Sometimes, soft is better than hard, as is the case for soft-pull auto loans. When you need an auto loan, a lender who engages in only a soft credit check of your credit report may be more likely to approve your application, and your credit score won’t be hurt in the process.

Read on to see where you can get a soft-pull auto loan that will best meet your needs.

Best Soft Pull Auto Loans — Bad Credit OK

Do you need an auto loan but suffer from a low credit score? We’ve identified several sources of automobile loans that specialize in serving consumers with subprime credit. These lenders can quickly preapprove your loan requests without a hard credit pull of your credit report.

They all have something in common — they want to work with you while making the process as easy as possible.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

It takes less than a minute to prequalify for a soft pull loan from Auto Credit Express. Since 1999, this company has matched borrowers with lenders and dealers on its network. All you have to do is complete the loan request form by supplying your credit profile, monthly income, housing costs, debt service, and garnishments.

You’ll immediately be hooked up with a local dealer eager to work with a borrower to finance a vehicle. To qualify, you must show a monthly income of at least $1,500. The company, a member of the Internet Brands Auto Group, has helped to arrange more than $1 billion in auto loans to consumers with bad credit.

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

LendingTree is a large nationwide network of banks, dealers, and other lenders that can help you obtain a car loan. There’s no hard credit check involved to see what kind of auto loan offers you qualify for.

Once you choose a loan offer, you’ll be directed to their website to finish the application. This is where you’ll likely undergo a hard credit pull, but you’ll already be preapproved for the loan, so your mind can rest easy.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

myAutoloan.com allows you to see whether you qualify for a loan on its website through a soft credit pull. You must earn $21,600 gross yearly and request a minimum loan amount of $8,000 to qualify.

Most lenders also require that the car doesn’t have more than 125,000 miles on it and not be older than 10 years. These are the general guidelines, but each lender sets its specific criteria.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.com also belongs to the Internet Brands Auto Group and specializes in soft pull loan matching for subprime auto loans, even during or after bankruptcy. It takes a couple of minutes to fill out the online loan request form. Car.Loan.com uses your information to match you with the best local candidate from its nationwide network of competing lenders and dealers.

The matching service is completely free, and there is never an obligation. Final approval of your loan can be completed on the same day and funded on the next. Cash-out auto refinancing is available if you have sufficient equity in your current car.

5. RefiJet

- RefiJet helps people lower their monthly auto payment

- Pre-qualifying for a refinance auto loan does not impact your credit score

- Nationwide network of lenders

- Presents you with options from lenders that fit your situation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2016 | 5 minutes | 8.0/10 |

RefiJet is a lender network that can facilitate a refinance loan of your existing auto loan. This is ideal if you want a lower car payment, to cash out equity in your vehicle, or to pay your loan off faster.

Even with bad credit, there’s no credit pull involved to see what kind of loan offers you qualify for. One may be just right for your car financing needs.

What is a Soft Pull Auto Loan?

The chief difference between a soft credit inquiry and a hard credit inquiry is that a soft credit inquiry does not affect your credit score, whereas a hard credit inquiry does. A creditor, lender, or another interested person can perform a soft credit check without your permission, and soft pulls are not visible to others who check your credit.

Your credit score and payment history are vital determinants when you apply for a loan or apply to a credit card company. A potential lender may want to see your credit history before making a final decision on whether to lend to you.

A creditor/lender can perform a hard pull of your credit report only if you first approve it. The credit bureaus keep track of hard pulls, as they represent requests for new credit and slightly reduce your credit score. The reasoning is that opening new loan accounts adds to your indebtedness, increasing the risk that you’ll be unable to repay your existing debt.

Inquies can reduce your credit score by a few points but the reduction to your score can only last for one year. However, if you are rate shopping for an auto loan, then clusters of competing hard pulls are treated as a single inquiry as long as they occur within a two-week period.

The five loan sources in this review all perform a soft pull prequalification of your loan request. This ensures you do not get penalized for a hard credit pull when you don’t prequalify for the loan.

However, your loan application may still be declined even if you are prequalified, although your chances of approval greatly improve if you pass the prequalification step.

Where Can I Get Prequalified for an Auto Loan?

The five companies we review here all prequalify auto loans. That means you can quickly find out whether it’s worthwhile to apply for a loan without risking the damage to your credit score inflicted by a hard pull.

The companies we review are loan-matching services. They each work with a network of lenders and car dealers that are willing to lend to subprime consumers. These companies perform only soft pulls because they only prequalify you for a loan from the car seller.

When a matching service successfully prequalifies you for a loan, it then finds one or more lenders/dealers in its network that indicate their willingness to work with you. If you agree to it, the lender/dealer will perform a hard pull and then possibly offer you a loan. The lender/dealer sets the loan term and rate based on the information it receives from you and from the credit report it pulls.

