In a Nutshell: When service-based nonprofits in the Midwest need funds to purchase or renovate facilities, they can turn to IFF. The organization provides loans tailored to the needs of NPOs that serve their communities. This financing helps organizations overcome the obstacles that have traditionally prevented them from modernizing their services and facilities. While IFF relies primarily on institutional bank investors, it also works with impact investors and faith-based investors to contribute to helping NPOs improve communities across the Midwest.

Meet the Need (MTN), a nonprofit organization based 30 miles outside of Kansas City, Missouri, provides support to community members experiencing difficult times. In 2009, the organization worked out of a large rented commercial warehouse. The facility wasn’t in great shape, but it was all MTN could afford at the time — and it managed to get the job done.

But soon, the warehouse was put up for sale, and it appeared likely that the organization would be forced out. With nowhere else to go, MTN tried to take control of its future by purchasing the facility. Unfortunately, banks wanted a 20% down payment on the purchase — which MTN could not afford.

But the organization found a lifeline through IFF, a mission-driven lender that focuses on helping nonprofits purchase and upgrade facilities. IFF loaned MTN $309,000 to buy the warehouse and regain that sense of control — but the relationship didn’t end there.

When the warehouse burned down three months later, IFF came through again with a construction loan to rebuild it. IFF also helped MTN open the Opportunity Cafe and Coffee shop, which generates revenue and provides valuable job training for the organization’s clients. From 2012 to 2017, MTN assisted more than 11,000 community members thanks, in part, to financial assistance from IFF.

Joe Neri, the CEO of IFF, talked with us about how IFF loans help nonprofits build stronger community bonds.

“We work hard to get capital in the hands of agencies so they can develop quality facilities,” said Joe Neri, CEO of IFF. “There are multiple examples of homeless shelters or transitional housing projects that are assets in their neighborhoods and overcome the challenges with their neighbors. But you need the right kind of capital to do that.”

IFF was founded by a woman named Trinita Logue, and was incubated by the Chicago Community Trust, an organization that provided grant funding to nonprofit organizations. NPOs often approached the trust for capital campaign grants that would allow the organizations to build or renovate social service facilities. The trust was unable to meet those capital demands, but established IFF to facilitate lending to worthy organizations seeking to secure facilities and provide services to low-income populations and people with disabilities.

“We’re still focused on helping nonprofit agencies borrow money for the facilities they use to provide services to low-income individuals. It’s broad across the whole nonprofit sector — education, healthcare, human services, affordable housing, childcare,” Neri said. “All of the nonprofit sectors that serve low-income or special needs communities are our market.”

Specialized Loans Developed to Help Organizations Overcome Financial Challenges

The unstable and unsustainable positions of many nonprofits requesting grants from the Chicago Community Trust were the motivating factors behind the founding of IFF. These organizations needed to renovate and improve their facilities, but they did not own those spaces. And if landlords increased the rent beyond what the NPOs could pay, the organizations would have to relocate. They would then often request another grant to secure a new facility and continue to provide service.

The logical solution was for NPOs to purchase outright the facilities they were using. That would exempt them from property taxes — which are built into rent — saving them money over time. Additionally, ownership would grant them more control over their work.

The challenge lay in the appraisal gap. Banks would lend only 75% of a property’s appraised value, while the entire project’s cost, including renovation, were much higher than the appraised value. This prevented the projects from getting off the ground, let alone achieving completion and serving the intended function.

IFF specializes in providing financing for organizations to purchase or upgrade their facilities.

Additionally, state-funded programs were always in danger of having their funding cut, making them a bad risk in the eyes of banks. Lenders also had concerns regarding the nonprofits’ financial management and sophistication. Many financial practices forced onto nonprofits — including zero-based budgeting, which requires an organization’s expenses and revenue to equal zero, leaving them with no means of saving — deepened that reluctance to extend credit.

IFF was established to circumvent those challenges. The institution provides loan products tailored to the unique financial needs — and constraints — of beleaguered nonprofit organizations.

“Our founders thought we could create an alternative loan fund at the time — which later became a community development financial institution (CDFI) — that could help agencies purchase their facilities,” Neri said. “We developed loan products based on nonprofits. They didn’t have a lot of fees. Most of our agencies had some form of construction in their projects, so we didn’t have construction loans that then became permit loans with more fees in the middle and fees at the end. We got rid of all of that.”

Serving Nonprofits Across 10 Midwestern States

Today, IFF has offices across the Midwest, including Indianapolis, Detroit, Kansas City, St. Louis, Milwaukee, and Columbus, Ohio. The organization also maintains a partner office in Minneapolis-St. Paul, Minnesota.

