Americans are no strangers to debt. Perhaps this isn’t surprising given the high cost of living, relatively low wages, and lack of savings.

According to Experian’s 2020 Consumer Credit Review, Americans have an average total debt balance of $92,727. This includes credit card debt, mortgages, and outstanding unsecured loans such as personal, auto, and student loan debt.

But what many of us may not be aware of is the number and type of programs out there to help relieve the burden of heavy debt. Here are some things every American should know about debt relief.

In simple terms, debt relief is the removal or restructuring of a certain portion of a loan obligation. It can take many different forms, including partial loan forgiveness, debt consolidation, government-backed loan programs, or other options.

One thing to keep in mind, however, is that not all debt relief programs or plans are alike. Debt relief should be considered carefully so as not to damage or cause any further harm to your credit.

Depending on how much debt you have and the current state of your credit score, some types of debt relief may do serious harm to your credit. This is particularly true in the case of credit card or consumer loan debt, where creditors may place a charge-off or other unfavorable note on your credit report as a result of debt relief negotiations.

A notation like this can stay on your credit report for up to seven years and can lower your credit score significantly.

Debt relief programs are often designed to manage certain types of loan debt by addressing the factors and considerations unique to each. Government and privately managed programs are also available to consumers — often without the need for an outside agency.

Of course, debt relief programs can be complex and are best handled by experts in the field. Here are some examples of different types of debt relief programs available.

Credit Card Debt

Credit card debt relief is one of the most common forms of debt relief consumers seek. It can be as simple as calling your card company and asking for a reduction in your APR or some extra time to pay your balance.

Of course, it can also be complex when you are unable to meet your debt obligations and must negotiate a settlement. Whether you choose to negotiate directly with your credit card issuer or hire a debt relief company to help you through the process, it pays to do your research and know your options. See options for debt relief companies listed above.

Student Debt (Private and Government)

The explosion of student loan debt in recent years has led to a steadily increasing number of loan defaults. Fortunately, student loan debt relief programs — both private and government-run — can help make student loan debt more manageable.

Loan forgiveness programs can also help reduce your principal amount and even eliminate your debt obligation entirely in some instances. In addition, many employers and even some states have initiated student loan assistance programs that can help in paying your loan debt.

Begin your research by checking out the FTC’s Student Loan website.

Medical Debt

Being overwhelmed with medical debt can be an especially hard burden on anyone. Not only does financial hardship add stress to one’s life, but it also affects a person’s health and welfare. Medical debt relief programs are designed to assist people who find themselves in financial difficulty due to medical bills.

State and federal programs, as well as those run by private organizations, can help in lowering payments and consolidating medical debt into a single payment. Some programs also offer grants and debt forgiveness for qualified candidates.

Recent changes to FICO credit scoring treats medical debt in collections differently than other debt making it possible to remove medical debt entirely from a report when the debt is settled.

Debt Relief Grants

Programs that allow for grants, loans, and federal assistance for debt relief can be difficult to research, and even harder to qualify for. However, the U.S. Department of the Treasury publishes a comprehensive list of such programs on its website.

Federal grants exist to help qualified consumers with overwhelming debt due to student loans, mortgage debt, medical debt, debt due to disaster or fire, and many other causes.

IRS and Tax Debt

When we think about the role of the IRS, most people don’t immediately think of debt relief. However, the IRS has statutes written into the tax code and has developed programs that allow for a fair amount of leeway when it comes to collecting tax debt.

When it comes to collecting what’s owed to them, the IRS is not unlike most lenders in wanting to collect something rather than nothing.

Programs such as the IRS Fresh Start Initiative offer taxpayers the ability to negotiate for less than what is owed, as well as take advantage of penalty relief and forgiveness. If you owe the IRS money, it pays to look into the tax debt relief offered.

Consumers who don’t know where to turn can research companies that specialize in navigating the complex world of debt relief. While not all of these companies are on the up and up, the vast majority are legitimate, helpful businesses staffed by honest, caring, and experienced professionals.

Below we review some of the best and most reputable debt relief companies we’ve found.