Can I Get Auto Financing with Bad Credit?

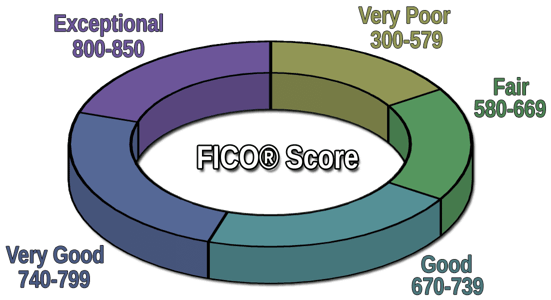

All the companies in this review work are happy to work with consumers that have bad credit. By bad, we mean a very poor credit score of below 580 on the 300-850 FICO score model.

As you would expect, your ability to obtain a loan decreases the lower your credit score. Nonetheless, the automobile industry knows that folks with bad credit may need a car as much as higher-credit consumers do and therefore looks for ways to say “yes” to subprime credit scores.

One factor that favors approval of a car loan versus a personal loan is that a car loan is secured by the car, whereas personal loans normally are unsecured. If you default on your auto loan, you’ll have a less-than-delightful episode with a car repo agent. You’ll not only lose the car, but a credit bureau will take note of the repo and sledgehammer your credit score.

Auto lenders take further precautions to protect themselves when doing business with subprime consumers. These include down payments and possibly a weekly loan payment schedule on cars that do not exceed a set price. Note that a loan payment may reflect high interest rates and fees.

What is the Minimum Credit Score Needed for a Car Loan?

Our research indicates that some lenders have no minimum credit score requirements for an online auto loan. Even though some lenders say they have no minimum credit score, if your credit falls below 500, it may be difficult and expensive.

But since all the lenders in this review can prequalify you without a hard pull, you’ve got nothing to lose by attempting to prequalify for an auto loan from any of them.

Does Prequalifying for an Auto Loan Hurt Your Credit?

Prequalifying for an auto loan won’t hurt your credit as long as it involves only a soft pull of your credit, which is almost universally the case. Soft pulls are recorded on your credit reports but are only visible to you. They never impact your credit score.

In fact, prequalifying is a good thing for your credit score because if you fail to prequalify, you’ll know not to apply to the lender and, therefore, won’t be subject to a score-unfriendly hard pull. When you prequalify, the lender determines that you are less likely to default if it offers you a loan.

Does Preapproval Guarantee a Car Loan?

Unfortunately, preapprovals do not guarantee you’ll be approved for a car loan. The auto loan preapproval process is built to be fast, which means the underwriting of the applicant’s riskiness is minimal.

If you pass the auto loan preapproval step, you’ll have cleared a major obstacle to final approval, but you must prepare yourself for the possibility that your credit application will ultimately be declined.

Preapprovals can thus be seen as a process in which multiple lenders winnow away the least creditworthy consumers. Only after preapproval will lenders be willing to foot the extra expense of performing the due diligence necessary for final loan approval. This is why you can be preapproved in seconds, but final approval may take considerably longer.

What is a Good APR for a Car Loan?

The annual percentage rate you’ll be offered depends on your credit rating and the car you’re trying to buy. Generally, low scores require higher APRs and used cars have higher APRs than new cars. A credit union may offer a very good annual percentage rate to its members.

If you have bad credit, you will have to accept the fact that your bad credit car loan will have a high-interest rate. Experian found in Q3 of 2023 that the average interest rate for subprime borrowers (500-600 credit scores) was 11.86% (new) and 18.39% (used). Deep subprime borrowers (below 500 credit scores) saw average interest rates as high as 21.18% for used cars and 14.17% for new ones.

The best you can do in this circumstance is reduce the amount financed. You can do this by selecting a less expensive car, offering a larger down payment, or providing a trade-in vehicle. Alternatively, try arranging for a cosigner with a good credit rating who qualifies for a lower interest rate.

Soft Pull Auto Loans Will Show You What You Qualify For

Soft-pull auto loans are valuable because they immediately indicate whether you qualify for a loan on the car you want to buy. You can shop the competition that offers soft pull prequalifications as much as you like without any harm to your credit score.

This not only lets you identify which lenders may approve your credit application, but it also lets you find the best deal among several competitors. Don’t forget to apply to a credit union for an auto loan if you are a member, as it may offer the best rates.

The right lender may offer you a bad credit auto loan without regard for how problematic your credit report is. By going through a loan provider that performs a soft pull preapproval, you will find lenders that want your business enough to overlook your turbulent credit history. And believe me, several car dealers out there fit that description — probably more than you think!

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.