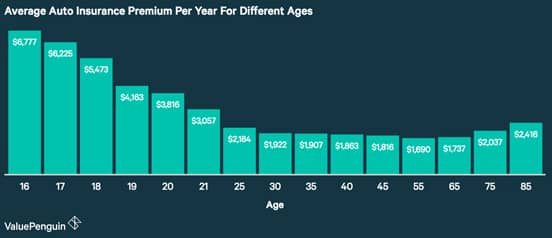

In a Nutshell: Getting a driver’s license as a teenager is a rite of passage for Americans. However, as with any newly learned skill, those early driving years often come with costly mistakes. A higher incidence of car accidents among teens takes a toll on auto insurance premiums for young drivers and their families, with rates often double what drivers in their 30s pay and triple what drivers between ages 55 and 65 pay. We recently spoke with ValuePenguin Co-Founder Ting Pen, who shared several tips to help contain the premiums on teen drivers.

As with anything else that requires focus and practice, the less experience you have, the more likely you are to make mistakes. No one is less experienced with driving than teenagers, and, not surprisingly, they make a lot of mistakes. Unfortunately, some of those mistakes are fatal, and motor vehicle crashes are the leading cause of death for US teens. The risk of motor vehicle crashes is higher in this age group than in any other, with teens three times more likely to be in a fatal crash than drivers 20 and older.

In 2013 — the most recent year for which data is available — people between the ages of 15 and 19 made up only 7% of the population, but accounted for 11% of the total costs of motor vehicle injuries. Plus, half of the people in this age group will get at least one ticket in their first year on the road. Teens are almost 10 times more likely to be in a crash in their first year driving, and 20% of 11th-graders report being in a crash as a driver.

ValuePenguin’s Ting Pen shared some tips on how teen drivers can save on insurance.

What this means for parents of teenagers — besides a lot of sleepless nights spent worrying about their offspring — are dramatically higher premiums on their auto insurance. The good news is that there are strategies available to help families put teens behind the wheel without breaking the bank.

We recently spoke with Ting Pen, Co-Founder of ValuePenguin, a financial product comparison site, who shared a number of suggestions for reducing the cost of those premiums.

“The quotes we received for 16-, 17- and 18-year-old drivers were more than three times as high as those for 55- and 65-year-olds, and more than double those for drivers in their 30s,” Ting said. “Once young drivers gain more experience at the wheel, the data shows, their car insurance costs will drop by about 30% at age 25.”

1. When it Comes to Premiums, it Pays to Be Studious

One of Ting’s suggestions for saving on premiums puts the onus on the teenagers (and young adults) themselves. College students with at least a B average, or those who score in the top 20% of their class grade-wise, or on ACT/SAT/PSAT/TAP/PACT, or the California Achievement Test, can receive discounts from some insurance companies, Ting said. State Farm provides discounts of up to 25%, and Allstate offers a 20% break on rates for qualifying students. Other companies provide a range of 1% to 39%. College graduates age 25 and under can also receive discounts.

Where students go to college can make a difference, Ting added.

“If a young driver attends college more than a hundred miles away from home without a car, the family may qualify for an away-from-home discount, or even be able to remove the student entirely from the family policy for the time they’re away,” she said. “If the student driver will be driving a car at college, families can still sometimes qualify for a discount if the college is located in an area the insurance company deems to be less risky than where you live.”

The number of students who take their cars with them when they go to college varies from school to school. Research shows that at 14 colleges, more than 90% of the students had cars on campus, a list led by Wayne State University in Michigan. At the other end of the spectrum, 0% of Georgetown University students reportedly had cars, which is not surprising because Georgetown does not provide on-campus parking for undergrads.

When it comes to teens and saving on insurance premiums, maintaining high grades can pay off.

An average 48% of college students throughout the US take cars with them to campus, which represents a significant number of families and young drivers who could potentially be saving on insurance premiums.

2. Save Money by Putting Young Drivers on the Family Plan

In general, adding a young driver to his or her parents’ insurance policy is the best way to spend less money on insurance premiums, Ting said.

“This results in significantly lower auto insurance costs for the family as a whole,” she said. “On average, parents who add their teens to their insurance policies can expect to pay an average of $3,852 a year, compared to $8,948 — which is what the family would pay if they took out a stand-alone auto insurance policy for the young driver.”

The main reason for this drastic difference is that parents will have a longer credit history with both lenders and insurance companies.

“That history, in turn, should result in a higher insurance-based score, which is one of the factors companies use to determine premiums,” Ting said, adding that the combined family insurance policy also promises access to multi-car discounts. “The flip side, however, comes from irresponsible teenage driving: A teenage driver’s accidents and moving violations can result in rate hikes for the parents. Parents also put themselves at risk of ‘liability exposure’ in the event the young driver is involved in a serious accident.”

Still, other strategies are effective in lowering premiums. For instance, some insurance companies also offer a pay-as-you-drive model, which allows drivers to place telematics devices in their cars that keep track of their mileage, so they pay for the miles they drive, rather than their driving patterns. Parents can also buy teens cheaper, safer cars, or assign teens the cheapest cars in the family to reduce insurance premiums.

3. Do Your Homework: Compare Premium Prices

Another strategy to save on auto insurance is to compare prices between insurance companies. People have already taken to comparing prices on flights and hotels before booking, so with this thought in mind, there’s no reason to settle for the first offer on virtually anything in the modern, consumer-friendly world.

“Comparison shopping is a must,” Ting said.

ValuePenguin looked at more than 200 cities and multiple insurers to see which one was the most affordable for young drivers based on a sample 17-year-old male driver.

“Rates could vary from $7,500 at the most expensive insurer to just over $2,400 at the most for that benchmark teenager,” Ting said. “Interestingly, none of the ‘Big Five’ car insurance companies — State Farm, GEICO, Allstate, Progressive, and Farmers Insurance — offer the cheapest rates. In fact, we found that rates from Erie Insurance — a mid-sized insurance company that operates in just nine states — were the overall cheapest for teen drivers.”

Ting added that this comparison shopping goes for both adding a teen driver to a family’s existing insurance policy, as well as starting a separate policy.

“Comparison shopping will help families who are weighing the benefits of lower premium costs, and their comfort, or discomfort, with their teenager’s driving,” she said. “Ultimately, families should do what’s best for them.”

Accidents and traffic violations take their toll on premium costs. So, the better driving record teenagers maintain, the better off they will be.

Another Option: Delay Teen Driving Altogether

Some teens are already onto the most sure-fire way to avoid skyrocketing premiums for their parents: delaying getting their license. While this option may not appeal to every teen, a good number are now waiting to get their licenses — just as they are waiting to date, drink alcohol, and engage in other “adult” behaviors.

While putting off driving can certainly save money, unless you live in a large city with an excellent public transportation system, most Americans will need to get on the road eventually. And for teens eager to take that step into adulthood, following these strategies is a great way to lessen the toll on their wallets and those of family members.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.