It’s time to go apartment hunting! You scour the neighborhood in search of “For Rent” signs in windows and check rental websites to identify places that seem great and are within your budget. Now you’re ready to see the places in real life and submit an application for the one you like best. But unfortunately, the landlord also requests permission to check your credit report, and you know it doesn’t look so good.

Does bad credit put you out of the running for a lease? Not necessarily. Here’s what to do.

1. Fix (and Delete) What You Can

There are three major credit reporting bureaus in the US that keep records of your credit reports: Experian, Equifax, and TransUnion. Because you don’t know which credit bureau the landlord will use, access all three reports immediately. You can get them for free on AnnualCreditReport.com.

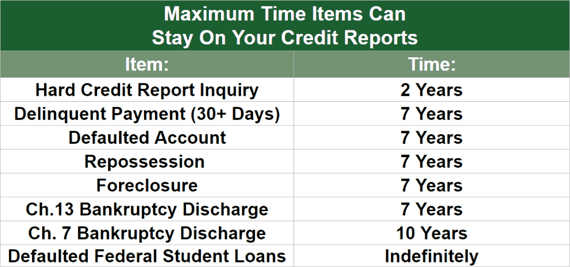

As per the Fair Credit Reporting Act, credit bureaus are required by law to only report accurate and timely data about consumers, so read through your reports carefully. Check to see if there is anything listed that is incorrect (such as accounts you never took out and strangely high balances) or too old (late payments and collection activity can only be reported for seven years when they first occurred, while Chapter 7 bankruptcy can remain for 10 years from the filing date).

If anything is amiss, dispute those items. The easiest and fastest way is via the credit bureau’s website. Once done, the credit bureau has 30 days to investigate your claim. If it cannot verify the information is correct, the account or information will be removed. You do not need to file a dispute with all three bureaus, as they will all be automatically updated.

2. Consider Attaching a 100-Word Statement

Perhaps the bureaus didn’t rule in your favor, and you couldn’t get the item you disputed off your report. Now you are stuck with it until it can no longer be reported by law.

If you will not be speaking to the landlord directly, consider adding a statement to your credit reports that explains the bad mark. The Fair Credit Reporting Act also gives you the right to add a consumer statement of up to 100 words to your reports, where you can give your reason for the dispute, and it will show up when the landlord pulls it. At the very least, it will give your side of the story.

3. Ask the Furnisher For a Break

Credit reporting bureaus get their information from the businesses that send them data about you. If the information is correct, but you do not want the landlord to see it, you may consider paying the company to stop furnishing the credit bureaus with the data.

If you can afford to pay the debt, you can send the furnisher a Pay For Delete Letter. This is an offer to pay them to stop reporting the information or account.

There is no guarantee that the company will accept your request, but it can be worth a try under certain circumstances.

4. Add Positive Accounts

Landlords want to see that you are financially stable, especially with past rental contracts. While these don’t usually show up on your credit report, you can take action to have them listed in your file. Some services are free, such as Fannie Mae’s Positive Rent Payment program and TransUnion’s Piñata, while others are fee-based, such as RentReporters and Rental Kharma.

Experian has a program called Boost where you can add your utility and cellphone bills to your Experian report. It’s free, and once these accounts are added, anyone pulling your report will see them. If you have a steady payment history with those accounts, they can help balance out accounts that you did not handle as well.

Proving that you can manage your regular bills can give you an edge. Be aware that this program is only for Experian credit reports, so if the landlord checks the other two bureaus, they will not see those accounts. For this reason, you may request that they use this bureau or bring your own recent copy.

5. Prepare Your Valid Explanation

You have high credit card debt, some accounts in collections, or you filed for bankruptcy last year… Whatever the case, the landlord will likely view such events as red flags. Get ready to give a short summary of the situation with the prospective landlord.

For example, maybe you went through an expensive divorce that hurt your finances, and at the time, you couldn’t afford to make your loan payments as agreed. You weren’t being irresponsible; you were going through a rough patch that is now over. If you have any proof that your bad credit is not an indication of your character but of an isolated event, bring it with you.

6. Sweeten the Deal With Cash

To the landlord, bad credit indicates that you are a risky tenant. You may be able to allay those fears with cash. No, not paying the landlord off, but offering to increase the security deposit or even pay for another month’s rent.

Just make sure you do it in conjunction with an explanation. For example, maybe you were laid off during corporate downsizing and fell behind on some bills. Now that you are back on your feet and in a secure financial position, you can afford the contract terms and maybe even a little more.

7. Show Your Documents

Your credit may be bad, but your ability to make all the payments consistently may be great. Show the landlord. Bring several months of paystubs from your job and paperwork that shows you’ve made your regular bill payments on time.

Also, bring proof that you have a history of being a responsible renter. Letters from past landlords or bank statements that show you’ve made a long series of rent payments on time can make a big difference. If anyone else can vouch for you, such as an employer or former roommates, ask them to write reference letters on your behalf.

8. Become a Roommate

If you plan on sharing an apartment, look for one that has already been rented and needs a roommate. Depending on the circumstances, the landlord may not check your credit because the primary leaseholder has already secured the apartment. Here are some tips for finding a suitable roommate.

9. Add a Cosigner

If you found the apartment of your dreams but the landlord is hesitant to offer you the place because of your bad credit, maybe you can bring somebody with good credit on board. Typically, this would be a parent or a spouse. But it can work in your favor if you can find somebody who will enter the contract with you and who the landlord determines is a good credit risk.

Just be aware that when somebody else signs the rental contract with you, they become the guarantor. If you do not pay as agreed, the landlord can turn to the cosigner for remittance. Therefore, that person needs to be aware of the risks and in full agreement, and you must be especially careful to make the payments in full and on time.

10. Find Landlords Who Don’t Check Credit

Most landlords check credit reports because they are a great tool to gauge how you have been handling your credit accounts. It gives them an indication of your level of financial responsibility. But not all landlords rely on credit reports.

Those who manage properties in less desirable neighborhoods or have an overabundance of properties to rent may be less discerning. They may not check your credit history at all; if they do, they will be much more forgiving about what they see.

If you know the landlord personally or a friend or a relative does and can vouch for you being a good tenant, that too can override a credit check.

11. Downsize if You Must

The perfect place may be out of reach right now. If the rental market is especially tight or the apartment is super desirable, the credit requirements may be too high. In that case, there may be nothing you can do to convince the landlord that you are the right renter.

If so, don’t bang your head against the wall — look elsewhere. Some landlords are very rigid, while others are more accepting. Broaden your search to lower-cost apartments and ask your friends if they know anyone searching for a great tenant.

12. Strengthen Your Credit For the Future

Remember, a credit report is just a snapshot in time. It shows what accounts you’ve opened and whether you paid them, among other things. But your credit history is also your best predictor of future behaviors.

Every loan and credit card payment you send on time will appear on your report and build your reputation as a responsible renter. Maintaining low or no consumer debt will also work in your favor.

Eventually, derogatory information such as late payments and collection activity will drop off your credit report, and you will be left with nothing but positive activity. The next time you go apartment hunting, it will be with a credit report that shows just how great you truly are without having to take so many extra steps.