In a Nutshell: Businesses often require banking services more sophisticated than what individual consumers need. Grasshopper, a digital bank dedicated to serving business clients, provides businesses with innovative banking solutions and financial education. Grasshopper develops trust with its clients by helping them solve problems and reach their goals.

The internet’s impact on modern life isn’t easy to quantify. It ranges from influencing how people communicate and interact socially with each other to how businesses operate. Simply stated, the internet’s impact on our lives can be described with one tiny word — big.

The internet has revolutionized how people and businesses bank in the 21st century. Before the internet, many companies banked at brick-and-mortar branches located near their businesses. But the presence of physical bank branches isn’t as important to companies as it used to be, thanks to the internet.

Grasshopper is a fully digital bank designed to serve businesses. The bank provides checking, lending, and online banking services to clients ranging in size from micro businesses to large private equity firms. We caught up with Danielle Kane, Grasshopper’s Director of Small Business Banking, to learn more about the bank’s innovative, client-first approach to banking.

Since Grasshopper’s inception in 2019, the bank has built its online banking services and onboarding programs for commercial clients with intricate banking needs, Kane said.

“We’re now able to bring in more complex businesses to complement the strong foundation we have with small businesses,” Kane said.

But Grasshopper’s focus has been on small businesses as of late. The bank partners with fintechs to provide solutions that meet a small business’s banking needs.

Grasshopper’s work with small businesses extends to startups and young companies working to establish themselves. Kane said Grasshopper’s partnerships with fintechs allow the bank to successfully onboard new businesses earlier than other banks can.

“Our partnerships enable us to onboard new businesses through our automated process,” Kane said. “It’s a bit of an advantage for us in the sense that it allows us to onboard new clients while other banks, who aren’t as tech-focused, don’t have the ability to verify certain documents.”

Kane said Grasshopper, which serves businesses based in the U.S., doesn’t cater to companies operating within any specific industry.

“We cast a wide net in our acquisition strategy,” Kane detailed. “Our products and solutions suit businesses regardless of the industry they’re in.”

Products Designed to Meet Small Business Needs

Kane said Grasshopper’s banking solutions meet a business’s needs as it matures and evolves. The bank’s executive leadership team has identified gaps in the small business banking environment, and Grasshopper’s products and services seek to fill those gaps and help small businesses grow.

Accelerator Checking, launched in 2023, is a checking and savings account for startups. Kane said the account aligns with Grasshopper’s focus on developing businesses, and she expects the account to be an attractive option for clients in 2024.

Grasshopper’s small business offerings include a checking account that allows businesses to earn interest on their balances. Kane said the account is ideal for companies that want an interest-earning operating account. The account has no monthly fees, no overdraft fees, free incoming domestic wire transfers, and unlimited transactions.

Grasshopper provides small businesses with a physical debit card to make purchases and withdraw cash. Clients receive 1% cash back on all signature and online-based purchases. Clients can also elect to use Grasshopper’s virtual debit card. Kane said the bank’s virtual debit card offers control features that business owners appreciate.

“The virtual debit card is very useful to our clients,” Kane said. “Business owners can manage how their employees are using the card, including blocking the card’s use at certain merchants and controlling the cardholder’s spending limits.”

Kane said many small businesses have difficulty finding lenders willing to provide them with a line of credit that meets their needs. Grasshopper introduced a funding marketplace in 2023 to help small businesses access financing. The bank established relationships with funding partners in 2023 and expects to add additional partners in 2024.

“Through the funding marketplace, we’re really aiming to find lending partners for micro, small, and medium-sized businesses,” Kane said. “It’s a unique way to provide our clients with funding in the form of term loans or lines of credit.”

Financial Literacy Services Benefit New Businesses

Kane said Grasshopper is fintech-friendly, and the bank doesn’t view fintechs as competitors but as a resource to lean into.

“There are some great technology companies out there that provide banking services that benefit our small business clients,” Kane said. “There’s no need for us not to help our clients get what they need. At the end of the day, we put the client first.”

Grasshopper provides financial education to help steer its clients to successful banking and business practices. The bank’s finance guides help businesses learn how to become financially stable. Kane said the bank also provides clients with financial education on secure banking and fraud prevention.

“We see firsthand in the banking industry how fraudsters are able to get someone’s identity, and we raise awareness about how to avoid that,” Kane explained.

Grasshopper’s blog addresses feedback the bank has received from its clients. It educates businesses on numerous topics, including creating a business plan, understanding how ACH transfers work, and tips to help clients maximize their cash back rewards.

Kane said although Grasshopper is a digital bank, it prioritizes establishing a personal connection with its clients. Grasshopper employs a US-based Client Services team who helps the bank’s clients achieve financial literacy and position their businesses for success.

“Our client’s success is our success, and we understand that a lot of small business owners would rather not get into the weeds of banking. ” Kane said. “We interact with our clients in a number of ways. They don’t need to come to a branch to speak with us. Using technology, we can meet with them wherever they are.”

Grasshopper Builds Trust With Its Clients

Business relationships built on trust tend to be stronger and more profitable than relationships that aren’t. Trust is a critical factor in the relationship between a bank and its clients. Kane said Grasshopper builds trust with its clientele by speaking with them directly and helping them solve their problems.

“We take steps to earn a client’s trust through the interactions we have with them and the content we give to them,” Kane said. “Earning a client’s trust takes time, but we win our clients over with our service and ability to solve any issues they may have.”

Grasshopper doesn’t employ traditional marketing efforts — its marketing campaigns are exclusively online. Kane said the bank also obtains new business through client recommendations.

“Small businesses are a tight-knit community, and they spread the word to each other about products, services, and business partners that they’re satisfied with,” Kane explained.

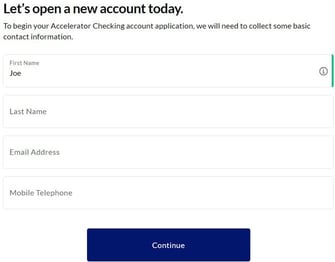

Grasshopper provides new clients with an efficient onboarding process. Kane said 90% of the bank’s new clients can open accounts with the bank in less than 10 minutes.

“We conduct a manual review of a business’s submitted documentation for about 10% of our new clients,” Kane said. “Manual reviews can be handled pretty quickly. Those businesses will likely be able to access their new account within one or two business days after applying. The other 90% of our new clients can open their accounts within 10 minutes. They’re then able to log into our online banking platform and order a business debit card.”