devote more funds to pivoting into advantageous positions, investing in software upgrades, and transitioning into digital services.

The upcoming change in administration also carries new promise for small business recovery.

“The incoming administration has already said they’re going to pay a lot of attention to increased lending,” Arora said. “They’re going to do a lot of stuff for minority-owned businesses or businesses in low-income areas, which is positive.”

However, Arora warns that harmful regulatory shifts may be on the way, including overregulation of small businesses.

“The previous administration lightened the regulation on small business lending, which was very important,” Arora said. “So regulation is good, but one thing that the government and the policymakers need to realize, especially in small business lending, is it’s already kind of a starved market. If you try to overregulate it or regulate it as a consumer market, then you’ll create more problems than you’re solving.”

Biz2Credit Prepares Borrowers for Opportunities

Despite the challenges of 2020, Arora said he is optimistic about how Biz2Credit can help small businesses in 2021. He cites plenty of reasons, including a new emphasis by the Biden Administration on helping minority-owned firms, more money coming into the space, and interest rates close to zero.

“I think there’s a lot of pent-up demand among small businesses. They need money,” Arora said. “Once the economy starts coming back, I think there’s going to be a lot of demand.”

He said that is especially true in service industries. People haven’t been traveling, going out to eat, and enjoying the everyday services many small businesses provide. A resurgence in demand will bring a much-needed hike in revenue.

Arora predicts that banks will focus on loss prevention and restructuring branch networks. That emphasis will affect the lines of credit those institutions make available.

“I think banks will have to transform and change themselves very quickly because they will have to take on a lot of fixed costs, and they’ll still have to grapple with a lot of legacy issues,” Arora said. “My feeling is that things will start happening in the banking space in 2022. That’s where we see a lot of opportunity for our platform, and we see a lot of opportunities for non-banks.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.