Bad credit car loans with zero down are the best way to ensure you and your family have reliable transportation without busting your budget to get the ride you need.

These loans can help you purchase a car today without needing a down payment to get the keys. Instead of paying a large sum of money upfront, you’ll repay your car loan over time through a series of affordable monthly payments.

And your bad credit score won’t keep you from getting the loan you need. The auto lending networks listed below all specialize in finding bad credit financing that includes a competitive interest rate, monthly payment, and loan term.

Bad Credit Car Loans You Can Get With $0 Down

The auto lending networks listed below provide several car financing options that may not require a down payment to help you meet your budget and car-buying needs — even if you have damaged credit. These bad credit auto loans can come directly from a car dealer in your area or private subprime lenders that offer same-day loan deals.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

- Prequalify in minutes without impacting your credit score

- Refinancing loans save an average of $191 per month

- 125% financing available for cash-out refis

- PenFed Credit Union membership required but can be applied for at the same time as your loan

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.19% and up | 1935 | 5 minutes | 8.5/10 |

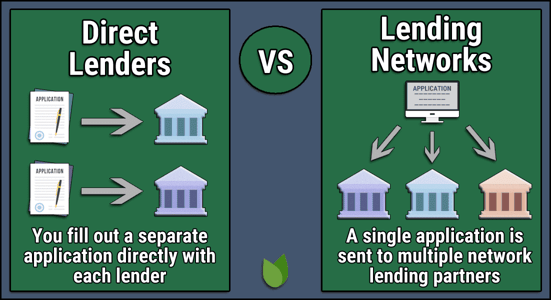

Auto lending networks have an advantage over local banks or credit unions in that your single loan request travels to multiple lenders that all compete for your business. In most cases, you’ll hear from a car dealership in your area within 24 hours.

The car dealer will go over your financing options and discuss the car lot’s current inventory. In most cases, you can get financing and drive off in your new car the same day.

Can You Get a Car Loan With No Down Payment If You Have Bad Credit?

Bad credit loans to purchase a vehicle aren’t as uncommon as you may think. While your credit history plays a major part in determining your creditworthiness with a car dealer, you can still find auto financing with a poor credit score.

That’s because an auto loan is a form of secured loan. When you accept a bad credit car loan, you agree to use the purchased vehicle as collateral. That means the car dealership or private lender can repossess the vehicle and sell it if you stop making payments.

This takes a good bit of the risk out of the lender’s hands and makes it easier to approve a loan for someone with a damaged credit history.

Whether you qualify for no down payment will depend on your creditworthiness and the lender or dealer you work with. But by filling out a form with any of the auto lending networks above, you can see whether any of their lending partners can meet your request for no down payment. There’s no obligation to move forward with a loan offer.

Your lender will look at more than just your credit report when considering your loan application. For example, some borrowers may have excellent credit, but their current income may not allow them to afford a new loan. These consumers may struggle to find a loan.

On the other hand, other borrowers may have poor credit scores — and even a bankruptcy, missed payments, or a repossession on their credit reports. But if they have little debt and a good income, they may find a variety of subprime auto loans from which to choose.

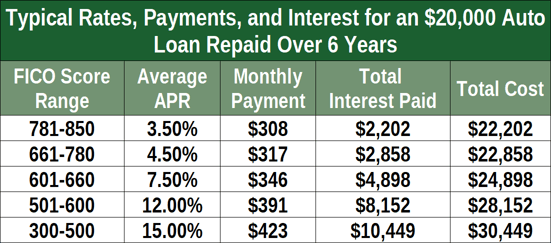

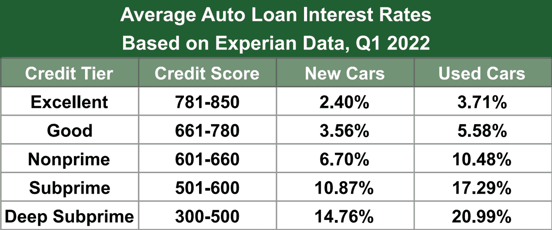

Just keep in mind that these loans often have higher interest rates or other fees that make them more expensive than a loan for someone with good credit or excellent credit.

What Credit Score Do You Need To Get a Car Loan?

Most auto lenders and dealers don’t have a minimum credit score for approval. Instead, lenders will examine your credit history, payment history, current debt obligations, and income data to determine your creditworthiness.

Since an auto loan is a secured loan, lenders often feel comfortable extending a loan to someone with a poor credit score. That’s because there’s recourse if a borrower stops making payments — the lender can repossess the vehicle and get some of their money back by selling it.

This isn’t the case for a traditional unsecured personal loan, where the lender simply loses any money that isn’t paid back.

While consumers with very poor credit scores — such as those under 520 — may have some issues finding car financing, lenders may still consider applicants in that credit score range.

