In a Nutshell: Budgeting is the foundation of responsible money management, but many Americans still struggle with it. The BudgetTracker web app simplifies that task with intuitive features that help users track income, expenses, accounts, and other aspects of their financial lives. The app has a free version and offers premium tiers that provide expanded capabilities for individuals, families, and businesses. BudgetTracker also provides a high level of security thanks to database encryption and the exclusion of sensitive account information.

According to a study published by Northwestern Mutual, 37% of Americans are informal budgeters who have general goals and a loose sense of how to achieve them, but no concrete plans. An additional 14% are non-planners, meaning they have not established specific goals and have no financial road map for their futures.

Without a well-defined budget, many of these people may meet their regular expenses but remain financially vulnerable. They may also be susceptible to overspending and hardships due to unexpected life events — which can be crippling to their financial well-being.

“The tricky thing is handling expenses that are unaccounted for. I think that’s where people get tripped up a lot,” said Kyle Kirman, Founder of BudgetTracker, a web app that makes it easy for users to keep up with their finances. “They start with a budget, and everything’s going great for a month or so until something unplanned comes up, like car maintenance or a medical bill. And then it just completely throws off their budget, and they give up.”

Tools designed to make tasks more manageable can be useful when establishing and adhering to a budget. Back in 2003, budgeting software was available, but there was no web app to meet money management needs, so Kirman set out to create one. He initially developed BudgetTracker for his own personal use, but he quickly discovered a broader need.

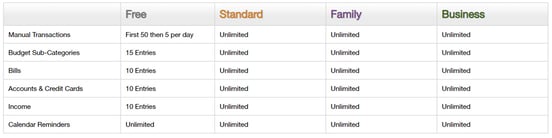

Today, the BudgetTracker web application is available at multiple subscription tiers, each of which is priced to make it accessible to people in need.

But its basic plan remains free for individual personal use, making it a valuable resource for those in difficult financial situations. Its ease of use and utility empower users to improve their money management skills and prepare for a more stable future by creating and maintaining a budget.

Features Designed to Help Users Organize All Aspects of Their Financial Lives

BudgetTracker is so effective because it helps users master the three fundamental principles of budgeting: managing income, spending, and saving. Additional features help users plan for future expenses and coordinate money management with their day-to-day activities.

“It not only does budgeting, but it also has a lot of other features built into it,” Kirman said. “Task management and a calendar, and tools for keeping track of different goods and services.”

Transactions may be entered manually or through a batch import, and each transaction can be tagged and classified with preset or customized categories. Scanning receipts and linking them to transactions also makes documentation easier when tax time rolls around.

Users can create categories for their expenses and earnings fall to better organize their bills and income streams. These transactions can be automated and linked to the user’s bank accounts and the built-in calendar, which provides daily, weekly, or monthly reminders of expenses.

The account management tool allows users to view all of their accounts in one interface to quickly compare interest rates and track balances with their banks and on their credit cards. BudgetTracker provides a financial forecast based on expenses and income, and shows users their anticipated balances at any time. Budgets may be customized for different times of the year, including holidays and vacations, to account and plan for expenses.

For users who have a specific need that isn’t already accommodated by BudgetTracker’s built-in features, the app provides customized add-ons. User-created add-ons then become available to other users, providing an expansive library of optional features for the BudgetTracker community.

Because budgeting is tied to many other aspects of life, BudgetTracker also helps users coordinate other day-to-day activities. A tracker for integrated shopping and to-do lists, a contacts directory, exercise schedule, and even New Year’s resolutions helps users budget their time as effectively as their money.

Four Pricing Plans Suit Many Needs and Means

BudgetTracker’s basic offering is its no-cost, ad-free plan. And it is not a trial version of the product; the free plan grants full access to the app. This version places budgeting software within the reach of even consumers in difficult financial situations.

The only limitation with the free plan is the number of transaction entries allowed each day. For a small monthly fee, users can get the standard plan that allows them unlimited entries. This plan also enables users to access data from their financial institutions and to visualize their cash flow in the form of graphs.

“I had one of my customers say, ‘You should really create a subscription plan or something for this,’” Kirman said. “I made it really cheap for them to get into it, and it allowed me to monetize the site and grow it a little bit more.”

BudgetTracker offers a free plan in addition to premium tiers suited to families and businesses.

At the next tier, users can purchase a family plan, which is BudgetTracker’s most popular offering. The primary user can add family members to an account, making it easy for spouses to coordinate budgeting. Each user on the plan gets a login and password, and the main account holder can view family data at any time.

Children included on a family plan can take advantage of a simplified interface that adds graphic components to help them track their income from allowances, chores, and odd jobs. That allows children to practice budgeting and take responsibility for their own financial behavior.

BudgetTracker also offers a business tier that provides more sophisticated tools for invoicing, inventory tracking, purchase orders, customer relationship management, and expense reporting among other helpful organizational tools.

Security Measures Ensure Financial Information Protection

BudgetTracker also treats user safety with the utmost concern. Unlike other financial apps, BudgetTracker doesn’t directly link to accounts with banks or other financial institutions. Information from those sources can be easily imported into the app.

“If you go to the guidelines on banking websites, they tell you not to give this information to third parties. But a lot of the software companies are doing it anyway,” Kirman said. “It just seemed too risky to implement.”

User information remains secure because BudgetTracker doesn’t store account info on its servers.

These precautions help protect BudgetTracker users, since no account information is stored on the app’s servers. All financial information is linked to the user’s email address, but no personal details are collected, and all financial information is encrypted within BudgetTracker’s database.

In the event of a security breach, no financial information can be correlated to a particular person — or their external accounts — and hackers would gain no additional personal information about the app’s users.

And none of the company’s employees have access to the information stored in the BudgetTracker database, further minimizing the possibility of a data breach. Users can rest assured that their financial information is stored on secure servers and will remain private and safe from malicious perpetrators.

BudgetTracker’s Development is Driven by Meeting Consumer Needs

BudgetTracker’s freemium model makes the app available to everyone, enabling all consumers to take control of their money and to live healthier financial lives. And because its success is so tied to the experience of its users, BudgetTracker collects feedback to ensure the product meets their needs at every tier.

Although users can connect with BudgetTracker via email, Facebook, and Twitter, the app’s message board is a popular way to connect with the app’s developers and share thoughts and pain points. It also serves as an FAQ for the app, allowing users to view issues that others have encountered and how they were addressed.

The number of downloads of the BudgetTracker app saw a substantial increase in 2007 when the recession caused more people to take an interest in money management. In tight economic times, a powerful, free solution is tough to beat, and the company plans to scale the app to ensure it can handle future spikes in demand.

Another of the company’s major focuses is to explore options for a white-label version of BudgetTracker. Some schools already use the app as a component of financial literacy curricula to prepare students for entering the workforce and managing their income and expenses.

But no matter what plan users choose, BudgetTracker is a valuable tool for taking control of money management. Thanks to its accessibility, it presents a means for more people to easily and safely maintain a budget and achieve financial security.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.