Buying a home is a dream many Americans have had to put on hold thanks to surging real estate prices, limited inventory, and record-high inflation.

Home prices have soared by nearly 20% since February 2021, according to recent data from the S&P Case-Shiller Index, a popular measure of the US housing market. And the National Associations of Realtors estimates that the median home sales price across the country has jumped 15% year-over-year to a high of $375,300.

With home prices and interest rates climbing, prospective homebuyers need to save even more to meet down payment requirements. Yet, with inflation raising the price of everything from groceries to gas to household utilities, finding extra room in your budget for savings may seem unlikely.

Luckily, there are several ways you can get ahead even as the cost of living skyrockets. Here are 15 practical ways to save money to buy a home even as inflation soars.

1. Set a Home Budget

Before you even begin saving for a down payment, you need to know how much home you can afford to buy. You should aim to spend no more than 30% of your take-home pay on housing costs.

You can use an online mortgage calculator to help determine a budget for a home purchase price based on the monthly mortgage payment you can realistically afford. Adjusting the monthly mortgage payment amount will help you determine the best home purchase price for your budget.

2. Research Loan Options

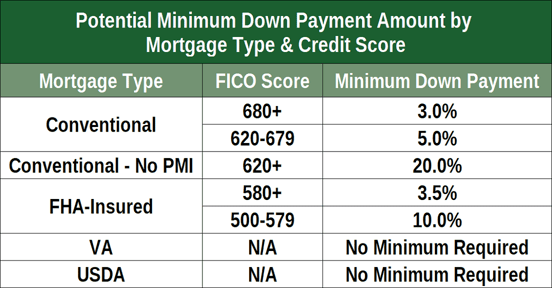

Several home loan options have different requirements and eligibility to help make buying a home more affordable. For instance, first-time homebuyers can save on the down payment by taking advantage of the government-backed Federal Housing Administration (FHA) loan program, which allows for a down payment of just 3.5%.

Meanwhile, USDA and VA loans require no money down for qualifying individuals. Even with a conventional loan, you can get away with a down payment as small as 3% of a home purchase price, but know that this could result in a higher interest rate and an additional monthly fee for private mortgage insurance (PMI) that gets tacked onto the mortgage payment.

Research all the loan options and review your eligibility for these loan programs at sites such as eligibility.org to see how you can save on your home purchase.

3. Compare Interest Rates

If you aren’t comparing rates among different mortgage lenders, you could be leaving money on the table. A report from Freddie Mac found that borrowers could save an average of $1,500 over the life of the loan by getting a rate quote from just one additional lender, and an average of $3,000 for five more quotes.

Take the time to speak to multiple lenders and compare interest rates to ensure you’re getting the lowest possible rate, just as you would when comparing prices on a new TV or car to snag the best deal.

4. Automate Savings

It’s tempting to spend money in the bank, but when it’s out of sight, it’s out of mind. So take this approach when working toward saving for a home: transfer your savings to a separate account.

Better yet, set up recurring auto-deposits to your down payment fund on the same date every week or month. This will keep you on track to meet your savings goal without thinking about it.

Some banks offer automation tools that grow your savings faster. For instance, Chime Bank‘s Round Ups automatically rounds up debit card purchases to the nearest whole dollar and transfers the difference into a separate savings account.

Don’t overlook the benefit of opening a high yield online savings account, as your down payment fund can grow faster thanks to higher interest rates.

5. Borrow From Your Future Self

Withdrawing from an IRA or retirement plan to fund a home purchase is usually frowned upon, given that you will miss out on years of compounded interest and get slapped with an early withdrawal tax of 10%. But the IRS offers exceptions to first-time homebuyers who can withdraw up to $10,000 from an IRA, SEP, SIMPLE IRA, and SARSEP plans without being penalized.

If you take this route, just make sure to increase retirement contributions once you get settled into your new home to catch up on what you withdrew.

6. Rethink Your Wireless Service

If you have an unlimited data plan, it’s time to rethink your wireless plan if you want to save some extra cash. A recent study found that 90% of mobile users waste money on unnecessary unlimited data plans even though they only use a small amount of data.

Look at your data usage to determine if the unlimited plan is best for you or switch to a lower-tiered option. You can also reduce your bill further by switching to an online-only wireless carrier such as Mint Mobile, which sells service in bulk at a dramatic discount.

7. Downsize Living Expenses

Rent prices have skyrocketed, with rates up nearly a whole percentage point, according to Apartment List’s rental report. Downsizing your current living space for a smaller apartment or looking for roommates with whom to split the rent will significantly reduce your monthly expenses, including rent and utilities, and beef up savings in less time.

For some, moving back home with your parents may also be an option if space permits, and you can put your would-be rent payment toward your savings account instead.

