In a Nutshell: Lunch Money is a multicurrency money management app designed to meet the needs of modern spenders. It offers a variety of digital tools, including expenditure categorization and subscription tracking, to help users keep their finances in focus. Lunch Money users enjoy peace of mind thanks to two-factor authentication, data encryption, and industry-trusted technology. Its support for crypto investments and FIRE (Financial Independence, Retire Early) planning adds plenty of value for tech-savvy individuals seeking to better manage their money today and for the long term.

Budgeting is a fundamental financial practice, but it is often challenging. That was the case for Jen Yip when she and her husband returned to Toronto, Canada, from the United States. The couple held funds in both U.S. and Canadian dollars, and they also enjoyed traveling, which added even more currencies to their asset mix.

Yip created a spreadsheet with recurring expenses and basic costs of living to help manage their various funds. Separate sheets covered other currencies and financial categories and kept everything organized. The spreadsheet worked so well that she started telling others about it.

Yip said that when friends and family began asking to use her spreadsheet, she realized she was on to something. So Yip decided to convert the spreadsheet into a freestanding app she called Lunch Money.

“It’s kind of like when you’re in school, and your mom gives you lunch money and says, ‘Don’t let the bullies take your lunch money,” said Yip, Founder and Chief Budgeter of Lunch Money. “It keeps track of your money and doesn’t let anyone else take your hard earnings.”

One of Lunch Money’s most innovative aspects is its incorporation of multiple currencies. That is especially important for users who travel frequently for business or pleasure.

The app offers a host of other money and credit management features that appeal to an emerging generation of tech-savvy millennials. And many users are looking for a more robust experience than traditional banking and credit apps can provide.

A Personal Finance App Engineered for the Modern Spender

Yip said she quickly realized there weren’t many good personal finance management options for people in her demographic.

“In the beginning, I would say that’s digital nomads. But as I started thinking about it more, it’s just the modern-day spender,” Yip said. “We’re — pre-pandemic, obviously — traveling a lot, doing a lot of cross-border banking. So it felt like a great opportunity to create something.”

One of Yip’s priorities was to get multicurrency functionality up and running to accommodate modern-day spending needs. After that, she wanted to ensure currency rates would automatically update every day. Everything else was built on that foundation.

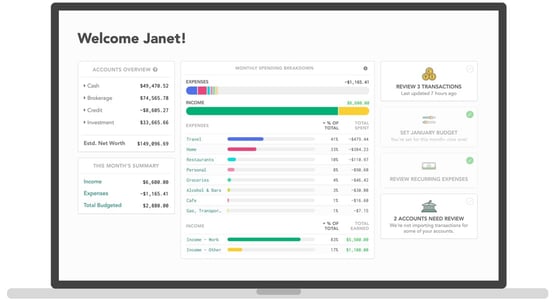

The Lunch Money app allows users to easily track their spending and budget.

“I thought my target audience would be digital nomads, and I spent a lot of my early marketing toward them,” Yip said. “I also saw a lot of success marketing my product to the tech crowd, mostly based in Silicon Valley.”

According to Yip, many of Lunch Money’s early users were engineers, product managers, and other tech-oriented people interested in an independently developed, personal financial tool to help them manage money and protect their credit.

“It is geared towards high earning millennials,” Yip said. “I am very engineering-minded. So a lot of our features resonate with that crowd.”

Many of them hail from the United States. Still, thanks to the app’s currency versatility, it has users across 30-plus countries.

Transparency and Automation Offer Simplicity and Control

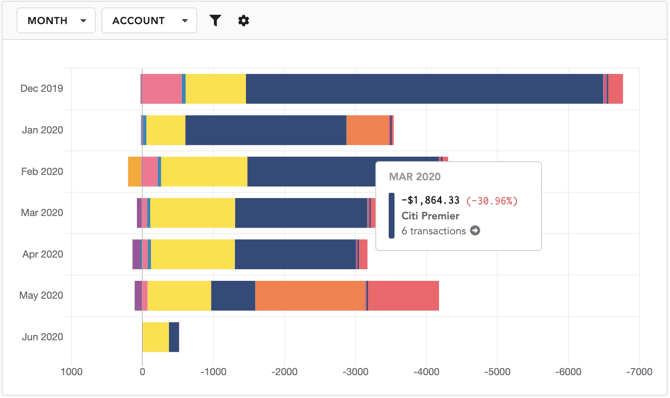

One of Lunch Money’s most popular features is its rules engine, which controls transactions and how they are categorized. That makes it easy for users to assess spending at a glance without wasting time sorting through transactions.

