In a Nutshell: The cost of higher education is an oft-debated topic among politicians and the general public. As the price of attending colleges and universities skyrockets, many prospective students turn to loans to help finance their education. Edvisors helps students assess the variety of loan providers and loan options available to them. It also provides resources that can help borrowers develop their loan-repayment plans. Edvisors is poised to offer guidance and resources to borrowers as they resume their student loan payments.

The COVID-19 pandemic changed the world in many ways. Outside of the medical arena, the pandemic ushered in government programs to ease the financial strain people were experiencing. But as we move further away from the pandemic’s epicenter, many of the policies and practices altered to ameliorate pandemic life have ended or are soon to end.

The U.S. government paused federal student loan payments in early 2020. After much debate and political posturing, student loan payments have resumed as of October 2023.

We checked in with Elaine Rubin, Director of Corporate Communications at Edvisors, to discuss how the student loan payment landscape has changed and what borrowers can expect as they resume making payments on their student loans.

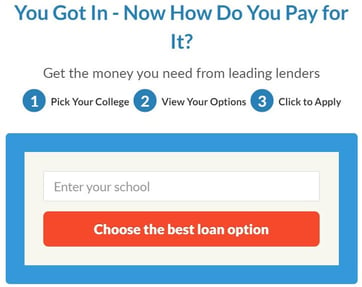

Edvisors helps students prepare for college and provides tools and resources to help them finance their education.

Rubin said borrowers now have more advantages than they did before the pandemic, including ways to help borrowers who may struggle to make their student loan payments.

The U.S. Department of Education introduced the Fresh Start program, a one-time, temporary initiative to assist borrowers who have defaulted on their student loans.

“Fresh Start turns defaulted loans to “in repayment’ status,” Rubin said. “That means that the borrower is considered to be in good standing, and the government removes the default record from the borrower’s credit report. It’s a huge step toward helping borrowers repair their credit and giving them a fresh start to repay their defaulted loans.”

Rubin said it’s difficult for borrowers who file for bankruptcy to get student loans discharged. Borrowers who don’t make timely student loan payments may face consequences, including wage garnishment to repay the debt.

“Borrowers who don’t repay their student loans can end up in default for years or even decades,” Rubin said. “Fresh Start can help them to head in the right direction.”

The SAVE Plan Provides Unique Benefits

The Saving on a Valuable Education (SAVE) Plan offers borrowers unique ways to save money on student loan payments. The plan’s interest subsidy aims to help borrowers manage the accrued monthly interest on their loan.

“One of the biggest criticisms of income-driven repayment plans is that borrowers can faithfully make their payments for many years without seeing an impact on their overall loan balance,” Rubin detailed. “In some cases, the balance could even increase if the loan’s interest outpaces the borrower’s regular payments. The SAVE Plan offers a really great interest subsidy to avoid increases to a borrower’s outstanding balance.”

Rubin said the SAVE Plan’s interest subsidy doesn’t allow a loan balance to grow because of unpaid interest as long as the borrower makes monthly payments on time. The SAVE Plan eliminates monthly accrued interest not covered by their payment on their federal student loans repaid under the plan. This can help borrowers make progress on their loans, even if their regular payments are relatively small.

The SAVE Plan also decreases monthly payments by not only lowering the percentage of discretionary income, but also by changing the way discretionary income is calculated. Rubin said components of the SAVE plan shelter more of a borrower’s income when it comes to determining a repayment amount—when compared to other income-driven repayment plans. With respect to the SAVE Plan, sheltered income is exempt from calculations used to compute a borrower’s adjusted gross income.

Income and the size of a borrower’s family are the determinants the plan uses to calculate the amount of a borrower’s monthly payment.

“These and other provisions of the SAVE Plan are exciting for borrowers who need more affordable payment plans,” Rubin said. “Student loans aren’t the only financial obligation many borrowers have. They need to be able to live their lives, pay their rent, make their car and phone payments, and pay for insurance and healthcare.”

There is a backlash against the SAVE Plan. Rubin said some congressional members oppose the plan, estimating it will be costly for the U.S. government. Edvisors will continue to monitor government action and any proposed bills seeking to curtail or eliminate elements of the SAVE Plan.

Borrowers Should Carefully Consider Course of Action

Borrowers seeking to secure loans to finance their education have numerous options. Edvisors can help students determine which loans best suit their needs. Rubin said she cautions borrowers that just because a particular loan plan offers low monthly payments doesn’t mean it’s the best plan for the borrower.

Rubin encourages borrowers to review the loan providers they are considering using carefully. Edvisors offers comparison tools to help prospective borrowers assess their lending options.

“Borrowers often try to figure out the most cost-effective loan options,” Rubin said. “But many times, there isn’t one clear answer. I advise borrowers to not only familiarize themselves with the different loan providers available but also to carefully review the details and terms of any loans they are considering. That will best position them to make an informed loan-provider selection.”

Rubin said some borrowers enter into loan agreements without adequately vetting the provider or their terms, which can lead to surprises down the road. Some borrowers may not realize their financial aid awards include student loans and are shocked when they get notices regarding their upcoming payments.

“Shockingly, there are undergraduate borrowers who aren’t aware of the fact that they’ve borrowed money, or they’re not sure how much they’ve borrowed,” Rubin explained. “We have resources to help these students educate themselves. Parents and friends with borrowing experience — whether it be for a home, car, or an education — are another resource borrowers can turn to when planning their borrowing and repayment strategies.”

Rubin said that, as student loan payments resume, the Department of Education is not planning to submit negative credit reporting to the credit bureaus for a year with their On Ramp program—helping borrowers re-enter repayment. Withholding negative credit reporting can protect borrowers who can’t make their student loan payments. This protection will only be available temporarily, so Rubin said borrowers should develop solid repayment habits now to help them repay their loans faster.

Edvisors Provides Comprehensive, Free Advice

Edvisors provides resources that help students evaluate the student loan landscape. It offers students a comprehensive view of the available loan providers and has a student loan calculator they can use to determine their monthly payments and the total amount they will need to repay.

Edvisors’ student life blog contains practical guidance on many aspects of college life, including insight into the college admission process, an examination of a college degree’s shelf life, and tips to help freshmen manage their finances.

Edvisors’ Youtube page contains educational videos covering student loans and tips on unconventional ways students can earn extra money.

Rubin said student loan payments previously established using an autopay feature will not automatically restart as student loan payments resume. Students who were using autopay before the pause on student loan payments must confirm their account information to resume automatic payments.

“Over the three-year payment freeze, many elements may have changed for the borrower. Some federal student loan servicers no longer are federal student loan servicers, and borrowers had their loans transferred. In addition, servicers don’t want to assume that a borrower’s bank information stayed the same for the past three years,” Rubin said. “Borrowers who need to verify their loan details can do so by logging into their studentaid.gov account.”

Rubin said that, despite all the resources Edvisors provides, a student or borrower may have a question or seek information on a topic they can’t locate on Edvisors’ website. In that scenario, Rubin advised students and borrowers to reach out directly to Edvisors using its Ask the Edvisor contact tool. Ask the Edvisor allows users to craft and submit their own inquiries. Rubin said it’s a service that Edvisors is proud to offer for free.

“If anyone can’t find the details they’re seeking, or if they need guidance on student loans or college information, I encourage them to reach out to us,” Rubin said. “We have a great team here. We’ll help you get on track.”