In a Nutshell: The student loan debt crisis was already a main focus for many, even before the COVID-19 pandemic. As the pandemic brought about new and unprecedented challenges, more questions arose about how to address the crisis, how students and prospective students should move forward, and what it all means for current borrowers. Edvisors provides valuable information on these and other student loan issues. The website has been providing in-depth guidance on all things related to student loans for more than 20 years. From seeking scholarships to understanding interest rates and filling out FAFSA paperwork, Edvisors is the go-to resource for student loan and financial aid information.

Student loan debt is one of the major financial challenges facing millions of U.S. residents today. At $1.6 trillion dollars, experts now refer to it as the student debt crisis.

In fact, student loan debt exceeds credit card and auto loan debt in the U.S., and is only surpassed by mortgage debt. It wasn’t always like this. Student loan debt has tripled since 2005.

This dramatic increase signals that there are failings somewhere in the system. And lawmakers have been slow to take action to alleviate the huge financial burden these borrowers carry. Many consumers who owe student loan debt did not even graduate from college, so they are stuck with paying loans for education and expertise they weren’t able to complete.

With the COVID-19 pandemic hitting the U.S. hard in 2020, federal student loan repayment was put on hold temporarily. The repayment freeze is set to expire August 31, with payments scheduled to start up again this September. But plenty of questions remain about the future of student loan debt, how to address current debt, and how people preparing to enter college should approach student loans.

Navigating the challenges of student loans can be difficult for an 18-year-old freshman college student as well as a mid-career professional who is in repayment.

One of the most valuable resources we have found that addresses all things related to student loans and debt is Edvisors.

“For 20 years we have been known as one of the largest and most trusted resources to help you find your path to success,” according to the company. “Everyone needs to find their own path, and we know that first-hand. Our team consists of diverse backgrounds and different experiences in our own higher education journeys.”

We recently spoke with Elaine Rubin, Director of Corporate Communications at Edvisors, to learn more about the company’s expertise and resources when it comes to all things student loan-related.

Making Sense of Inflation and the Student Loan Repayment Moratorium

Inflation in the U.S. hit a 39-year high in 2021 at 7%. Staples such as food and gas are reaching sky-high prices. The increase in prices is occurring for two main reasons. One is demand. Consumers are spending more after having been indoors for most of 2020. Thanks to stimulus checks and pandemic-related aid, families have more spending power to keep the economy going.

The second reason prices are going up is supply. The increased demand for products comes just as the entire world is experiencing significant supply chain problems. More demand and less supply results in higher prices.

So, how does this connect to student loans? With increased costs, students may take out more loans because the cost of living has increased. Increased budgets also mean those in repayment need to adjust their payments based on what their new costs are.

“It’s adding the idea of inflation to their budget as they get ready for their loans to re-enter repayment,” Rubin said. “You have to be able to manage those payments along with your new budget, which includes a significant increase in the cost of gasoline and groceries. What you were paying for your loans two years ago factors differently today.”

As stated above, the moratorium on Direct Federal Student Loans will end in August. But the White House extended the moratorium twice after warning the extension in January 2022 would be the last. Democrats in Congress also wrote a letter urging the President to extend the pause until at least the end of the year.

Edvisors told us that having a plan for when payments come back is key to not falling behind on your finances.

Forming Educated Decisions About Student Loans and Exploring Scholarships

“Edvisors provides a lot of great tools and resources and free information for students and parents who are planning for and paying for college,” Rubin said.

The website also provides valuable information about the repayment of student loans, she added.

“Sometimes paying for college goes beyond your college days,” Rubin said. “If you still have student loan debt or anything that’s hovering over you, you will continue to pay for college even once you graduate, so we focus a lot of information on that.”

