For those who know what to expect, credit repair can be the salve to a wounded credit report. With the help of an experienced firm, credit repair may resolve the errors, incomplete information, and unverifiable accounts that weigh down credit scores and make obtaining financing so difficult.

Of course, in the modern world of endless internet options, finding the right credit repair firm can be a challenge. A quick search shows literally millions of results, and it can be hard to separate the wheat from the chaff. In this case, you have to rely on a little common sense — and a lot of research.

When looking for a reputable credit repair firm, one name you likely see time and again is Lexington Law Firm — and with good reason. Having been around since 2004, Lexington Law is one of the biggest names in the space, and has worked with hundreds of thousands of consumers looking to clean up their credit. Keep reading for our Lexington Law review, including valuable background information on the company, how Lexington Law is perceived by consumers, and a rundown of how the credit repair process works.

Our Take | Consumer Reviews | How It Works

In Business Since 2004

While being long-lived and having a large client base doesn’t necessarily mean you’re a quality firm, we’ve found that Lexington Law has more than that. First, as a legitimate law firm — with actual lawyers — Lexington Law is optimally qualified to keep up with the evolving credit laws, and has a dedication to maintaining adherence to the latest federal standards (which is likely how they’ve lasted so long in such a heavily watched and regulated industry).

And, just as — if not more — important, Lexington Law does it while maintaining an impressive success rate. In fact, according to numbers from Lexington Law, the firm’s clients saw an average of 10.2 negative items removed, and over 9 million items were removed in 2016 alone.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

Another thing we like about Lexington Law? The firm is very upfront about their monthly price, clearly laying out what they offer and what clients can expect. We do think they could be a little clearer about the five-day period clients have to cancel without penalty, as well as the one-time work fee that is charged after work begins and is separate from the monthly service fee.

On the plus side, while it is not the cheapest credit repair firm on the block, Lexington Law is about on-par with other credit repair services.

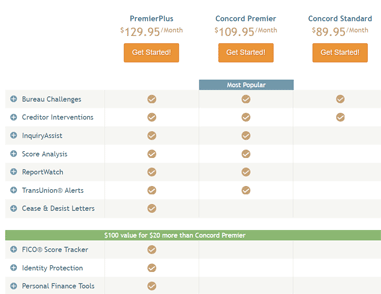

Lexington Law offers several levels of service depending on your needs.

The firm does make it easy to explore your options, as your initial consultation is completely free.

A representative will walk you through the services Lexington Law offers, discuss your current situation and help you determine the best path for cleaning up your credit report and improving your credit score.

The consultation isn’t the only free service Lexington Law offers, either. The firm’s website has a range of educational resources that can help consumers learn more about the ins and outs of their credit and financial rights.

The Credit in a Minute video series imparts helpful tips, while the blogs, books, and articles cover topics from bankruptcy and debt to credit cards and building credit.

Lexington Law Earned a 4-Star Rating with Consumer Affairs

For a second, third, or four-thousandth, opinion, of course, you can head online. With over a quarter century of experience working with consumers to repair their credit, it makes perfect sense that Lexington Law has plenty of testimonials and reviews to its name, thousands of which are floating around the web.

Indeed, the firm has well over 2,200 reviews on BestCompany.com, with a solid user score of 8.1 out of 10, and a site score of 8.6. Additionally, Lexington Law has 345 reviews with ConsumerAffrairs.com — 78% of which are 5-star ratings, giving the firm an overall 4-star rating from clients around the country.

“When I started with Lexington Law I had over 100 items on my credit report and a score under 400. I couldn’t buy a hot dog on credit. Lexington Law took on the challenge and have removed 91 so far. My score is over 700 and I have no problems with credit anymore. The job they have done is so great. I would recommend them to anyone needing to clear up their reports.” — Patrick, ConsumerAffairs.com Reviewer

That said, Lexington Law’s reviews aren’t all milk and honey. The ranks of reviewers do include a few who were unhappy with their experience, often due to the speed of the process. However, Lexington Law’s site is careful to state that every case will vary in the timeline and effectiveness of the process, and many reviewers note that the firm never guarantees results.

“I found Lexington Law on Credit Karma. I hired them because there was, at minimum, 10 negative items on my report. There were five charge offs, a judgment, and a civil claim, just to name a few. My report was a hot mess. All of them have been removed since January. I think the problem people have with Lexington Law is that they are not patient. I realize that it took a while for my credit to become bad, and it will take a while for it to be cleared and considered great again.” — Robin, BBB Reviewer

Other negative reviews center around the difficulty of getting a staff member on the phone, with some citing waits of 30 minutes or more. However, few of these reviews mention the efficacy of Lexington Law’s other contact methods, which include email and online chats.

What to Expect From Your Credit Repair Process

Although every credit repair case is individual and dependent upon the client’s specific credit situation, your experience with Lexington Law will follow some basic steps. It starts with the consultation, which includes a complete review of your free credit report summary and score.

Once you’ve retained Lexington Law’s credit repair services, you’ll go through the onboarding stage, for which you’ll need your three credit reports, one each from Experian, Equifax, and TransUnion. If necessary, Lexington Law can help you obtain your credit reports.

During onboarding, you’ll go over your reports with a trained paralegal, including discussing the specific circumstances around each questionable item. The onboarding process should give you a good idea of which accounts on your report can be disputed.

That’s when Lexington Law’s attorneys and paralegals get to business, working out the best strategies to address each disputable item on your report. The initial stage of action typically involves sending appropriate correspondence to the bureaus and your creditors to address simple fixes, mistakes, and incomplete information.

An Average of 10.2 Negative Items Removed Per Client

All in all, the most important thing to remember when it comes to credit repair is that it is a very individualized process. The actual number and type of negative accounts you have will dictate the effectiveness of the process, as well as the time it takes to see results.

And because the process is based on your personal credit situation, there is no one-size-fits-all solution. However, for a credit repair firm with more than years of experience, a proven record of success, and a wealth of positive consumer reviews, Lexington Law is our top pick.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.