In a Nutshell: A bank’s location used to be an important consideration for consumers, but with advances in technology and mobile banking, location is no longer as crucial for quality service. Bank5 Connect recognizes this with its fully online banking services available in 48 states. The bank’s roots go back to 1855 in Massachusetts where it still maintains brick-and-mortar branches (it also maintains physical branches in Rhode Island). Thanks to its lower overhead, Bank5 Connect is able to offer competitive products like its high-interest checking account and debit card with cash back rewards. Because of its innovative approach to banking and competitive products, we are recognizing Bank5 Connect with our Editor’s Choice™ Award for Best Free Online Checking Account.

When it came time to open my first checking account — more than two decades ago — I entrusted my hard-earned funds to a large national bank, largely because it operated a branch within a couple of miles of my house.

Back then, digital banking was in its infancy and having your bank just down the road was a major perk. Otherwise, you would have to go out of your way to make deposits, withdrawals, or basically do any other business at the bank.

My experience with the bank was just — fine. The service was acceptable, and their products weren’t terribly competitive compared to options today. But I did get my first credit card through the bank, which helped me begin establishing my credit history fairly soon after graduating high school.

Today it’s a different story.

Thanks to major advances in fintech over the past 20 years, most U.S. residents can do their banking business from just about anywhere as long as they have internet connectivity. With geography no longer a major consideration, choosing a bank often comes down to the quality of products and level of service (and convenience) offered.

Thanks to major advances in fintech over the past 20 years, most U.S. residents can do their banking business from just about anywhere as long as they have internet connectivity. With geography no longer a major consideration, choosing a bank often comes down to the quality of products and level of service (and convenience) offered.

Bank5 Connect is an online bank that prioritizes customer service with a personal touch and offers competitive financial products and services, all with the ultimate convenience — never having to step foot in a brick and mortar branch.

As we close out a year that has been tumultuous in many ways, a lot of people are uncertain about their economic future. Pay cuts and layoffs due to the COVID-19 pandemic have left people relying more heavily on credit cards than usual. And the resulting debt is piling up.

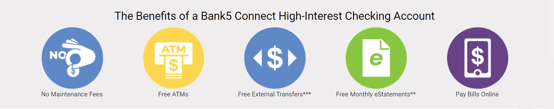

Bank5 Connect offers several products that stand out, particularly in challenging times like these. Its free, high-yield checking account and debit card with cash back rewards offer consumers a chance to save money while planning for a healthy financial future.

Because of its innovative take on banking and its convenient high-yield checking account, we are recognizing Bank5 Connect with our Editor’s Choice™ Award for Best Free Online Checking Account.

We recently spoke with Jeff Sanson, Bank5 Connect’s First Vice President of Customer Support, to learn more about its checking account, its approach to customer service, and its other benefits to customers.

Maintaining the Personal Feel of a Community Bank while Operating Online

Before you back away from the idea of using a bank that only exists online, there are a few important things you should know. Bank5 Connect’s business philosophy is rooted in one of the country’s oldest banking institutions — BankFive, a trusted brick-and-mortar community bank operating in Massachusetts since 1855.

And while Bank5 Connect operates entirely online, it’s not powered by artificial intelligence or algorithms set in motion by some faceless team of computer scientists in a covert lab. Bank5 Connect is run by people and makes a point to keep people front and center when it comes to customer service.

“Bank5 Connect started in 2013,” Sanson said. “It was a way to try to entice customers with better rates because we have lower overhead on the e-brand side.”

Jeff Sanson is Bank5 Connect’s First Vice President of Customer Support.

The online bank is available in 48 states with the exception of Massachusetts and Rhode Island, Sanson said, because those are the two states where the bank operates its long-running brick-and-mortar locations.

“Since our brick-and-mortar branches have been in business since 1855, we wanted to figure out a way to offer that community bank feel that we have in our Massachusetts and Rhode Island locations,” he said.

One way Bank5 Connect does this is by emphasizing the personal touch at every opportunity — and living up to its community bank mission.

“We created a website that focuses heavily on the person instead of the products,” Sanson said. “When you go to the website, you see a bunch of people wearing Bank5 Connect branded attire — that’s actually all of the call center folks that you actually speak with when you call us.”

He said the bank only has six employees in its call center, so customers can really get to know who they are dealing with and speak with the same people on a regular basis when they need help.

“That way, you’re getting that nice hometown feel of a bank, and it’s completely electronic,” Sanson said.

Competitive Products Include a High-Yield Checking Account to Help Customers Live a Healthy Financial Life

“As you probably are aware, the industry has taken quite a hit with rates across the board,” Sanson said. “But we’re still able to offer a high-interest checking account with a $100 minimum, and as of December 2020 we’re paying 0.20% APY, which is much higher than most.”

Bank5 Connect also reimburses select ATM fees for people who use the institution but don’t have any partner ATM locations nearby, he explained.

“In addition, we offer a pretty cool product called our 24-month investment CD,” Sanson said. “Over the course of 24 months, you can continuously put money in. It’s going to allow you to continuously add money to the CD without any type of penalty.”

Sanson said the high-interest checking account is a popular product and a good fit for nearly anybody.

Bank5 Connect offers a competitive high-yield checking account that can help people save.

“As a bank employee, I test it out to make sure it works well, and it’s actually one of my favorite accounts because of the interest rate,” he said. “And we’re not going to charge you any monthly maintenance fees at all — there are no maintenance fees ever.”

Customers also receive free checks on their first order upon opening an account. Bank5 Connect also maintains a purchase rewards program associated with its debit card, Sanson said.

“It’s similar to a cash back option where you can go into your online banking account, and based on your shopping pattern, we’ll give you offers that you can attach to your card,” he explained. “And then once you go shopping, whether it be in person or on the internet, you’ll earn cash back on those select offers.”

All of these features coupled with the convenience of doing everything online helps customers establish a solid financial foundation on which to build for years to come.

Prioritizing Financial Literacy via Digital Resources

Bank5 Connect doesn’t stop at offering competitive products and a strong focus on customer service. It also recognizes the importance of helping customers stay educated about finance.

“We really focused on our website to make sure that it’s a resource to our customers,” Sanson said. “So, we have a lot of blogs that have been posted to help with financial literacy and giving customers tips and tricks on how to save money and avoid scams.”

Other blog posts address topics like how to rebuild credit and how to boost a flagging credit score.

In keeping with its e-bank model, the institution also strives to be very technology-forward, Sanson continued.

“We also offer customers different ways to communicate with us so they can learn even more. We have a chat functionality so you can do live instant messaging with us. You can do secure emails as well. So if you want to ask account-specific questions, you can do that through either of these channels.” — Jeff Sanson, First Vice President of Customer Support

Sanson said it’s important to the bank that it adds value by cultivating relationships with customers and not simply giving them a quick answer and moving along.

“In regards to people that are rebuilding their credit, they absolutely would be a good fit for Bank5 Connect because we’re here to help you save,” he said. “The more you save with us charging less in fees and paying more in interest, the more you have the ability to start paying your creditors so you can keep up with your monthly payments.”

Enhancing Convenience for Customers

Always looking to the future, Bank5 Connect has a couple of big developments on deck for the coming months.

For one, it will enhance the online account opening process starting in January, Sanson said. The whole process can be done via smartphone and will only take about three minutes.

“Also, in early 2021 we’re actually going to be offering video banking so all of our customers will be able to communicate with us face-to-face through their mobile device,” he said. “You’ll just pick up the phone, hit a button and we’ll be able to do anything from looking over documents with you to answering questions about your bank statements.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.