National Debt Relief Review

National Debt Relief claims to be able to get consumers out of debt within 24 to 48 months. They also have a satisfaction guarantee with a stated 100% money-back refund promise. The company specializes in debt settlement and negotiation, with a $10,000 debt amount minimum. National Debt Relief deals primarily with credit card debt and does not handle IRS, student loan, or mortgage debt. It is credited with a BBB A+ rating.

National Debt Relief claims to be able to get consumers out of debt within 24 to 48 months. They also have a satisfaction guarantee with a stated 100% money-back refund promise. The company specializes in debt settlement and negotiation, with a $10,000 debt amount minimum. National Debt Relief deals primarily with credit card debt and does not handle IRS, student loan, or mortgage debt. It is credited with a BBB A+ rating.

CuraDebt Review

Working in the debt relief industry for more than 15 years, CuraDebt is among the most established in the business. It offers debt relief, debt settlement, and debt negotiation services, as well as debt consolidation programs. It also offers a free consultation and plenty of valuable information on its website. CuraDebt receives high marks from users of its services, however, it is not rated by BBB or by Consumer Affairs.

Freedom Debt Relief Review

Freedom Debt Relief is the parent company of DebtBenefit.com, listed above. This parent company was founded in 2002 and claims to have helped more than 150,000 people resolve their debt problems. It focuses on debt evaluation, with debt negotiation and settlement as the ultimate goal. This company requires a minimum of $10,000 in debt to engage its services. As mentioned above, Freedom Debt Relief gets a BBB rating of A+.

Consolidated Credit Counseling Services Review

Consolidated Credit Counseling has been in operation for more than 20 years and claims to have helped more than 5 million Americans with its services. It offers services ranging from financial education and counseling to debt consolidation, debt management, and debt settlement programs. Both Consumer Affairs and the Better Business Bureau give Consolidated Credit Counseling Services their highest ratings.

Accredited Debt Relief Review

Accredited Debt Relief provides negotiated debt relief as an alternative to bankruptcy and debt consolidation. It deals primarily with credit card debt and offers its expertise in negotiating debt settlement and debt relief for consumers. It requires a percentage of what you owe to be placed in a protected and insured escrow account while it works to negotiate a settlement with your creditors. Accredited Debt Relief currently holds a BBB rating of A+.

Credit counseling and debt relief service agencies are typically not philanthropic organizations and are in business to make money. That said, some organizations and industry groups offer low-cost or no-cost programs to individuals who meet certain requirements.

These nonprofit credit counseling and debt relief programs are typically aimed at consumers who have gotten in over their heads and need some help getting out from under credit card debt.

The Consumer Financial Protection Bureau (CFPB), as well as the Federal Trade Commission (FTC) both, have information on their respective websites on how to recognize debt relief organizations that are above board and those that are not.

Further, industry groups such as the National Foundation for Credit Counseling and the nonprofit American Consumer Credit Counseling service both offer information on free or low-cost debt relief programs.

A reputable debt relief services company is there to help consumers get out from under unmanageable debt obligations. It offers services that can assist in negotiating debt repayment, consolidating debts into a single payment, and advising consumers on the best course of action for their unique situation.

Red flags or warning signs you should be aware of when choosing a debt relief services company include things like:

- Asking for upfront payment directly to the company

- Promising to improve your credit score

- High monthly fees

- High percentage fee based on reduced debt amount

- Guarantees that debt will go away

- Guarantees that bad marks will be removed from credit report

A debt relief service is not a bank or a payment service — although it may legitimately request you put a certain amount of money into an escrow account to cover payments that it negotiates.

The federal government has limited programs that can help with certain debts such as student loans and some mortgages. These programs are specific to certain types of loans and dates when they were issued, although any consumer who meets the requirements can take part.

Some examples of government programs that are available include:

Despite low wages and today’s high cost of living, Americans have many options for relieving the burden of debt.

Debt settlement is a type of debt relief. If you opt for a debt settlement service, you can expect a debt relief provider to negotiate with your creditors. The goal will be to settle your debts for less than what you owe.

