When you’re approved for a new loan, there are usually some things you understand right away. The value of the loan, the interest rate, and the monthly payments, for example, are usually not hard to figure out. But what about how each of these factors affects the other?

But certain important pieces to a loan puzzle can only be figured out through an amortization schedule. Read on to learn what you should know about this vital financial tool, or use the links below to jump ahead to a specific loan type.

Auto | Student | Mortgage | Business

What is Loan Amortization?

Amortization sounds like a fancy word, but it’s actually a pretty simple concept. It refers to the method of paying off a loan or any type of debt in fixed payments for a specific period of time. The most popular types of amortization include mortgages and car loans.

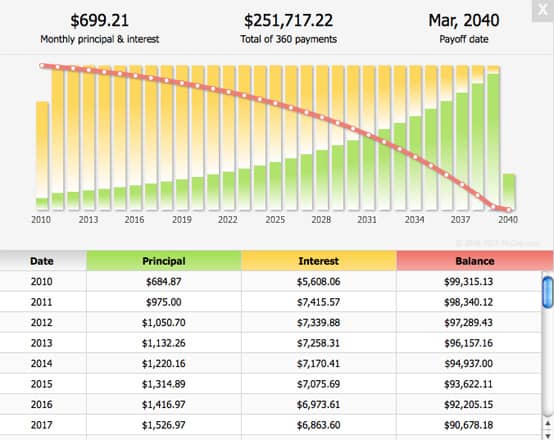

When all of the information from amortization is laid out as specific payment amounts for the life of the loan, it is called an amortization schedule.

This image shows a loan amortization schedule for a 30-year mortgage, where green represents the principal of the loan paid, yellow represents interest paid, and red represents the remaining balance for each calendar year listed. Photo credits: Amotid.com.

The two important features that make loan amortization different from other methods of repayment is that the payments are the same amount every month, and they have a definite start and end. Compare that to a credit card payment plan; credit cards change the payment amount from month to month, depending on what’s owed. They also don’t have a specific time by which the consumer must pay off the loan.

Amortization Schedule Calculators

It is possible to create and maintain your own loan amortization calculator. Either by using a calculator and the formula for interest and payments, or by taking advantage of a simple spreadsheet application, you can figure out exactly how much principal and interest will make up your payment for any month. Here is a good example of how to set this up for yourself.

But there is an easier way. Amortization schedule calculators are popular, easy, and free. They can provide you a long-term view of your payment composition, and they can motivate you to keep making the payments that will eventually lower interest and get you to your final payment faster.

There are many kinds of free amortization calculators, but these are the most common:

Auto Loans

Cars, boats, and RVs are usually purchased with loans made specifically for them. They are calculated much the same way as a mortgage. Since cars have a shorter useful life than a home, however, you won’t find most loans to be longer than four to six years. The amortization schedule you create should reflect this, as well as your down payment, interest rate, and how often payments will be made (monthly vs. bi-weekly).

We recommend this Auto Loan Amortization Calculator from Calculator.me to determine your car loan amortization schedule.

Student Loans

The low interest rate of many student loans typically results in the first few years’ payments going mainly toward interest. Combine that with the very long life of a student loan (15 to 30 years is possible), and you can end up with a very large and complicated amortization schedule.

Student loan borrowers may find that creating an amortization schedule can be helpful in reducing overall interest paid to the lender; just be sure to request that any prepayments or extra payments be applied directly to principal when you make them.

Calculate your student loan amortization schedule with this calculator from FinAid.org.

Mortgage Loans (15- and 30-Year Fixed Rates)

Home ownership is often the first time most consumers actually look at or use a loan amortization schedule. That’s because the cost to own a home is usually so high and the payment terms are long. This is also when it becomes important to know the difference between a 15-year and 30-year fixed rate mortgage.

The 30-year fixed rate mortgage is the most popular due to its lower monthly payment amounts, but consumers pay considerably more interest. Many experts have recommended a hybrid approach to these loans; by choosing a 30-year and treating it like a 15-year (paying twice the monthly amount), you can tackle that interest head on and get yourself a much cheaper home.

Business / Commercial Loans

Small business owners or self-employed workers may find that a commercial line better meets their needs for flexibility, interest rate, and repayment terms. If you want to expand your business or take advantage of certain business class banking perks, a small business line may be the best loan product out there.

It’s important to note that business loans are usually paid annually, or semi-annually, so the amortization schedule will look unique. Calculate a typical commercial loan amortization schedule with an online business loan calculator.

Principal vs. Interest: Know Where Your Payments are Going

The one major benefit to creating an amortization schedule is that you’ll know exactly how much of each month’s payment is going toward principal. Why is this important?

Too many times, consumers don’t understand how even the smallest extra payments can drastically reduce interest paid over the life of a loan. A good amortization schedule should allow for adjustments to forecast how small changes to your payment can benefit your financial future.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.