When growing your hair from short to long, there’s often a transitional stage in the middle when it’s long enough to get in your eyes but not so long it can be tied back. A credit score of 600 to 650 is the financial equivalent of that follicular midpoint — it’s probably not good enough for a prime rewards card, but it may be too good to settle for expensive subprime cards.

In many ways, the cards you can get with a 600 credit score will depend on the nature of your score; if you’re building credit for the first time, a student or no annual fee card may be the right choice. If you’re rebuilding credit after some mistakes, a secured card may provide the best value.

Keep reading for our experts’ selections for the best credit cards for 600 credit score ranges, including the overall best cards, unsecured, secured, no annual fee cards, and student cards.

Overall | Unsecured | Secured | No Annual Fee | Student | FAQs

Top Overall Cards For 600 to 650 Credit Scores

Although consumers with credit scores in the 600 range are hardly the lowest cardholders on the credit card food chain, they’re not exactly writing their own tickets, either. To easily qualify for the rewards-rich prime credit cards so popular these days, you’ll likely need a credit score north of the 670 mark.

What you can get with a 600 to 650 credit score is a solid unsecured credit card or a low-fee secured card that will allow you to build credit and, maybe, earn some rewards. Use your new card responsibly for six to 12 months, and your score should increase enough to get your hands on even better cards.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

A Fortiva® Mastercard® Credit Card can be obtained by consumers with fair credit. The card can be used to make purchases both online and in stores and can help you build credit with responsible use. It also pays up to 3% cash back and gives automatic credit increase reviews.

2. Platinum Mastercard® from Capital One

The Platinum Mastercard® from Capital One is a rarity: an unsecured card for fair credit that has no annual fee. It doesn’t offer rewards, but it does have the standard set of Capital One and Mastercard perks, including $0 fraud liability and an easy-to-use mobile app.

- Make the first six bill payments on time to be considered for a higher credit limit

- Unsecured card reports to all three credit bureaus

- Pay $0 annual fee

Although starter cards like this aren’t known for their high credit limits, Capital One does offer the option to boost your credit limit if you make your first six payments on time. The card also comes with access to free credit score tracking to help you keep an eye on your progress.

3. Discover it® Secured Card

The Discover it® Secured Card is an all-around winner, offering purchase rewards, flexible credit requirements, and no annual fee. The minimum required deposit is just $200, and the credit line will be equal to the deposit.

- Earn 2% cash back at restaurants & gas stations on up to $1,000 in combined purchases each quarter, up to the quarterly maximum

- Minimum $200 deposit required

- Pay $0 annual fee

Cardholders who pay on time each month and maintain healthy credit habits may be upgraded to an unsecured account and have their security deposit refunded. Closing the account with a $0 balance will also result in the deposit being returned.

Top Unsecured Cards for 600 to 650 Credit Scores

With a middling credit score in the 600 to 650 range, you have a few more options for unsecured credit cards than you would were your score much lower — but the easiest cards to get will still be the bottom-tier cards with annual fees and/or few perks.

If you’re concerned about being approved for a particular card, or simply want to explore your options, many issuers will let you check for pre-qualified card offers online. Of course, the easiest way to stack the approval deck in your favor is often by applying for a card known to accept low-scoring applicants, such as the cards below.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

This card pays generous cash back rewards and is marketed toward people who have “less than perfect credit,” which includes a credit score of 600. You can see if you prequalify for this card before you officially apply to avoid a possible denial without affecting your credit.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 29.99% APR (Variable) | Yes | 8.5/10 |

This card offers a generous credit limit considering it’s designed for subprime credit scores. The APR is on the high side, but not as high as some other unsecured cards for bad credit. You’ll benefit from credit bureau reporting and Mastercard’s Zero Liability protection on authorized charges.

6. Revvi Card

- Earn 1% cash back rewards^^ on payments made to your Revvi Credit Card

- Perfect credit not required

- $300 credit limit (subject to available credit)

- Checking account required

- Opportunity to request credit limit increase after twelve months, fee applies

- *See Rates, Fees, Costs & Limitations for complete offer details

- ^^See Revvi Rewards Programs Terms & Conditions for details

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 8 minutes | 35.99%* | Yes | 8.0/10 |

This card offers cash back rewards without requiring a security deposit, which is pretty rare in the subprime market. But its APR is high, so always pay on time to avoid being charged interest.

