In a Nutshell: With widespread smartphone use and convenience driving a trend toward mobile banking, a growing number of Americans are finding they don’t need traditional brick-and-mortar bank branches anymore. BankMobile is an online bank that is taking advantage of this shift in sentiment, and it’s parlaying the savings that comes with avoiding the expense associated with maintaining a brick-and-mortar presence by offering some of the most student-friendly banking in the business with BankMobile Vibe. Along with a comprehensive and easy-to-use mobile app, money management tools, and a Passport Recognition rewards program, BankMobile is changing the way the next generation does its banking.

It’s been just over 50 years since the first ATM was introduced in London, marking the entry of the banking industry into the modern technological age. The idea for a machine that dispensed cash was based upon the common vending machine, in widespread use since the 1880s before anyone thought to adapt it to banking.

Acceptance of technology in the world of banking had been slow and steady, but in recent years, banks have begun adopting new technology at a faster pace, largely driven by the need to improve efficiency and fend off competition from the world of fintech.

One of the most dramatic recent examples of this has been the adoption of mobile banking applications, and the flexibility of anytime, anywhere access to financial data. Mobile banking is the preferred method of financial account management for 82% of 18- to 24-year-old smartphone users, according to a recent PwC digital banking survey. The same study found 60% of all smartphone users have tried mobile banking in some form.

The trend toward mobile banking is driven in part by sheer convenience, and, in part, by the widespread incorporation of technology in general. Smartphones, in particular, have become an integral part of our daily lives. Combined with demographic shifts toward reliance on these devices, the trend toward mobile banking is sure to continue ticking upward.

BankMobile is an online banking institution that recognized this trend four years ago and has built the first FDIC-insured exclusively digital bank. Started as a way to help colleges and universities disburse financial aid refunds to students, BankMobile has quickly grown into a powerhouse online bank, serving 2 million college students on more than 800 campuses across the country.

Regine Fiddler is Vice President of Marketing and Product Management at BankMobile, and we recently spoke with her about the bank’s evolution.

“BankMobile is 100% digital, which helps us to keep the costs low and pass on the savings to our customers,” Fiddler said. “We don’t charge monthly, overdraft, or NSF (Non-Sufficient Funds) fees for students. In fact, to date we’ve saved students more than $100 million so far by helping them avoid fees. That’s based on numbers issued by the CFPB (Consumer Financial Protection Bureau).”

Designed with input from actual college students, BankMobile now offers some of the most student-friendly banking in the business with BankMobile Vibe.

Vibe Delivers Premier Mobile Banking and Money Management Tools

When BankMobile set out to create banking products that would appeal to college students, they did so in collaboration with students themselves. BankMobile Vibe is a checking and savings account designed around how students have said they want to do their banking.

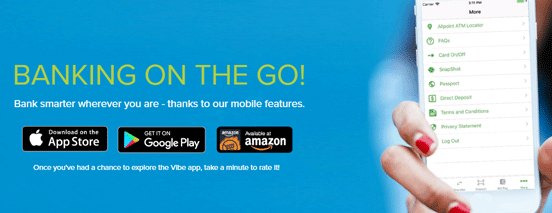

The robust mobile app at the center of BankMobile Vibe is the way account holders can do everything from checking their balance and viewing recent transactions to paying bills and transferring money. It also lets them deposit a check simply by taking a photo with their mobile device and tapping a deposit button.

“I think the mobile app is important from the standpoint that we have more than half of our population that, when they’re accessing their account, they’re doing it through a mobile device,” Fiddler said. “So, for us, it’s really important to use that channel to not just inform them of the status of their account or transactions but to engage with them. That’s why we’ve invested in building such a robust mobile app.”

In addition to the convenience of having all your banking options in the palm of your hand, Vibe also comes with a range of budgeting and money management tools. Members can set financial goals and receive notifications on their progress toward achieving them.

Snapshot is a money management tool that’s available on the BankMobile app, or by logging into your account online. This unique feature gives a view of your account balances from a very different and more useful perspective. While similar tools show a current balance, Snapshot presents the “at-hand” balance — reflecting any upcoming online bill payments and virtual reserves that have been set up. In this way, the Snapshot balance truly reflects the amount that’s available to spend.

Passport Program — A Ticket to Financial Rewards

We all love rewards, and BankMobile has designed a way to reward students for both their academic accomplishments and good financial behavior. Account holders who choose to can participate in the Passport Recognition Program, where they will have access to Deals & Discounts, Surprise & Delights, and be eligible to win the Student Success Sweepstakes.

“This recognition was co-created with students, who said they want a rewards program that caters to where they are in life,” Fiddler said. “So we came up with the Passport Program, a type of gamification that helps reinforce positive behavior, including rewards for hitting a certain GPA or for keeping a positive balance in their account, and the ultimate prize is that we can help them pay off their student loan debt.”

That part about paying off their student loan debt is what’s known as the Student Success Sweepstakes. By participating in the Passport Program, students earn virtual stamps for things like setting up a budget, maintaining a positive balance, reaching a certain GPA, and other accomplishments. Each stamp is an entry into the sweepstakes, with a grand prize of $10,000 that goes toward paying down student loan debt.

Emily Weber won the 2016 BankMobile Passport Student Success Sweepstakes, which helped pay off her current student loans.

“The fundamental goal for us is to help students be successful, not just financially but to help them achieve their goals,” Fiddler said. “We know that 46% of freshmen don’t complete college, and one of the reasons for that is financial hardship. We created this program, not just to help them with a fundamental financial understanding but also to show how they could be successful in achieving the goal of graduation.”

Round-the-Clock Support for BankMobile Clients

Potential account holders may wonder about having access to customer support with digital-only BankMobile. Of course, as a bank built around technology and convenience, BankMobile has also built a robust support model.

Customer care via live phone support is available from 8 a.m. to 11 p.m. for anyone wishing to speak with a representative. Access to support via social media and live chat is available 24/7 and is staffed by a dedicated team. But many of the questions account holders have can be answered via the interactive FAQ section, where they can type in a question or look up answers by category.

All of this speaks to the modernization of banking, and the fact that brick-and-mortar branches are becoming less a necessary part of the bank experience. And let’s not forget, BankMobile is part of the Allpoint ATM network, providing fee-free access to more than 55,000 cash machines around the world.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.