Don’t limit downsizing to just your housing costs. If there are multiple cars in your garage, think about cutting down to one. This may work if one partner works from home or you live within walking distance to work and stores.

Doing so means reducing your auto payments, maintenance expenses, and insurance by 50%, which could free up plenty of extra cash to build your home savings quickly.

8. Limit Impulse Purchases

A survey from Slick Deals says Americans spend around $276 on impulse purchases each month. That money would be much better used toward buying a home than wasted on things you don’t need.

Curb mindless shopping by deleting payment information stored in online retail accounts and unsubscribing from store emails that send tempting sales. Every time you dodge a potential yet unnecessary purchase, move the money you would’ve spent into your home down payment fund.

9. Earn More Cash Back

Opening a new credit card may seem counterintuitive when trying to increase savings, but finding one that offers more rewards for the types of purchases you make the most could translate into greater savings toward your dream home in the long run.

Data collected by Gigapoints found that the average cardholder is using the wrong reward card missing out on $1,000 in cash back. Review your year-end bank and credit card statement to see which category you spent the most on in 2021, and then look for a cash back card that offers more rewards for those types of purchases.

This is also a good time to tap into a few cash back tools that you can apply toward your savings. For instance, CouponCabin.com offers cash back on daily essentials such as groceries, including 2% back at Vons, and big-ticket purchases such as home appliances and travel bookings, which can really add up!

10. Cash In On Clutter

Look no further than around your own home for some extra cash to boost your home savings fund. You can sell gently used clothing through sites such as Poshmark and Tradesy.

Unused tech – like that smartphone you recently upgraded – can get you quick cash from sites such as Decluttr.com, and even unused gift cards can be sold at Raise.com.

Larger items such as furniture, sporting goods, and other household goods are easiest to sell via local marketplaces such as OfferUp.com. Just make sure to put whatever you earn toward your down payment fund before you get a chance to spend it.

11. Rent Your Stuff

Selling your unused items isn’t the only way to make some extra cash that you can earmark for savings. Renting is another option to consider.

For instance, rent your spare bedroom on a nightly basis to travelers via Airbnb, or rent your unused car by the hour via GetAround.com. You can rent your swimming pool via Swimly, and even rent baby gear your child has outgrown to families who are traveling and don’t want to lug bulky items such as playpens, high chairs, and car seats through BabyQuip.com.

12. Get a Side Hustle

No matter how much you cut back on your day-to-day spending, rising consumer prices can make it hard to find room in your budget to save more each month. Increasing your cash flow may be the only way to reach your down payment goal fast amid inflation, so look for a flexible side hustle that you can do in your spare time.

If you like working with kids, you can offer virtual tutoring on nights and weekends through Tutors.com, and people who prefer to spend time with animals can make up to $1,000 a month by pet sitting at Rover.com. Other ideas include getting paid to chat via The Chat Shop or running odd jobs for people in your area through TaskRabbit.

Or maybe you have a business idea you’ve always dreamt of pursuing. There are so many free tools available to help you create an online brand and get started with whatever business venture your heart desires.

13. Share Your Opinion

You can even earn money by sharing your opinion online. Sign up for virtual focus groups through 20|20 Panel, where you can make anywhere from $50 to $150 for talking about topics that interest you, including travel, shopping, or politics.

Sites like Inbox Dollars and Survey Junkie will also pay you in points for taking online surveys that you can cash out through PayPal and earn some extra cash toward your home savings.

14. Opt For a Staycation

Inflation is hitting almost every area of the consumer budget, including travel. Considering the national average for a gallon of regular gas is now above $4, and car rental prices have shot up 25%, as reported by the U.S. Department of Labor, taking a summer trip may mean putting your savings progress toward buying a home on hold.

Consider staying home and creating a memorable staycation with your family instead with these ideas.

15. Start Crowdfunding

While you don’t want to start asking strangers for money toward your dream home, you can ask loved ones to contribute to your down payment goal.

Set up a savings fund for any upcoming celebrations such as a wedding, birthday, or holiday. Family and friends can give a more meaningful gift by contributing to the goal with a down payment gifting platform such as HomeFundIt, Downpayment.gift, and Feather The Nest.

You can even increase your down payment fund by shopping through HomeFundIt’s online portal that offers to contribute an extra percent of each purchase made at participating retailers. For example, you can earn 5% back to your down payment fund by shopping at Target through this site.

Final Thoughts

Saving money to buy a home may be overwhelming at first, but there are plenty of ways to reach your goal faster and turn your dream of homeownership into a reality. Employing several of these strategies can help your money grow quickly so you can accrue the necessary down payment and begin the process of closing on your new home.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.