In a Nutshell: Rhino offers insurance that helps renters bypass the cost of security deposits, which are often a barrier to entry into stable housing. With Rhino, renters can pay a fee of as little as $5 per month and keep that security deposit cash on hand for an emergency, day-to-day expenses, or additional moving costs. Rhino also provides a fast claims process for landlords and property managers, extending financial benefits to the other side of the housing transaction. Rhino aims to remove barriers to housing and help improve the financial stability of renters.

Everyone moves into a new home or apartment at some point, and many times they go directly from one rental property to another. In those situations, renters may be blindsided by the expense of security deposits. Managing those fees can be difficult, especially for college students and recent graduates, as they may also carry plenty of student loan debt. And in 2020, it got even more difficult.

“The concept of housing affordability and accessibility is a multilayered and mission-critical issue across America,” said Jordan Stein, Head of Public Policy at Rhino, a company that offers insurance to help renters with their security deposits. “In particular, the COVID-19 crisis has exacerbated issues that already existed. There are so many elements, and there is no one silver bullet that can fix housing affordability and accessibility.”

For the rental ecosystem to operate successfully, it is essential for landlords to be protected against excessive damages and unpaid rent. But a traditional cash security deposit can be equivalent to a month’s rent, which must be paid in addition to the first month’s rent, creating a significant barrier to entry into stable housing.

According to a 2019 report from the Federal Reserve, only about 40% of U.S. adults have enough cash to pay for an emergency expense of $400. Meanwhile, Stein said there’s around $45 billion locked up in security deposits across the nation — money that could be put to better use.

Instead of renters putting down thousands of dollars in security deposits, Rhino allows them to pay an amount as low as $5 per month for deposit insurance.

And the company works with property owners and managers across the housing spectrum, from nationally recognized companies to single-dwelling landlords. Rhino’s low-cost insurance, which is now a regulated insurance product, is available to 1 million residences in the United States.

Rhino can save renters money in the short term, helping them alleviate consumer debt and pay for day-to-day expenses by not having so much tied up in a substantial security deposit.

“Our program is a tool we believe should be in every renter’s toolbox,” Stein said.

Affordable Alternative to Paying Security Deposits

Rhino’s primary focus is on giving all renters the choice to make a small monthly payment in lieu of paying the security deposit upfront in one lump sum.

“We believe that Rhino is best deployed as a choice and as a contrast,” Stein said. “There’s evidence to support the fact that a tremendous number of people are going to take the Rhino option. But we believe we should have that option.”

To encourage landlords to offer Rhino insurance, the company provides an online tool and integrates with most major property management platforms. If a property owner or manager approves a tenant to rent an apartment or house, Rhino automatically approves that renter for Rhino coverage. There are no credit restrictions to qualify for Rhino, although the service can make a soft credit check as a means of offering a better deal on a policy.

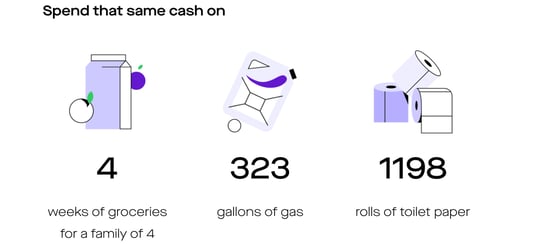

Security deposits can tie up money that renters could use for everyday purchases.

“We can give you a free, no-obligation quote in 60 seconds so you can see the cost based on a couple of simple questions about age, approximate income level, and education level,” Stein said.

If renters opt for insurance, they can pay the fee every month, or they can choose to pay the full amount upfront. The latter can still be cheaper than paying a security deposit, with the caveat that, unlike a security deposit, the renter won’t get their money back at the end of their lease. But they will have more cash on hand in case they need it.

“Getting that choice in front of every renter is critical to us,” Stein said. “It presents cost savings and, frankly, to a lot of folks, it breaks down a barrier.”

