In a Nutshell: Atmos Financial is dedicated to encouraging global sustainability through its financial products. Checking and savings customers earn cash back and rewards for climate-positive actions, and Atmos lends exclusively to solar projects. The combination creates a self-contained financial system around sustainability. Nationwide, financial consumers of all generations turn to Atmos to transform their environmental hopes into realities.

Global citizens increasingly know their role in promoting sustainability and the environment. But many don’t consider how their financial services provider can have a significant impact on their global footprint.

That’s because banks earn profits by collecting interest on loans to businesses and organizations that can exert a profound negative effect on the environment.

In its 2023 report “Banking on Climate Chaos,” the Rainforest Action Network detailed how big banks, in effect, fund the climate crisis, fracking, Arctic drilling, and many other practices that harm the environment by lending to businesses engaged in those activities.

The difficulty associated with changing financial providers adds to the problem. Even in today’s predominantly online financial services environment, switching accounts and rearranging payments is confusing and time-consuming. Most consumers prefer to establish a relationship and stick with it.

The Rainforest Action Network also found that when consumers understand the impact their financial institution can have on the environment, they’re motivated to change. Atmos Financial, a fintech dedicated to sustainability, provides multiple incentives to help consumers interested in sustainability make the switch.

Atmos lends exclusively to fund solar projects proven to reduce reliance on carbon-generating fossil fuels. Atmos checking account holders earn up to 5% cash back on purchases at hundreds of sustainable businesses. Savings account holders double their savings rate when they support nonprofits on the Atmos platform.

And Atmos makes switching easy. Head of Marketing River Mizell said the combination makes Atmos the financial services provider of choice for those interested in aligning their values with their consumption habits.

“It’s a revolutionary way to look at financial services — nobody else does what we do,” Mizell said. “We’re an organization with climate activism at its core.”

Products Leverage Customer-Driven Climate Actions

Atmos started when Ravi Mikkelsen, who worked in the solar industry, met banker Pete Hellwig. They realized that combining their areas of expertise could encourage consumers, businesses, and financial professionals to build positive environmental solutions together.

Mizell said that while many businesses engage in a cosmetic approach to environmentalism known as greenwashing, Atmos truly puts its money where its mouth is.

“We don’t do anything like tree planting or carbon offsetting,” Mizell said. “We’re all about building long-term sustainable solutions.”

Marketing at Atmos.

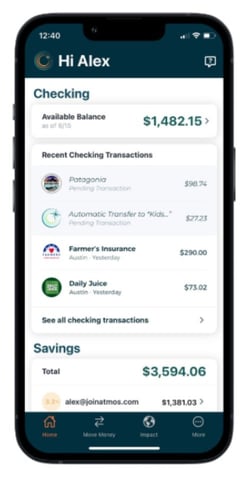

Atmos’ Cash-Back Checking pays customers to spend sustainably using a debit card made from recycled plastic. The account carries no monthly service fees or minimum balance requirements and provides access to unlimited, fee-free withdrawals at 55,000 ATM locations worldwide.

Account holders earn up to 5% cash back by shopping with a large and growing list of climate partners in categories such as electric mobility, sustainable apparel, and many other climate-conscious businesses. Customers may also request new climate partners based on their shopping patterns.

“We want to encourage people to shop with businesses they’re familiar with instead of selecting randomly off the internet,” Mizell said. “If most of our customer base shops at a particular climate-positive business, that’s where we want to be giving cash back.”

Atmos’ High-Yield Savings provides a similar incentive by doubling an already generous 1.75% savings rate to 3.5% when a customer donates to an Atmos-approved nonprofit. The donation can be as little as $1 because Atmos recognizes that although not every customer can contribute a large amount, everyone deserves recognition and the reward benefit.

“Nonprofits are on the ground utilizing the infrastructures we’re helping to build to facilitate change, but donations can falter when people need to prioritize other financial aspects of their lives,” Mizell said. “By offering that higher savings rate, we can allow people to continue donating to the organizations they love.”

Lending Makes Going Solar More Reasonable and Reputable

Like banks, Atmos uses customer deposits to make loans. The difference is that Atmos lends exclusively to solar projects.

Atmos’ Solar Loans are a better way to pay for solar. While other solar lenders charge high up-front fees and present an initially low interest rate that may increase significantly, Atmos offers lower fees and fairer rates.

Most recipients of solar loans pay back their funds in 6-7 years. The result of Atmos fee and rate transparency is that Atmos Solar Loans carry a lower total cost even when the payback period stretches to 14-18 years.

In other words, Atmos makes going solar cheaper. Fees can be up to 90% lower. Every early repayment lowers the customer’s monthly bill. And there are no repayments required for the first six months.

“While we’ve been revolutionizing banking, we’re also trying to revolutionize loans by making them more equitable,” Mizell said. “People who have traditionally been left out of solar solutions are gaining access.”

Furthermore, because the solar industry is traditionally unstable, with installers frequently entering and exiting the market, many potential solar customers fear the process. Solar projects are lifetime home installation projects where if something goes wrong, the consequences can be dire.

Atmos uses its expertise to partner with a relatively small group of approved installers with successful industry track records. Atmos works in a limited but growing number of states and welcomes installers to apply to join its network. If approved according to stringent Atmos requirements, they gain access to a growing market of consumers committed to living their environmental values.

“Atmos is very diligent about the installers we work with to ensure they’re reputable and communicative,” Mizell said. “The customer comes first in every solar installation.”

Facilitating Financial Services with a Larger Purpose

In “Banking on Climate Chaos,” the Rainforest Action Network reported that the world’s 60 biggest banks have loaned more than $5.5 trillion to support the fossil fuel industry over the past seven years.

Tragically, fossil fuel industries often disproportionately harm the lives and livelihoods of poor and working-class communities, particularly Indigenous, Black, and Brown communities.

Atmos and its dedicated customer base have done a great deal to make a dent in those numbers by funding climate-positive infrastructure that has prevented more than 150 million pounds of CO2 from ever entering the atmosphere. Mizell said that good things happen when financial services mesh with customer demand.

“Ethics is built into Atmos every step of the way. There is no ultra-billionaire on staff. We are ensuring money is returning to our customers,” they said.

Because transitioning to a new financial services provider is a headache, Atmos strives to simplify the process. Many new customers test the waters by opening a savings account to evaluate the app and appreciate the significance of the high-yield rate.

Atmos also teams with environmental partners to produce webinars, articles, and live Q&As to help consumers understand how to clean up their finances.

Customers also come first when it comes to product iteration. Atmos acts on feedback from in-app chats, phone conversations, and its website to ensure products and partners mesh with customer needs.

The platform is highly secure, robust, and user-friendly. Atmos provides FDIC insurance on deposits of up to $250,000 or $500,000 when customers register for new joint savings accounts.

As a Certified B Corp and member of the 1% for the Planet Alliance, Atmos strives to live the values it promotes to consumers and partners as it facilitates synergy around sustainability.

“Again and again, Atmos has shown its desire to build a climate future with clean water and air,” Mizell said. “Our mission is decarbonization and to de-finance fossil fuels and get climate solutions for everyone.”