Here’s how the process will work: You’ll deposit money into a special account every month. As your balance goes up, the debt settlement professional will contact your creditors and attempt to negotiate a lower settlement amount. With debt settlement, you may be able to settle your debt in as little as 24 to 48 months, so this is a great option if you don’t want to wait long to be debt-free.

As with any debt relief program, debt settlement also comes with some drawbacks. First off, there are no guarantees, as your creditors don’t have any obligation to negotiate your debt. When you settle a debt, you can also expect your credit to take a hit because your credit report will indicate that you paid off a debt for less than the entire amount.

In addition, professional debt settlement is not free and you’ll owe the company you hire a percentage of your total debt once it is settled. Lastly, you may be on the hook for taxes on the portion of your debt that your creditors forgive.

A debt relief program can affect your credit in a good or bad way. It all depends on the method you choose and what happens to your debt. Of course, if you miss your payments and are past due on your accounts, your credit score will drop.

Here’s a brief overview of how a few of the major debt relief options can impact your credit.

- Debt Settlement: A debt settlement company will likely ask you to stop making payments. Once you do, it will negotiate for lower settlements on your behalf. While this sounds great, it will cause your credit score to suffer. After all, making regular on-time payments is the most crucial factor in your credit score and even one missed monthly payment can hurt it.

- Debt Consolidation: As long as you’re responsible, you can consolidate your debt and keep your credit score in good shape. Although a debt consolidation loan or credit card will lead to a hard inquiry, it will only ding your credit score a bit temporarily. If you make your payments on time, your credit score can actually improve. It’s wise to avoid new credit cards and loans while you pay off your consolidated debt.

- Bankruptcy: Bankruptcy, which involves an extensive legal process to get rid of debt should be a last resort. If you file for Chapter 7 bankruptcy, you won’t have to pay for secured debt like your house. However, a creditor may put your house in foreclosure. One of the reasons bankruptcy is not recommended until other options have been exhausted is because it can severely damage your credit score. Depending on the type of bankruptcy you undergo, it will remain on your credit report for seven to 10 years. This can make it a real challenge for you to qualify for credit down the road.

Before you go with any debt relief option, make sure you know exactly how it will affect your credit. This way you can avoid unwanted surprises that get in the way of your short and long-term financial goals.

You will have to pay to receive professional debt settlement services with a debt consultant. While every company is different, most will charge you anywhere between 15% to 25% of your enrolled debt.

It’s important to note that a debt settlement company can’t collect payment from you until it has settled your debt, you’ve agreed to the settlement, and you’ve made at least one payment to the creditor.

Don’t commit to a debt settlement program until the company has clearly conveyed how it will charge you for its services. This information should be outlined in your agreement. If you don’t agree to it or believe it’s not worth it, you’re not obligated to sign on the dotted line. You can explore other, more affordable debt relief options.

The smartest way to consolidate debt depends on your unique situation. One good option may be a debt consolidation loan.