Top Secured Cards For 600 to 650 Credit Scores

The reason a low credit score makes it difficult to get approved for most types of credit is that a low score indicates a high credit risk. In other words, people with low credit scores are more likely to default on — i.e., stop paying — their debt, which means the creditor loses money.

Secured credit cards, on the other hand, require a cash deposit to open and maintain. That deposit acts as security for the loan, which reduces the risk to the issuer. This means secured cards are much easier to get than unsecured cards, and many secured cards will charge lower fees and/or offer purchase rewards, as well.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

This card requires no credit check for approval, offers a free credit score, and charges a moderately low APR — lower than that of the two secured cards from big banks below. But it does charge an annual fee. If you tend to carry a balance, this card may be your best bet.

8. Discover it® Secured Card

The Discover it® Secured Card is an affordable secured card that has no annual fee and a manageable minimum deposit requirement of just $200. Cardholders can put down as much as $2,500 for a larger credit line.

- Earn 2% cash back at restaurants & gas stations on up to $1,000 in combined purchases each quarter

- Minimum $200 deposit required

- Pay $0 annual fee

In addition to affordable fees, this card also comes with purchase rewards and a year-end match of all the cash back they earn during their first year with the card. It doesn’t charge an annual fee, but its purchase APR is higher than we’

9. Quicksilver Secured from Capital One

The Quicksilver Secured from Capital One charges no annual fee and pays generous rewards. The minimum deposit amount will be $200, but applicants will receive 1.5% cash back on every purchase they make.

- Earn 1.5% cash back rewards on all eligible purchases

- Reports to all three major credit bureaus

- Pay $0 annual fee

Similar to the Discover card, this card can potentially be upgraded to an unsecured card after your credit improves. Capital One will periodically check your eligibility and upgrade you automatically if your account qualifies.

Top No Annual Fee Cards for 600 to 650 Credit Scores

Although many people associate annual fees with fancy rewards cards, many cards at the other end of the spectrum also tend to charge annual fees. In fact, outside of your local credit union, it’s actually rare for starter and credit-building cards to have a $0 annual fee — rare, but not impossible to find.

If you want both a low-fee card and rewards, you’ll likely need to turn to a secured credit card. Otherwise, you can find some no-frills unsecured cards that won’t charge you a fee, so you can build credit without having to pay for the privilege of using your card.

10. Platinum Mastercard® from Capital One

The Platinum Mastercard® from Capital One is an unsecured card you can get with a 600 credit score that charges no annual fee. It doesn’t offer rewards and the APR is a bit higher than we’d like to see, but it’s a genuine Mastercard from a large bank that can be used anywhere.

- Make the first six bill payments on time to be considered for a higher credit limit

- Unsecured card reports to all three credit bureaus

- Pay $0 annual fee

Your account may be considered for a credit limit increase when you make your first six payments on time, which can also help you boost your credit score over time. You’ll also get access to your free credit score.

11. Discover it® Secured Card

The Discover it® Secured Card charges no annual fee, but, as a secured card, it requires a cash deposit to open and maintain. Approved applicants will need to put down a deposit of $200 to $2,500 to get a credit lien of equal size.

- Earn 2% cash back at restaurants & gas stations on up to $1,000 in combined purchases each quarter

- Minimum $200 deposit required

- Pay $0 annual fee

This is also one of the few cards that will offer purchase rewards to fair-credit consumers, providing up to 2% cash back on eligible bonus purchases and an unlimited 1% cash back on everything else.

12. Quicksilver Secured Rewards from Capital One

The Quicksilver Secured Rewards from Capital One card lands among our favorites with no annual fee because it offers cash back rewards and prequalification with no risk to your credit score. A minimum deposit of $200 is required to open an account.

- Earn 1.5% cash back rewards on all eligible purchases

- Reports to all three major credit bureaus

- Pay $0 annual fee

You can raise your credit limit by depositing more than the minimum before activating your card. And by paying your bill on time each month, you may earn an upgrade to an unsecured Quicksilver card in the future.

