In a Nutshell: When an earthquake strikes, you have only a few minutes to respond — if that. That’s why earthquake preparedness should take place far before the seismic waves are felt. Without proper protection, families risk financial devastation as well as loss of life. It is more important than ever that families prepare themselves with emergency kits and insurance — especially in light of rising housing costs and construction supply shortages. Developing plans for before and after an earthquake are critical in preventing tragedy.

Twenty-eight years ago, California experienced one of the worst natural disasters in U.S. history. A 6.7-magnitude earthquake struck Northridge, a neighborhood in northern Los Angeles.

The initial quake and ensuing aftershocks destroyed thousands of homes, leaving 22,000 people without shelter. More than 50 people died, and the total cost in damage is estimated to be $35 billion.

Several of the worst earthquakes have occurred in March. But seismic activity can take place at any time. The 1994 Northridge earthquake is proof that being prepared for disaster to occur at any time is essential.

While California and Alaska get the bulk of earthquakes in the U.S., tremors occur across the country. Between 2010 and 2015, all but 10 states experienced at least one earthquake.

Earthquakes are expensive. Annual losses to earthquakes are estimated to be at $4.4 billion. Without proper preparedness, families have to foot costly bills to potentially replace their entire home.

As home prices skyrocket, many who believe they have adequate home insurance coverage may need to check again. The value of home five years ago may be a fraction of what it is worth today.

While that means insurance costs stay low, it also implies that insurance will only pay out what the home was insured for years ago if disaster strikes.

The cost and time it will take to replace a home, especially considering the ongoing supply chain issues and construction material shortages, can put families in financial ruin.

Reassessing your insurance policies and staying on top of earthquake preparedness information for your area can help keep you and your family from financial setbacks.

What to do Before an Earthquake

One of the first things families should do as soon as they buy a new home and get settled in is assess the house for disaster-prone areas. Make sure to secure to the wall or floor any heavy furniture and appliances that can topple over. The Earthquake Country Alliance has a guide showing how to secure your space.

Identify safe areas in the house to run to that offer the best protection from falling objects. Seeking shelter under a sturdy table or desk is the best option on short notice. Stay away from walls, windows, fireplaces, and hanging objects. The U.S. government’s disaster preparedness site has diagrams showing how to protect yourself during an earthquake.

Things that can break and shatter if they fall should move to lower shelves. Bolting the home to its foundation is an option for areas where earthquakes are more common.

Retrofitting your home for earthquake protection is an option that protects the house and cuts down on insurance premiums.

This includes:

- Bracing the chimney.

- Installing automatic gas shut-off valves.

- Repairing cracks in walls and foundation.

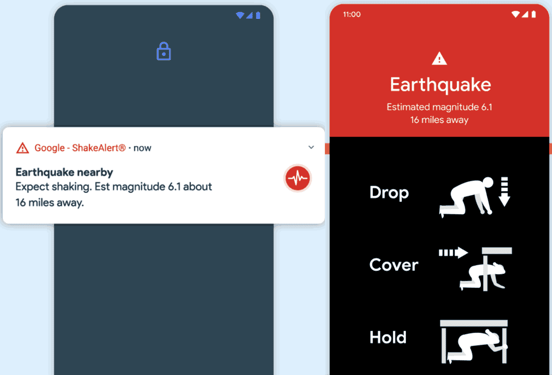

Setting up alerts from local authorities is the fastest way to receive emergency information. For example, in California, the MyShake App warns users when an earthquake is about to occur. For Android users, California partnered with Google to include an alerting system in its phones.

Securing the Right Coverage

Choosing the right insurance policy is essential to being ready for catastrophe. Homeowners should know the disasters and hazards common to their neighborhood.

Remember that earthquake insurance covers most damage from an earthquake, including the cost of rebuilding a home and replacing belongings if they are damaged during an earthquake.

If the home is damaged to the point where no one can live there, the insurance company will pay for temporary living expenses while the house is under repair.

Earthquake insurance, however, does not cover damage from a disaster caused by an earthquake. If a fire or flood caused by an earthquake destroys your home, that policy will not cover it. But if you have fire or flood insurance, you are covered.

Earthquake insurance deductibles aren’t like traditional deductibles. Instead of the deductible being tied to a specific dollar amount, an earthquake insurance deductible is tied to a percentage of what the home is worth. For a home worth $300,000, the deductible might be 10%.

That’s why it is so important to reassess disaster insurance policies with rising home prices. That home might have been valued at $300,000 five years ago. But now it may be worth $500,000. If an earthquake destroys it, insurance will only pay out to the $300,000 value of the policy from years ago.

Reassessing a home’s value will cost a few extra dollars a month, but it might be worth it so the house is protected when disaster strikes.

Packing an Emergency Supply Kit

After an emergency, families may have to live on their own for several days. For large-scale disasters, this could mean no access to clean water, electricity, food, or cellphone service.

Being prepared for a disaster means having supplies at hand at all times. The American Red Cross has a checklist on packing an emergency supply kit.

Essential supplies to have handy include:

- Identity documents such as ID, passport, Social Security card, and birth certificates.

- Housing payments to identify financial records.

- Insurance policy information.

- Tax statements.

- Emergency contact information.

- Medical information, including health insurance information.

- Batteries and battery-powered chargers for electronics.

Get to know your neighbors and ask them for their emergency tips. Some of those neighbors may have lived in those homes for decades and know what to look for and can help create financial and safety plans for disasters.

Ready.gov has multiple resources on crafting a plan with neighbors and friends and what to look out for when creating your plan.

Assessing Damage and Taking Action

The minutes right before and after an earthquake are crucial to staying safe.

As soon as possible, go to a safe space in the home when an earthquake is coming. Once it passes, assess the damage in the house, especially checking for damaged gas, electric, and water lines while staying alert for aftershocks.

Aftershocks may have less intensity than the earthquake itself, but it can still cause significant damage. Regular aftershocks can occur for an hour following the mainshock. Debris can fall from damaged areas following aftershocks, so staying in a safe space is crucial.

For areas near the coast, earthquakes can cause a series of waves known as tsunamis. The city of Gresham, Oregon, said people in these areas need to seek high ground and stay there until they receive an all-clear from authorities.

Once things have settled down, it’s time to keep track of damaged property, including the value lost. After documenting the damage, file a claim with the insurance company as soon as possible.

Keep records of everyone you speak with at the insurance company and what they say and store them in a safe spot.

The insurance company will send an adjuster to inspect the home for damages to determine how much it will pay. During this step, make sure that the adjuster inspects hidden crawl spaces and easy-to-miss areas inside the home.

While one earthquake may have ended, another one can come at any time. Scientists say the risks linked to earthquakes have risen with the growth of urban developments in the U.S. That makes it even more important to stay up-to-date with disaster preparedness. The good news is that most people are more protected than they may think.

“It’s important people feel empowered to take actions to help keep themselves, their families, and their communities safe,” said Oregon Office of Emergency Management Director Andrew Phelps. These actions can be as simple as signing up for local emergency alerts, reviewing community evacuation routes, or talking with a neighbor who may need some extra help during an emergency — all are measures that can mean the difference between being a disaster survivor or a disaster victim.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.