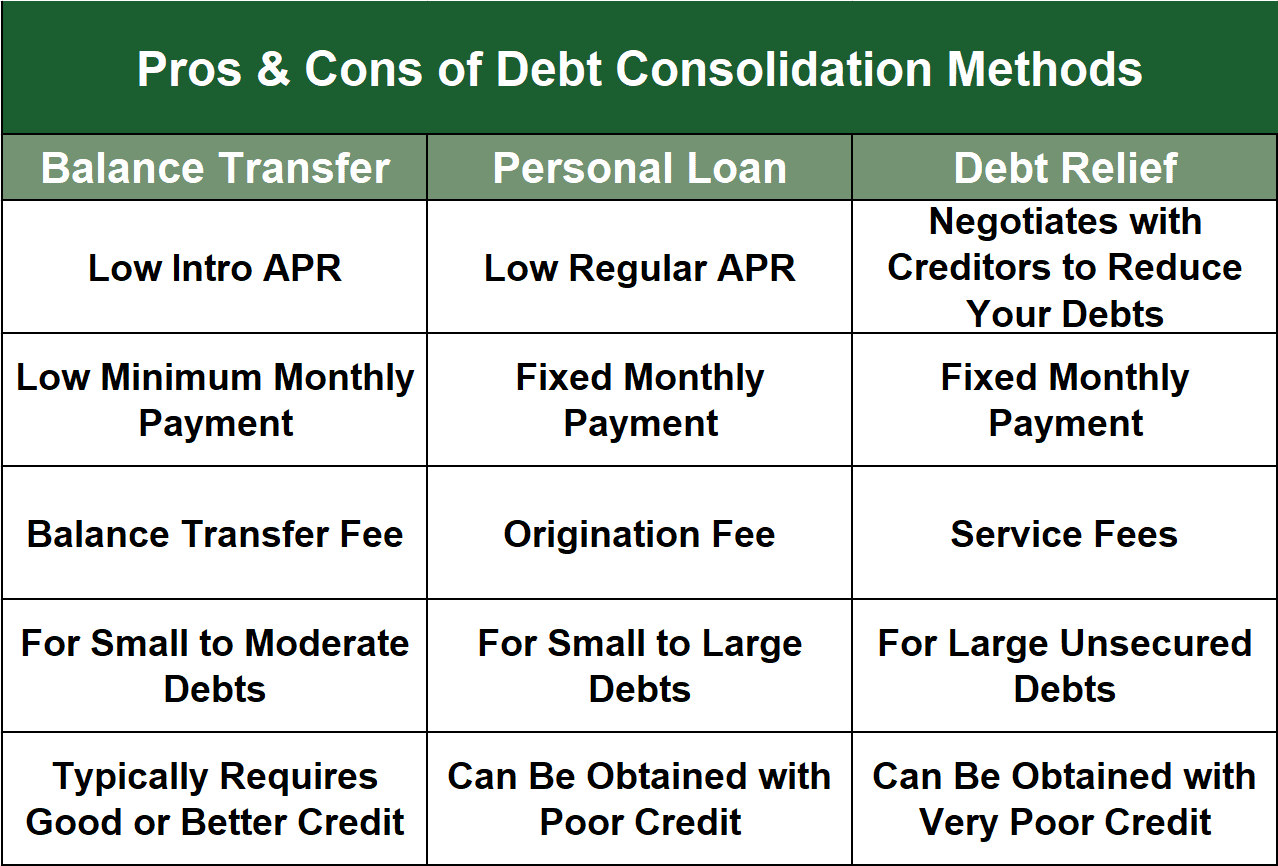

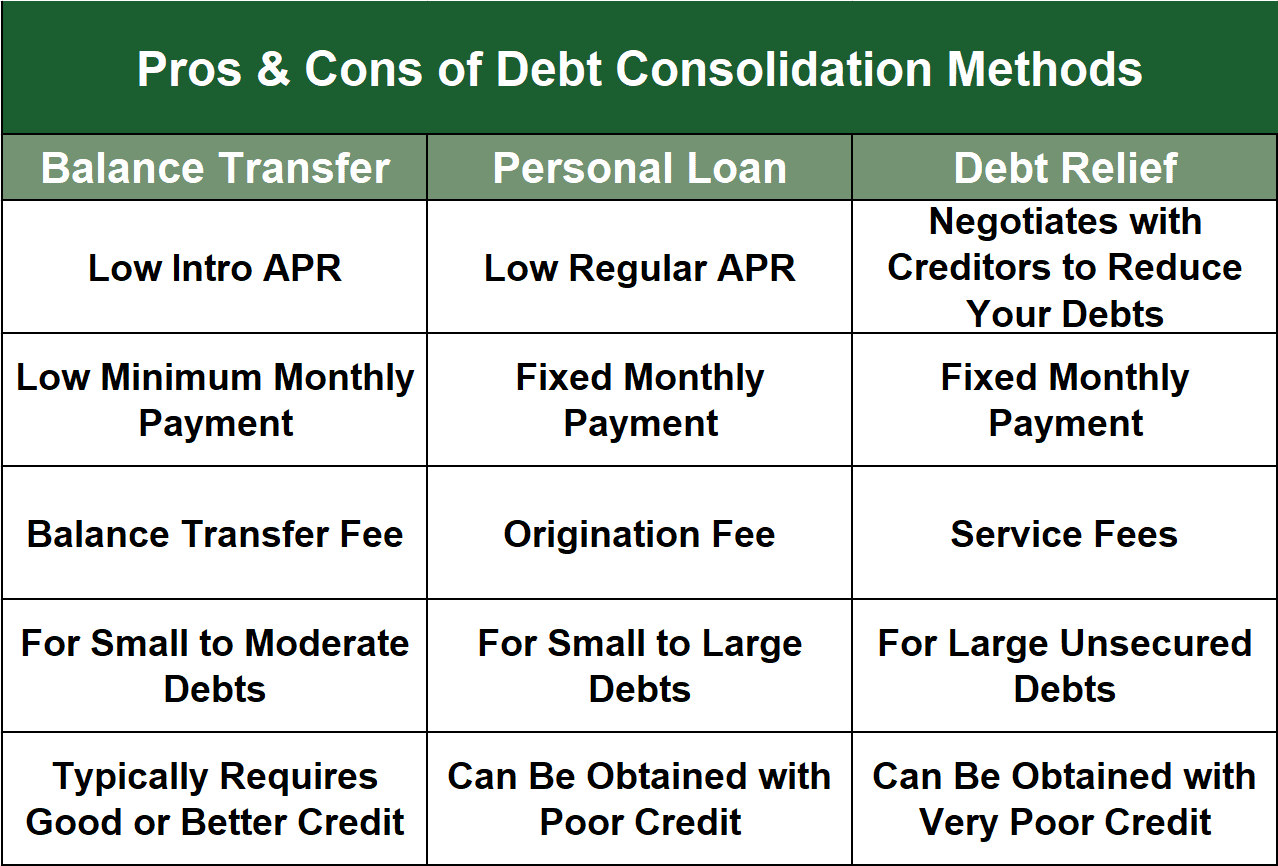

Check out the graphic below to compare popular consolidation methods.

With a debt consolidation loan, which is essentially a personal loan, you can combine several debts into one — often at a lower interest rate.

A debt consolidation loan may make sense if you’re overwhelmed with having to keep track of multiple debt payments each month. It can also be a solid choice if you’re able to land a lower interest rate and save thousands of dollars while becoming debt-free in about two to five years.

While a debt consolidation loan can be wise, it’s not always the best route. It won’t help you if you have a spending problem and tend to live beyond your means. Also, you may need a good credit score to lock down one of these loans, so you may not qualify if you have bad or even fair credit.

Another smart way to consolidate debt is a balance transfer card. This lets you roll all of your credit card debt onto a single card with a promotional rate. Depending on the card you select, the rate may be as low as 0%.

As long as you’re confident you can repay your debt before the promotional period expires, a balance transfer card could help you out. The caveat with this option is that you may need to pay a balance transfer fee, which will likely be between 2% and 5% of your balance. If you decide to consolidate your debt with a balance transfer card, do your research and find the best credit card company and option for your particular needs.

The amount you’d like to transfer and how much you can pay off each month should guide you in your decision. You can also turn to a debt consolidation company for some guidance.

As stated, debt settlement is a strategy to negotiate with your creditor to settle for less than the outstanding balance of your debt. While you can do this on your own, it may be a good idea to hire a debt settlement company.

A debt settlement company has a team of professionals that perform debt settlement services day in and day out. These professionals often have connections and relationships with certain creditors, making it easier for them to achieve favorable outcomes. In addition, debt settlement professionals know strategies that can help them produce great results for you as a client.

Even though you’ll have to pay for a debt settlement company or debt management program, you may find that doing so is well worth it. This is particularly true if you’ve never communicated with creditors before and are new to the entire debt settlement process. A debt settlement company can give you the peace of mind of knowing your debt negotiations and outstanding debt are in the hands of those who know how to handle them properly.

Fortunately, you don’t always have to pay a debt relief agency to get out of debt. Depending on your situation, lifestyle, and preferences, you may be able to meet your goal with a DIY debt solution.