“That feature is something a lot of people have enjoyed, just to completely automate their finances,” Yip said. “It learns your habits as you go.”

Lunch Money also aims to be transparent. It allows users to maintain tighter control over their finances while still relying on the app to do the heavy lifting.

“From the beginning, I wanted to make sure that there wasn’t any magic behind the scenes,” Yip said. “And while we do a lot of automation, it’s all under the hood, and you can see it. You can automatically add tags and anything that you normally do. You could have it automatically done for you.”

Lunch Money automates its analysis to give users updated information on their financial outlook.

Automation is equally helpful with both one-off purchases and recurring payments. Many consumers have monthly and annual subscriptions that sometimes go unnoticed and cost them more than they realize, especially if charged to credit cards.

“I think it’s important to separate that from your daily incidental spending. Because if you’re going to cut down on your spending, recurring expenses should be the first place you look because it adds up,” Yip said. “It’s a good place to start when you get into budgeting and your finances because it says a lot about your lifestyle. And it’s a good place to start pondering potential changes.”

The value is both reflective and future-oriented. Lunch Money reminds users how much they pay in subscriptions and recurring charges each month, helping users budget accordingly. That helps consumers save money and avoid possible overspending or excessive credit card debt if they carry a balance.

“We also track which of your recurring expenses have been paid each month and which ones haven’t,” Yip said. “So if you expected something two weeks ago, and it still hasn’t been paid, then you know that needs investigating.”

Onboarding and Security Ensure User Peace of Mind

Lunch Money simplifies the sign-up process and offers multiple ways for users to get familiar with the app after onboarding. After signing in, users can start with a clean slate or populate the app with demo data that provides concrete examples of how the system works.

“If you go through the demo data, then we seed your account with transactions, recurring items, a few accounts, and some balance history so you can check the net worth tracker and get a feel for what it would look like,” Yip said. “Then, from the demo, you can always start fresh again and add your own info.”

Lunch Money walks users through the process of adding their own information. That includes setting categories, setting display preferences, and connecting the app with financial accounts. It also provides other options for retrieving transaction information.

All of that financial data is sensitive information, but users can rest assured that Lunch Money takes security seriously.

“I am also very wary of who I gave my data to, and I don’t take it lightly that all my users trust me with their data,” Yip said. “We only store and collect and ask for what’s necessary. And then we have a lot of security measures.”

Those include two-factor authentication for access and two-layer encryption for data. Access is read-only for sensitive connections with financial institutions.

“The hosting platforms that I use, the APIs that I use, they are not experimental by any means,” Yip said. “They’ve been around for many, many years and are trusted within the industry.”

Lunch Money: Upcoming Features Keep Pace with New Products and Financial Trends

Lunch Money’s primary user base of millennials and tech enthusiasts deal with more than just month-to-month budgeting and spending. Finance extends into the long term, and investments are often more than just government-backed currencies.

“One thing that has been popular, and I think is great for the modern spender, is our crypto portfolio tracker,” Yip said. “I haven’t seen any of the major personal financial tools support tracking traditional assets alongside crypto.”

Lunch Money can connect directly to a user’s crypto wallet or exchange, just as it does with banks. Or users can choose to track their digital assets manually. The app updates the currency’s value every few minutes, and that value converts to the user’s primary currency and reflects in the overall net worth tracker.

In her continuing quest to innovate, Yip has also built a FIRE tracker more suited to the modern spender. Users can enter events and milestones, and the app will weigh them against net worth to calculate the individual’s FIRE number — or the amount of money they’ll need to invest to retire early.

“My hope with this also is to demystify FIRE for a lot of people,” Yip said. “Because I think when you start getting into it, a lot of the material and calculators out there are intimidating. There’s a lot of numbers that you might not know off the top of your head. So, as with everything I do with Lunch Money, I try to make it delightfully simple.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.