It won’t harm your credit score to submit a loan request to one of the auto lending networks listed above. The application takes less than five minutes to complete, and you could get a credit decision very quickly. Just be aware that lower credit scores often result in higher interest rates and other fees.

Before you apply for an auto loan, you should consider pulling your free annual credit report. This report won’t show your actual credit score, but it will display all of the data that’s used to calculate your credit score.

Examine your credit history to make sure all of the data is accurate. Make sure no recent negative items persist on your reports that may give a lender pause. Try to keep all of your credit card and other loan balances low and be certain that your loan application lists all of the income you regularly receive.

This can include more than just your wages from regular employment. You can also list any child support, government benefits, retirement, investment income, or other income you receive.

Can I Get a Bad Credit Auto Loan Through a Bank?

Most banks and credit unions won’t consider an auto loan application from someone who has bad credit. Banks are especially tough on lenders who don’t have a good credit score.

That’s because banks are often publicly traded companies that must turn a profit every quarter to keep investors happy. Risky loans, such as subprime auto loans, can create problems if they aren’t repaid. That eats into profits and risks executives’ jobs.

Plus, when you apply for a loan through a bank or credit union, you’re only requesting a loan from that single business. With an auto lending network, you’re applying to multiple lenders at once, which increases your chances of success and forces the lenders to compete for your business. That means more competitive loan offers.

Why Do Car Dealers Want a Down Payment?

Car dealers often like it when a borrower includes a down payment because it shows that they have some skin in the game.

If times get tough and you have trouble making your monthly payment shortly after getting your new vehicle, you’re more likely to hustle to make your payment if you’ve already invested a few thousand dollars of your own money into a down payment. After all, you won’t get that money back if the lender repossesses the vehicle.

On the other hand, you may have no problem letting the vehicle go if you haven’t sunk a lot of your money into the loan. Lenders want you to repay your loan. Repossessions are expensive and require a lot of man-hours that lenders can’t afford to dedicate to a single loan.

While a down payment may increase your odds of finding loan approval, you can often find lenders that offer bad credit car loans with zero down.

How Can I Get an Auto Loan Online?

Online loans are easy to find and even easier to apply for. This ease of use has more and more consumers turning to the internet over banks and credit unions when they need a loan.

Car buyers can find the online loan process especially easy. The online lending networks listed above provide a short loan request form that takes less than five minutes to complete. It will require your basic identifying information — such as your name, address, phone number, Social Security number, and income.

This process doesn’t leave an inquiry on your credit report and won’t harm your credit score.

Each network will then forward your loan request to all of its partner lenders. This can be a private lender or a car dealership in your area that’s connected with several lenders that offer bad credit auto financing.

Within 24 hours — but typically much faster — a lender or dealer will contact you via email or phone to go over your car-buying options. In most cases, you can close your loan and leave with your new car on the same day.

These aren’t guaranteed auto loans, but most dealers can find financing options for borrowers with just about any credit problem — including bankruptcy, a repossession, or missed payments.

In fact, most dealerships employ a credit specialist who works directly with many lenders and has a relationship with each business that makes it easier to push through financing that otherwise may not be approved. This is how many subprime auto loans come to fruition.

If you find a dealer or lender that you want to work with, that business will require a full credit check with at least one of the major credit bureaus. After examining your credit history, income information, and other vital data, the dealer can work to find the bad credit financing you need.

Your loan’s interest rate, monthly payment, and loan term will vary based on your creditworthiness and the standards set by the multiple lenders that receive your loan request.

Which Credit Score Do Lenders Use for Car Loans?

While lenders may use different credit scores or a combination of scores, one of the most popular is the FICO Auto Score. This score is designed specifically for auto lenders and weighs the factors on your credit report differently than traditional FICO Scores.

Another significant difference is that the industry-specific FICO Auto Score ranges from 250 to 900, while other base FICO Scores, such as the FICO Score 8 and FICO Score 9, range from 300 to 850. If you want to know your FICO Auto Score before you go car shopping, you can get it directly from FICO — for a fee.

Auto lenders may also use VantageScore as a source to check your credit standing. Your VantageScore and FICO Score may vary slightly, so it could be wise to identify which score (or scores) your lender will use to accurately assess your approval odds.

Prequalify For Bad Credit Car Loans Online With No Money Down

In many ways, your automobile can define your life — but not by any prestige that comes with a make, model, or year. Instead, the reliability of your vehicle assures you get to work or school and that you and your family can get groceries or other necessities.

Reliable transportation can mean the difference between paying bills or going into default. But purchasing a vehicle is expensive. Large banks and credit unions want down payments and have other requirements before approving bad credit auto financing.

But the lending networks listed above all provide car buyers with less than perfect credit a chance to secure bad credit car loans, possibly with zero down. This means that you’ll get the reliable transportation you need without sacrificing money that’s supposed to go to other necessary expenses.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.