Top Student Cards for 600 to 650 Credit Scores

As a student just starting to build credit, it’s natural to have a low credit score — or not have a score at all (it takes six months of credit history to qualify for a FICO credit score). But, a low credit score probably won’t stop you from getting a good credit card so long as you’re a student.

That’s because student credit cards are purposely designed for young people who need to build credit, and student cards tend to have very flexible credit requirements and no minimum credit history requirements. Plus, student cards typically charge no annual fee and many also offer purchase rewards and other perks.

13. Bank of America® Customized Cash Rewards for Students

The Bank of America® Customized Cash Rewards for Students is a competitive rewards card for college students with no annual fee that allows users to select their own 3% cash back bonus category from a list of six options.

- Earn 3% cash back in the category of your choice & 2% at grocery stores and wholesale clubs

- Earn 1% cash back on everything else

- Pay no annual fee

Cardholders can also earn a modest signup bonus and an introductory 0% APR offer. Bonus cash back is limited to the first $2,500 in combined category purchases each quarter.

14. Discover it® Student Cash Back

The Discover it® Student Cash Back is a good starter card for college students, providing high-rate bonus rewards in the form of 5% cash back on up to $1,500 in eligible bonus category purchases each activated quarter.

- Earn 5% cash back rewards for purchases on up to $1,500 in qualifying category purchases each activated quarter

- Earn unlimited 1% cash back on all other purchases

- Pay $0 annual fee

In addition to purchase rewards, the card also offers Discover’s signature Cash Back Match signup bonus that doubles the cash back cardholders earn in their first year. The card even offers a 0% APR for new purchases and a reduced balance transfer rate for six months.

15. Quicksilver Rewards for Students from Capital One

The Quicksilver Rewards for Students from Capital One is a solid option for any tertiary student who doesn’t want to worry about rotating rewards categories. This card offers flat-rate rewards valued at 1.5% per $1 spent.

- Earn unlimited 1.5% cash back on every purchase every day

- Be automatically considered for a higher credit line in 6 months

- Pay $0 annual fee

The card’s variable APR is on the higher side, so do your best to pay your balance off each month so you can avoid interest charges altogether, thanks to the interest-free grace period.

Is a Credit Score of 600 to 650 a Good Score?

These days, you can get a free credit score from nearly every major credit card issuer and from dozens of third-party websites and mobile apps. But all the numbers in the world won’t do you a lick of good if you don’t actually know what they mean.

To know where your score stands in the overall scheme of things, you need to know more about which scoring model was used to generate it. While creditors can use any number of the dozens of scoring models out there — or even their own internal models — most credit scores come from either FICO or VantageScore.

The most popular FICO credit score you’ll encounter is currently the FICO® Score 8, and the most common iteration of the VantageScore is the VantageScore 3.0. The nice part of these two types of scores is that they both have the same scoring range; namely, each model operates on a range of 300 to 850, with 850 being the best possible score.

At a quick look, having a credit score of 600 to 650 out of a possible 850 may seem like you’re doing OK — after all, 600 / 850 = 71%, and that would have gotten you a passing grade of “C” in school, right?

Sort of. The general cutoff for good or prime credit is the 670 mark. A credit score in the 600 range will often be considered “nonprime” — as in, it’s not a prime score, but it’s not a subprime score, either. In other words, your credit score is still considered to be risky, just not as high risk as someone with a score below 580.

However, it gets more complicated than that. For one thing, both scoring models have different ways they categorize credit scores. For the FICO scoring model, a credit score of 600 to 650 falls into the fair category, while the VantageScore model considers the same score range to be in the poor category.

And, of course, each creditor that checks your credit scores will also have its own rules — rules that may not have much to do with your credit score itself, and more to do with your actual credit history.

For example, some consumers have reported being approved for a prime credit card with a score below 650, while folks with scores above 600 may end up being declined for a secured card. Credit card issuers will look at everything from your payment history to your open accounts to your individual history with the specific bank; any or all of these can impact whether you’re approved for credit.

Can You Get a Credit Card With a 600 FICO Score?

One of the nicer things about the modern credit card market is that pretty much everyone can get some type of credit card, regardless of their credit scores. That said, the quality of the credit cards you can get will significantly vary based on your credit reports.

