In a Nutshell: According to the US Small Business Administration (SBA), small businesses account for more than 90% of all enterprises — and create more than half of all jobs in America. However, for these businesses to operate and grow, they need access to business capital, often in the form of loans. Fundera is a small-business funding service that helps match businesses in need of capital with lenders that meet their specific financing needs. Fundera advocates for small businesses by getting to know how a business operates and determining the best type of loan product for them. By understanding their specific needs, Fundera is able to help businesses apply to the best lenders, regardless of product space or category. Fundera is helping this critical part of our economy continue to operate, expand, and flourish.

When Emilie Christenson decided to leave behind her corporate job at a reputable investment firm, the move primarily was motivated by a desire to spend more time with her daughters. At the same time, she was also driven by an entrepreneurial spirit — and the desire to create something for a change. But while her KYDS children’s boutique and two other women’s apparel stores became successful, she continued to struggle with finding the capital to make larger purchases and expand her business.

Emilie found her answer when she saw an ad for loan-matching service Fundera on a social media site and decided to give it a try. The Fundera loan specialist worked with her to devise a plan to get out of the short-term debt cycle as quickly as possible, and to obtain better funding. He helped Emilie apply for an SBA loan, and also get a term loan through an online lender that would hold her over until the SBA loan came through.

By working with the Fundera specialist and the lender, Emilie was able to quickly get the term loan and refinance her short-term debt. Weeks later, when the SBA loan came through, she was able to refinance the term loan using that funding. The result was that Fundera helped Emilie save her business nearly $15,000 a month — and Emilie couldn’t have been happier.

It’s this dedication to helping small businesses that sets Fundera apart from traditional banks and loan brokers. We recently sat down with Meredith Wood, VP of Content and Editor-in-Chief of the Fundera Ledger, which houses blog content on the Fundera website.

“Some of our favorite loans to make are refinancing loans,” Meredith said. “That’s because some business owners may end up with financing that doesn’t suit their business, or wasn’t done in their best interest. We’re able to come in and evaluate the business, and the type of loan that’s needed, and, in some cases, save the business owner up to $15,000 a month — as in Emilie’s case.”

As a loan matching service, Fundera takes pride in working with lenders that are flexible and able to offer the most well-suited financing products to its clients. Fundera’s approach is to match small businesses with willing lenders that meet their specific needs. With a focus on transparency, customer service, and helping small businesses succeed, Fundera is bringing integrity and simplicity to the business lending process.

Small Businesses Face Challenges in Obtaining Financing

At one time, all of small business lending was handled by the banks in each local community. However, with banking consolidation and a shift in priority to meeting investors’ bottom lines, banks have become more focused on larger-scale loans. One of the things Meredith pointed out to us was just how much the lending process has evolved.

“The reality is that bank financing to small businesses has changed dramatically over the past few years,” she said. “Part of the reason for this is that it costs banks as much to service a small loan as to service a larger loan. So, banks aren’t as willing to lend to smaller businesses as they may have been in the past.

“This is sort of the catalyst for the range of alternative lending and online lending companies out there. But the fact is, it’s still such a young industry that it can be difficult for businesses to know just where to go and who to trust for the best deal.”

That’s where Fundera’s loan specialists stand out. They help businesses through the entire loan process, including applying, reviewing offers, obtaining financing, and even mapping out a plan toward obtaining less expensive financing over time.

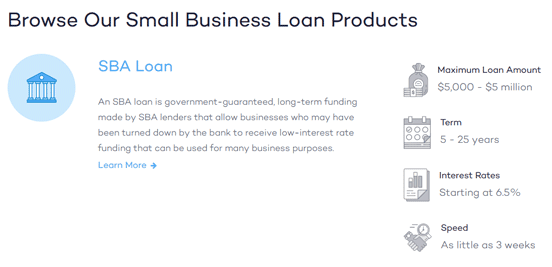

While many loan brokers tend to offer products from the lenders who pay the highest commission rates, Fundera is more selective in the institutions it partners with. Fundera’s lenders must be among the most competitive, while still offering a broad range of products, like merchant cash advances, short- and medium-term loans, SBA loans, equipment loans, lines of credit, and even personal loans.

Customized Loan Applications Put the Needs of Business Owners First

Fundera is committed to transparent and clear communication in everything it does. As a signatory to the Small Business Borrowers Bill of Rights, Fundera upholds the highest standards of business lending, including transparency, fairness, and the rights of borrowers. The company also promotes innovation and increased access to credit in underserved communities.

When you start the application process with Fundera, you’ll create an account and provide information about your business. The questions asked are factors like your annual revenue, how long you’ve been operating, the industry you’re in, and whether you turn a profit. The answers you give will allow a loan specialist to determine the type of loan products you are eligible for.

Through its partners, Fundera offers a range of financing options from SBA loans and term loans to business lines of credit and merchant cash advances.

If the loan products you’re presented with after the initial process are appealing, you’ll then fill out an actual application. Another difference with Fundera is that once you’ve completed the application and provided the proper documentation and statements, that’s it. There’s no need to fill out multiple loan applications, as the Fundera specialist will build a profile of your business and provide any required information to the lenders you choose.

Meredith explained the process to us this way, “With Fundera, you fill out one application, and businesses are able to apply to the best lenders, regardless of product space or category. Borrowers can then see all of their options and get the best deal for their business. Fundera cultivates relationships, helping businesses to build and graduate their lending options and the products they are eligible for.”

Digital Tools and Resources Help Further Financial Education

Going beyond loan matching, Fundera also provides business owners with advice and tips on starting, managing, and growing their businesses. The Fundera Resources page contains a wealth of information, such as business loan calculators, reviews of leading small business lenders, and a library of tools and templates for small business financial management.

The company’s blog page, the Fundera Ledger, for which Meredith is the Editor-in-Chief, provides business owners with daily insights on financing and growing their business. Another valuable section includes in-depth guides that cover nearly everything about small business financing.

If you need to brush up on the terms and references when reviewing a loan, Fundera provides a comprehensive financing glossary for you to use. For those who would rather watch than read, an FAQ video library explores what business owners need to know before getting a small business loan.

Fundera is Committed to Funding the Success of SMBs

Financing is the lifeblood of any business, but this is especially true of the small and medium-sized businesses that make up so much of our economy. In fact, more than half of the US workforce are in small businesses.

Fundera is committed to transforming the way these businesses obtain the funding that is often crucial for operations and growth. The company recognizes that business owners are good at what they do, but may not have the expertise to find the right business loan with the right terms.

The experienced team of loan specialists at Fundera walk business owners through the process and help them choose the best possible source of funding from available options. And those same specialists will be there to help with more and better options as your business grows.

Emilie knows this firsthand, and she can directly attribute the growth of her retail businesses to the loan savings she achieved through working with Fundera.

“The banks won’t work with us anymore,” Emilie told Fundera. “I just didn’t think there were options out there. I can’t believe I did the whole short-term loan, credit card thing. I can’t believe I didn’t know about Fundera sooner. Fundera didn’t have any interest in anything but our best interest.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.