Low Rates Keep Cash Freed Up for Other Expenses

Moving can be expensive as people have to pack boxes and rent a truck — or hire a moving company. The process can be a financial strain, especially with deposits added on top of the other costs. That also may make it difficult to keep money on hand for when it’s needed.

Saving can be difficult for many people, especially in economically uncertain times when it’s more important than ever to keep funds liquid. But having money locked up in a security deposit can force consumers into loans or credit card debt to meet daily expenses and the cost of living.

Worse yet, the spiral of debt can lead to even more serious issues, including bankruptcy.

Rhino offers a much-needed solution that allows renters to keep some extra money in their pockets. By opting for a monthly fee instead of a lump sum deposit, renters can meet essential expenses while maintaining housing and a higher quality of life.

That’s why Rhino is now trusted in more than 1 million homes across the United States.

“They may need it for child care, debt payments, emergency savings, or healthcare. It also may be young people saying, ‘I want to take a trip to Orlando in better times,’” Stein said. “Someone may want to purchase a piece of furniture they need for their home. That concept of optionality, that concept of choice, it bleeds into so many of the consequences of using Rhino’s program. They say, ‘What can I have money freed up to do now that, frankly, I may not be able to wait a year for.’”

Fast, Simple Claims Process Protects Landlords and Tenants

Stein said that he’d heard anecdotal evidence from landlords and property managers about fears of future slowdowns and economic uncertainty. Not being able to afford a security deposit is detrimental to renters, but it’s also harmful to landlords. If renters can’t supply their security deposit, landlords can’t risk renting to them, which hurts their bottom line. That can force them to make financially detrimental offers just to get people in the door.

“Owners in a lot of cities are offering concessions of one or two months free rent,” Stein said. “This is a way to offer a financial amenity to renters without having to concede anything by way of financial collection.”

In this situation, Rhino is equally beneficial to property managers and landlords. It helps them rent out vacant homes while offering the same level of protection — and, in some cases, greater protection — that security deposits traditionally provide.

“Rhino is better than cash because we have a very streamlined claims process that can pay out for excessive damage and unpaid rent quickly,” Stein said. “A lot of times, owners find themselves with that cash deposit, as per tradition and convention, having to wait until the conclusion of a lease to recoup losses for unpaid rent and things like that. That’s not the case with a program like Rhino.”

When a unit is damaged, or rent goes unpaid, property managers can file a report and provide evidence for their claim. Rhino pays out to the landlord and then follows up with renters to get their side of the story.

“Fundamentally, the vast majority of renters don’t damage their units, and pay their rent. And with Rhino, they save a whole bunch of money on upfront moving costs, and that’s the end of the story,” Stein said.

Rhino: Leading the Legislative Charge for Renter Choice

Rhino is currently available to 1 million households, but its goal is to reach beyond that to the entire population of renters. Part of Stein’s job as Head of Public Policy is to work with legislators to make the product more widely available. And he said he’s already seen significant success.

“After a public policy proposal and campaign we ran, Cincinnati and Atlanta became the first and second cities in the country, respectively, to pass what we call renter’s choice legislation. This new law recognizes the important role security deposit replacement insurance can play in not only creating efficiencies for property owners, but also in bringing down costs for renters. It basically ensures every renter in the city has access and a choice to use low-cost alternatives to traditional, full-cash security deposits,” Stein said. “One of those solutions is Rhino. We’re excited that more cities across the country are working on initiatives like this, and we’re leading the way.”

The cities of Philadelphia, Atlanta, and Columbus, Ohio, are following Cincinnati’s lead. Soon, renters and landlords in these cities should have options other than potentially detrimental security deposits — which may lead to more loan and credit card debt.

“This is a model and an offering that works to bring down the cost of renting,” Stein said. “We think it’s an opportunity that should be in front of every renter. That’s a real element in how we not only grow our business but, I would argue, more importantly, an opportunity to bring down the cost of renting.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.