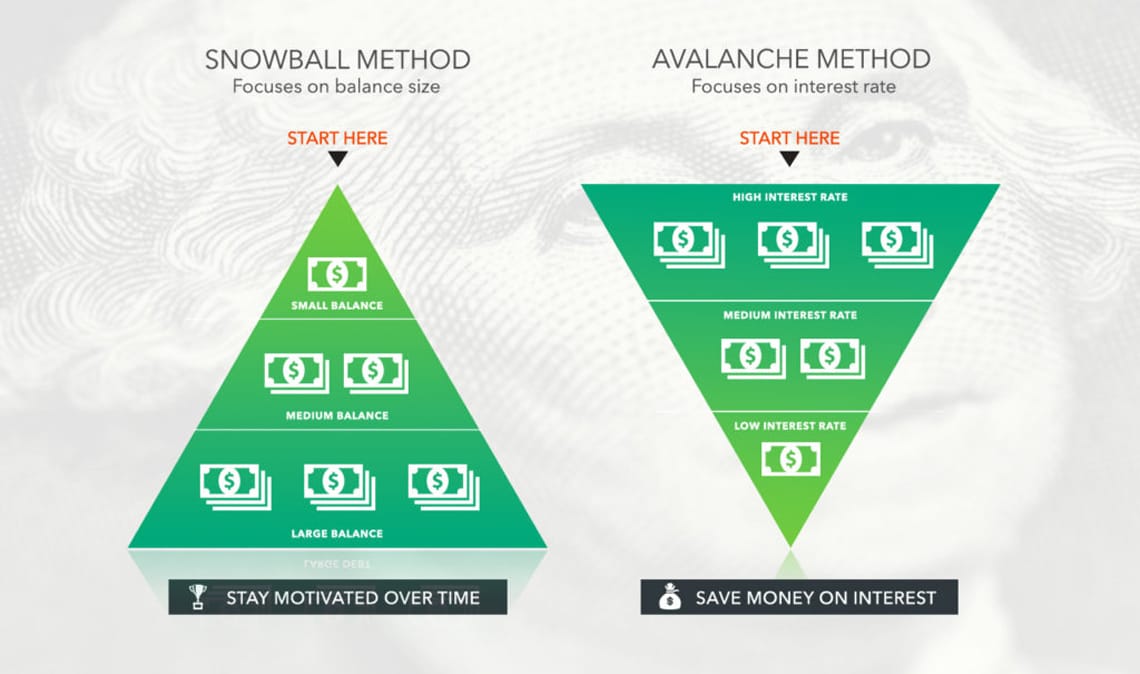

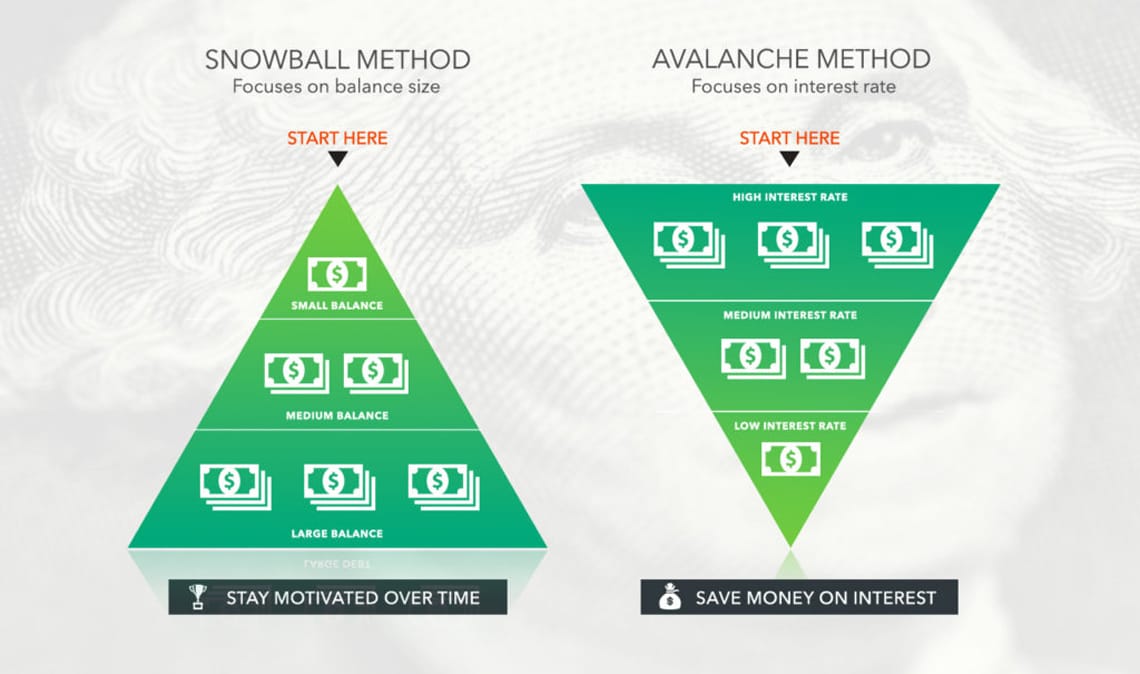

The two most popular DIY debt solutions are the debt snowball and debt avalanche methods. With the debt snowball method, you pay off your smallest debts first. Then, you roll the amount you used to pay your smallest debts into your larger debts. This can help you stay motivated until all of your debt is paid.

Photo source: Art of Thinking Smart

If your goal is to save on interest, the debt avalanche method is the way to go. The debt avalanche method is where you prioritize paying off your debts with the highest interest. After you pay them off, you move on to debts with lower interest rates.

No matter which DIY option you choose, you won’t have to worry about a ding to your credit score or any hidden fees that further harm your financial situation. Keep in mind that if you are overwhelmed with your debt or don’t have the time to devote to a DIY plan, paying for a debt relief solution with a debt consultant may be worth the cost.

While many reputable debt settlement companies are out there, scams do exist. The good news is you can protect yourself from them by becoming familiar with the red flags.

If you receive a recorded message from a company that claims it can get rid of your debt, do not call them back because it is likely a debt relief scam.

Be cautious if a company “guarantees” that your creditors will settle your debt for less than you owe. There is no way it can guarantee that this will happen. Reputable debt settlement firms will be honest with you and explain that while they will try their best to negotiate successfully, they can’t promise a positive outcome.

It is illegal for a debt relief provider to ask you to pay an upfront fee before it settles your total debt. Also, if its website lacks a physical address or you notice negative reviews or a poor rating with the Better Business Bureau, there’s a good chance it’s a scam.

