Knowing how to remove medical collections from your credit report can be extremely useful.

Whether the result of an injury or illness, few things in life are as stressful as dealing with a major medical problem — except, that is, trying to pay for it. Collectively, Americans dish out around $3.4 trillion a year for medical care each year, and that number is only expected to rise.

Given the difficulty many people have in keeping up with costly medical bills, it’s little surprise that a number of consumers end up with medical collections on their credit reports. While these defunct debts can put a damper on your credit score, making it harder — and more expensive — to obtain new credit, you don’t have to deal with it forever. You have two main options for removing medical collections from your reports. Keep reading as we dive into this issue and offer some helpful tips, as well as information on some of our favorite credit repair companies in case you want to enlist some professional assistance.

1. Credit Repair | 2. Wait it Out

1. Dispute the Debts Yourself or Through Credit Repair

Although it hasn’t always been the case, as of September 15, 2017, the only medical bills you’ll need to worry about showing up on your credit reports are those that are more than 180 days late. Of course, once that period is up, any delinquent medical debts can find their way onto your credit reports, dropping your credit score like a stone — unless you do something about it.

For cases in which medical debts are incorrectly or unfairly reported to the credit bureaus, such as those reported too soon, the best way to deal with them may be to dispute the item directly with the credit reporting agency. While you can file individual disputes yourself, many consumers find it easier and more effective to use a reputable credit repair company instead. You can browse our expert-rated companies to compare options.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

+See More Credit Repair Companies

Whether you choose to file disputes yourself or to hire a professional, the process will follow a similar vein. An individual dispute will need to be filed with each credit bureau for each item that is mistakenly reported. For instance, if you have two different medical collections accounts you need to dispute that show up on each of your three credit reports, you’ll need to file a total of six disputes.

Upon receiving a consumer dispute, the credit bureau has 30 days to investigate its validity and respond to the consumer. If the investigation concludes that the medical debt was placed on your credit report incorrectly or unfairly, the credit bureau is required to remove the item from your credit report right away.

Credit reporting companies must investigate the items in question — usually within 30 days — unless they consider your dispute frivolous. They also must forward all the relevant data you provide about the inaccuracy to the organization that provided the information. After the information provider receives notice of a dispute from the credit reporting company, it must investigate, review the relevant information, and report the results back to the credit reporting company. — Federal Trade Commission

You can facilitate the process by providing as much supporting documentation (read: proof) as possible when filing your dispute. This can include obtaining your payment records from the doctor or hospital, providing copies of relevant credit card statements, or pertinent invoices and receipts.

For the best results, make sure you understand the limitations of credit disputes and credit repair before starting the process. Only those medical debts erroneously or unfairly reported to the credit bureaus can be successfully disputed, either by yourself or by a credit repair company. If your debt is legitimate — and legitimately delinquent — the only thing that will likely remove it from your report is time.

2. Wait for Medical Collections to Fall Off Naturally

While some medical collections may show up on your credit report by mistake, chances are better that you own that debt and that it really is delinquent (or was at the time it was reported). The best thing you can do in this situation is to pay off the delinquent debt, if possible; unpaid accounts are always less attractive to future lenders than paid ones, especially ones that went into collections.

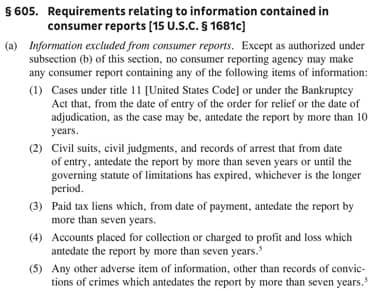

The Fair Credit Reporting Act (FCRA) dictates how long negative accounts can remain on your credit report.

After that, the only thing you can really do about the credit impacts of medical collections is to wait them out. The Fair Credit Reporting Act (FCRA) limits the duration negative accounts can stay on your credit report to seven years for most account types (up to 10 years for certain bankruptcies).

Furthermore, most credit scoring models give negative items less weight as they age. In other words, the credit damage of a delinquent medical bill will lessen over time — and disappear altogether after seven years.

If you want to improve your credit score further, or at least mitigate the negative impacts at the start, the best thing to do is often to bolster the other parts of your credit score. For example, maintaining a positive payment history before and after your medical collections hit your report may help to minimize the negative impacts to your credit score (though it won’t erase them completely by any means).

Medical Issues Don’t Need to Be Credit Issues

Dealing with a major medical problem can be debilitating — and not just for your health. A typical visit to the emergency room can cost you up to $2,000 if your insurance doesn’t cover it, and extended medical problems can easily hit five-digit figures even with health insurance. And it’s not getting any cheaper in the future. Not to mention how long an ER visit can take — I spent eight hours there the last time I had a stomach bug!

It’s not all bad news, however. While the healthcare industry and politicians work to try and mitigate the problems with medical costs, the financial industry has stepped in to help consumers deal with the credit fallout.

In addition to the mandatory 180-day grace period before medical debts can be reported to the credit bureaus that kicked in September 15, 2017, the latest FICO credit scoring model, the FICO® Score 9, has also made some big changes to how medical debts are treated. Specifically, the Score 9 model ignores paid collections accounts, meaning your score can recover shortly after you pay off your delinquent medical bills.

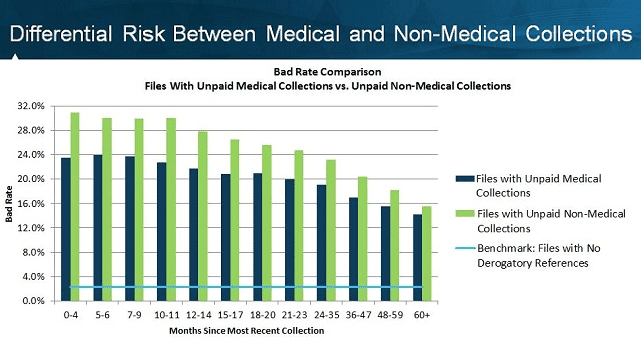

This chart from FICO shows consumers with only unpaid medical collections present lower risk than those with unpaid non-medical collections.

Additionally, the FICO® Score 9 is capable of distinguishing between unpaid medical collections and unpaid non-medical collections. Since FICO found that consumers with only unpaid medical collections present less credit risk than those with unpaid non-medical collections, unpaid medical collections have less negative impact on your credit score under the Score 9 model.

The biggest drawback to the FICO® Score 9, which was introduced in 2014, is that the adoption of the new model has been gradual at best. While FICO advertises that over 100 million FICO® Score 9 scores have been pulled by lenders, many major lenders still use previous FICO credit score versions, and mortgage lenders, in particular, seem to be in the credit scoring model stone age.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.