“We serve all of those states as well as Kansas and metropolitan Louisville, Cincinnati, and Kentucky,” Neri said.

And it finances nonprofit organizations working in a broad variety of sectors. These include education, affordable housing, healthcare, arts and culture, workforce development, and community development, among others.

“We also have a group that counsels nonprofit agencies to help them conceive, plan, and implement their facilities projects,” Neri said. “We do consulting, as well, to help them develop their facilities. A big chunk of our Detroit work is in that space.”

IFF understands that if organizations can’t raise the necessary funds, they can’t secure facilities to further their missions. Not only will services suffer, but the organization can’t represent the positive aspects and potential value that they bring to a given community.

“Their facilities often represent exactly what neighbors don’t want in their neighborhood — run-down facilities they can’t maintain, often because they’re leasing and a landlord’s not maintaining it,” Neri said. “But even when they own it, if they can’t raise the right money, those facilities are not the kind of places that the agencies want to represent them. It can become a self-fulfilling prophecy.”

Financing Up to 95% of Costs for New and Enhanced Facilities

IFF bases its lending decisions not on appraisals, but instead on the applicant’s perceived ability to repay the funds. This is one of the features that agencies appreciate the most.

“We will lend up to 95% of what those total project costs would be because we’re trying to help agencies overcome the hurdle of having a large down payment,” Neri said. “For many, they may have the revenue, but they don’t have a fundraising machine that will allow them to develop a huge amount of equity up front. The fact that we’re willing to lend up to 95% of the total development cost, versus the appraised cost, is a game changer for agencies.”

“All of these Midwestern cities have neighborhoods that have seen disinvestment that has hurt them in terms of valuation and made it highly difficult for nonprofits to get credit.” — Joe Neri, IFF CEO

Neri said this approach made IFF highly attractive to nonprofits in Detroit when the institution opened its office there in 2013. At the time, it was difficult for organizations to get properties appraised, and banks certainly weren’t going to extend loans without any basis for the financing provided. That situation further hindered the ability of organizations to secure property and establish service facilities.

“The fact is, that’s the same issue on the south and west sides of Chicago, the northwest side of Milwaukee, the west side of Kansas City, and the north side of St. Louis,” Neri said. “All of these Midwestern cities have neighborhoods that have seen disinvestment that has hurt them in terms of valuation and made it highly difficult for nonprofits to get credit.”

Success Stories Show the Significance of Impact Investing

In Muskegon, Kalamazoo, and Saginaw, the Covenant Academies Foundation provides education for the homeless, high school dropouts, and at-risk youths. The YWCA of Dayton, Ohio provides the only domestic violence shelter in Montgomery County. The Emmanuel Family and Childhood Development Centers offers early education and care to 175 children in Kansas City. These organizations, MTN, and many others can provide valuable community services thanks to loans from IFF.

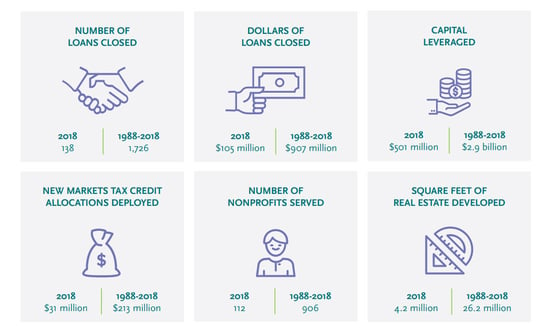

Since 1988, IFF has dispensed more than 1,700 loans worth a total of $907 million to over 900 nonprofits. That money has enabled organizations to develop a total of 26.2 million square feet of facility space, educate more than 50,311 students, create or preserve nearly 11,000 housing units, and achieve other critical charitable goals.

IFF has been helping nonprofits secure financing for more than 30 years.

“IFF has been around for 31 years, and we’ve taken investments from foundations and financial institutions, then reinvested that into nonprofits,” Neri said. “In the CDFI field, we often say we’re the original impact investors.”

In 2018 alone, IFF dispersed $90 million worth of loans. IFF focuses on raising capital from large-scale institutional investors rather than from individual impact investors — for now.

“That’s something on the horizon — how far out, I don’t know. Right now, we’re concentrating on getting more small community foundations and family foundations to invest in us,” Neri said. “We’re building capacity so that agencies are in a better position to act as impact investors, which is a part of our conversation as well.”

In the future, investment in IFF’s loans may be open to anyone who wants to contribute to the greater good in underprivileged communities while realizing a return on that investment. But until that time comes, IFF will continue providing financing to organizations that bring essential services to people across the Midwest.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.