Notice here that we said credit report and not just credit score. That’s because credit card issuers look at your entire credit report — not just your scores — when it comes to evaluating your application. So, the issuer will pull one (or more) of your credit reports and look at everything from how many hard inquiries you have to your payment history for the last seven years.

Because issuers look at the entire credit history, your score alone won’t tell if you’ll get approved for a given card. If you have a so-so credit score but a pristine payment history, for example, you may be approved for a card while someone with the same credit score but a past delinquent payment may be denied.

Consumers with credit scores in the 600 to 650 range tend to either be building credit for the first time or repairing their credit after making a few mistakes. No matter which group you’re in, issuers will see you as fairly risky, which eliminates most prime credit cards as options.

The easiest unsecured cards to get with a poor to fair credit score will either be starter credit cards — bare-bones cards from major banks or local credit unions — or subprime credit cards, the latter of which will typically be fairly expensive. Secured credit cards are also a good option, and secured cards may offer more perks like purchase rewards.

Although credit scores are not the only approval factor, because your credit scores are based on the information in your credit reports, you can use your scores as a way to gauge what types of credit cards to apply for in the first place. Choosing cards that tend to approve applicants with similar credit scores can help prevent wasted hard credit inquiries from failed applications.

For instance, a score in the 600 to 650 range is typically considered to be poor or fair, depending on the scoring metric. This means that, right away, you know an application for a credit card aimed at consumers with excellent credit scores — 750 FICO and up — will be unlikely to be approved.

How Do You Get Your Credit Score From 600 to 700?

Increasing your credit score by 100 points takes time. But achieving a good credit score (670+ FICO Score) is well worth it. Your new card can help you improve your credit score — here’s how:

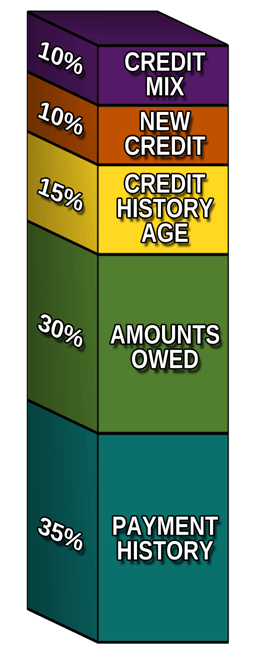

- Make all of your payments on time. In the graphic above you see that payment history accounts for 35% of your FICO Score and is the most important credit scoring factor. Maintaining an on-time payment history is the single best thing you can do to protect and improve your credit score.

- Keep your credit utilization low. Credit utilization refers to your credit card balance and how much you owe compared with how much credit you have available, i.e., your credit limit. The cards in this review are likely to approve you for a modest credit limit of $1,000 or less. Keep your credit utilization ratio at or below 30%, which means not exceeding a $300 balance if you have a $1,000 limit.

- Don’t apply for several cards within a short period. The age of your credit history is worth 15% of your FICO Score, and the longer your history, the better it is for your score. Opening new accounts reduces your average age of credit, which can negatively impact your credit. It also adds hard inquiries to your credit report (the “new credit” factor above) that can affect your credit score for up to one year.

- Diversify your credit mix. If this is your first or second credit card, just opening the account may help your credit in two ways, one of which is expanding your credit mix. Your credit mix refers to the types of accounts open in your name, such as a car loan, home loan, student loan, personal loan, etc. Credit scoring models like FICO want to see that you can manage payments on different accounts well. The second way opening a new card can instantly help your credit is by increasing the amount of credit you have available to you, as represented by your credit utilization ratio discussed above.

You can improve your credit score within a few months by following these basic credit management guidelines, but it won’t happen overnight and could take up to a year.

Make the Most of Your Fair Credit Score

Having bad credit can feel a bit like a bad haircut; you spend a lot of time just waiting for it to grow. As you start inching into the fair credit range, your credit card options will start to expand — but it may not be quite as quick as you hope.

With fair credit, you may be able to leave the subprime cards behind, which can help make building credit a lot more affordable. At this point, the choice prime rewards cards are still more of a goal than a realistic option, though you’ll likely get closer to that goal with every on-time credit card payment.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.