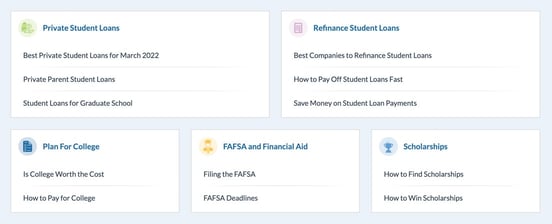

The Edvisors website is rife with helpful information on nearly every aspect of student loans and the considerations that should be taken into account when taking out loans. This includes the ability to compare private lenders, learn about the pros and cons of federal versus private loans, and access informative resources about preparing for college in general.

“We definitely put out a lot of information about what student loans mean and how student loan interest works,” Rubin said. “I think it’s pretty confusing. We get a lot of questions about it. Our site visitors and social media followers can ask us questions, and we’re able to respond.”

Edvisors also provides useful information on other ways to pay for higher education, such as scholarships.

“I always like to encourage students to put some time into scholarships — finding them and trying to win them,” Rubin said. “And even look locally for scholarships. Ask your school and community organizations around where you live to see if they offer any type of scholarships.”

Providing Guidance on FAFSA Paperwork

Another important component of the Edvisors website is the information it provides on FAFSA — the Free Application for Student Aid. Anybody who has dealt with FAFSA may get an uneasy feeling just thinking about it.

FAFSA is one of the most important components for securing financial support for many students — and it can be one of the most frustrating.

“Thousands of students and parents reach out to us asking for help to complete the FAFSA,” according to Edvisors. “We picked up on the main areas of confusion to drive the creation of our 2021-2022 Guide to Filling the FAFSA, as well as other resources including videos to help you through.”

Rubin emphasized just how important FAFSA is for people seeking aid.

“For students — even those students who don’t think they’ll qualify — as long as you fill it out, you’re putting yourself in a pool to be considered for not only federal student aid but also institutional aid from your school,” she explained. “A lot of schools will offer financial aid to their students, especially low-income and middle-income students.”

Rubin said the FAFSA also allows many people to qualify for an unsubsidized Stafford Loan.

“Federal unsubsidized loans tend to be beneficial and they really help if you need them,” she said. “Obviously, borrow wisely, it’s still a loan.”

As with other aspects of student loans, Edvisors provides in-depth information on just about any question that may arise regarding FAFSA, including filling out the paperwork, important deadlines, and even how to seek more financial aid.

Meeting the Challenges Presented by COVID-19

The challenges brought about by the COVID-19 pandemic are too many to name. But higher education and the student loan situation, in particular, were the focus of a lot of attention.

The Edvisors website offers a robust collection of information addressing a wide variety of questions students and parents may have about how the pandemic relates to school and their student loans.

One way Edvisors is keeping borrowers in the loop is through its new podcast, Student LIFE Edvisors. The podcast delves into navigating college during the pandemic, as well as advice on paying for college.

“We are in an unprecedented state of emergency with economic impacts,” according to Edvisors. “And during this time, many people have concerns about student loan repayment. Many of our social media followers have reached out to us with fantastic questions. If you are a student or student loan borrower, we want to make sure you have an understanding of your options.”

As of right now, there are no plans in place to cancel student loan debt. President Biden promised to forgive $10,000 in student loan debt for every borrower while on the campaign trail, but has not provided a specific proposal to Congress yet.

While there is still time during the presidency to get a proposal done, not every borrower should hold off hope on having their loans forgiven. During the presidential campaign, President Biden proposed federal student loan forgiveness to students who went to public universities and colleges, as well as students at historically Black colleges and universities. The loans must have also been used for undergraduate studies.

Students who went to private universities or accrued loans in post-graduate schools would not qualify. Students who received loans through private companies such as Sallie Mae and SoFi also would not have loans canceled.

While the pandemic has been challenging for so many, college students, prospective students, and student loan borrowers have had to deal with a particularly unique set of circumstances. But, just as it has been for more than 20 years, Edvisors is there to help guide people with its vast wealth of information.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.