Lastly, if a company explains what it’ll do to help you over the phone but never puts anything in writing, you don’t want to hire them. A legitimate debt settlement company will send you an agreement that clearly outlines all of its terms and conditions. You’ll find that it is upfront about what it can do to help you, and how much it’ll charge you for its services.

At the end of the day, it’s wise to go with your gut feeling. If something seems off with a company you’re communicating with or the service seems too good to be true, protect yourself and find an alternative option. Several quality debt settlement firms are out there, so you’re sure to find one that can accommodate you.

A credit counseling agency may assist with debt relief. You can expect a credit counseling agency to design an affordable monthly payment plan on your behalf. It may also offer a debt management plan if you have a lot of credit card debt.

With a debt management plan, you can lock down lower interest rates with your creditors and become debt-free quickly. Your certified credit counselor will negotiate a lower interest rate on your credit cards. Then, they will arrange a payment plan that will relieve you of your debt in three to six years.

During this time, you’ll send monthly payments to the debt management company, which will distribute the funds to your creditors until all of your debt has been repaid.

If you decide to pursue credit counseling, choose a reputable credit counseling company with a solid track record and good reviews on the BBB’s website. It should also be a member of an organization like the National Foundation for Credit Counseling or the Financial Counseling Association of America.

Credit counseling should be on your radar if you owe at least $5,000 in unsecured debt, including credit card or personal loan debt. In this situation, a certified credit counselor can be an invaluable resource.