October 2023 marks the end of more than three and a half years of student loan forbearance and the non-repayment of federal student loans. Regardless of your position with respect to the idea of debt forgiveness, what is clear is many consumers will have to resume making payments on their debts, which they had hoped to avoid.

So, the question posed is how is this going to impact the credit scores of those consumers?

Understanding How Student Loans Are Reported to the Bureaus

Student loans are unlike any other form of credit as it pertains to credit reporting. For example, when you borrow money to buy a house or a car, two other very common forms of installment loans, a single loan will appear on your credit reports. But that’s not at all how student loans appear on credit reports.

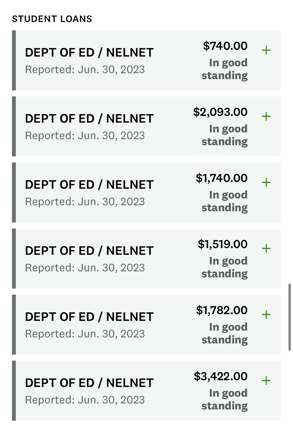

Student loans are reported or “furnished” to the credit bureaus on a disbursement-by-disbursement basis. So, if you took five student loan disbursements over the course of a few semesters, they are reported as five separate loans to the credit bureaus.

And yes, even if you make one student loan payment each month, they still show up as multiple loans on your credit reports.

No credit-reporting method distinguishes between student loan money that was used to pay for tuition and student loan money used for living expenses or other items that have nothing to do with school-related expenses (like my former college roommate who used his student loan money to buy instruments for members of his band).

This is important because credit scores are based entirely on the information in your credit reports, nothing more and nothing less. So the representation of your student loans is paramount during the credit scoring process.

If you make your student loan payments on time, then all your student loans will be reported as being in good standing or in a “current account status,” as it’s called in the credit world. If you decide you’re not going to resume making your payments, all of your loans will be reported as late and, eventually, in default.

So instead of defaulting on one loan, as would happen in a credit card, mortgage, or auto loan scenario, you will default on multiple student loans.

If you choose not to make your payments and you go into default, it’s also likely the current student loan servicer — the company that collects your payments each month — is going to transfer the loans to the Department of Education default loan servicer, which will also report them as being in a collection status.

If you haven’t already figured it out, many bad things will happen if you don’t resume making your payments.

If all of this sounds overwhelming and terrible, you’re right. Not making payments on your credit obligations come with real-world consequences. The fact that you have multiple student loans that could go into default magnifies the problem because of their disbursement-based reporting.

And you should not expect your servicer to take an adverse position in the SCOTUS ruling on student loan repayment and preemptively choose not to report your late payments to the credit bureaus. The Department of Education requires federal student loan servicers to report to the credit bureaus, so they’d be in default of their contracts with the United States Government by doing so.

How Credit Scores Will Be Affected

VantageScore Solutions studied the effects of student loan repayments and published results quantifying the impact of making and not making payments.

If You Stop Making Payments: Expect a 49- to 82-Point Average Decrease

If you stop making your payments and your loans go delinquent or in default, there’s a very good chance your scores will go down. The size of the score reduction will vary by consumer, depending on the rest of the information on their credit reports.

There is no uniform impact of anything on a credit score. But VantageScore found that those who experience a score reduction will experience something between 49 and 82 points.

If You Resume Payments On Time: Expect an Average 8-Point Increase

Of course, many borrowers will resume making their payments and, hopefully, have been budgeting for the eventual resumption of paying their debts. For borrowers who make their payments on time, their accounts will remain in a current account status, and their scores will benefit. According to the VantageScore research, the average benefit will be eight credit score points.

While eight points may not seem like a big deal, remember that all student loans that were not already in default had to be reported as having a current account status. This means they were already in good standing per the CARES Act credit reporting requirements, so they were not harming consumer credit scores.

The modest eight-point increase should be seen as the cherry on top of what is likely an already solid credit score.

You should assume a similar impact on FICO’s scores when you miss or make payments. FICO’s scores will penalize consumers who have recent delinquencies and defaults on their credit reports, and their scoring models will reward consumers who resume making their payments on time.

The impact will vary depending on the unrelated information on a consumer’s credit reports. As with VantageScore’s credit scores, there is no uniform impact of anything on a consumer’s FICO scores.

What to Do If You’re Unable to Make Payments

Inevitably, a percentage of borrowers won’t be able to afford to make their student loan payments or will go delinquent on other obligations because of the resumption of their student loan payments. But you have better alternatives to doing nothing and letting your loans or other debts fall into default.

Soon after the SCOTUS announced its ruling on June 30, the National Foundation for Credit Counseling (or NFCC) sent a press statement reminding consumers that it offers programs to distressed debtors dealing with untenable repayment options.

The NFCC offers legitimate debt management programs to those in need. Its track record of helping consumers deal with debt is impressive.

Another option consumers have when dealing with student loans is to free up disposable monthly income by reorganizing other debts, such as credit card debt. For example, if you can lower your credit card payments by $100, then that $100 can go toward paying your student loans.

Your credit card debt tends to be the most expensive debt you’re carrying, with an average APR of over 20%, so there’s generally some room to improve.

If you have an income and decent credit, you may qualify for a personal consolidation loan through a mainstream lender, a peer-to-peer lending platform, or an online lender. The point of the personal loan isn’t to pay off your student loan debt but, rather, to pay off your credit card debt and create new disposable income you can use to reduce your student loan debt.

APRs on personal loans are not nearly as good as APRs on federal student loans. So paying off student loans with personal loans isn’t a wise financial move. And interest on federal student loans is tax deductible while interest on personal loans is not.

But APRs on personal loans can easily be much lower, even less than half, of the APRs on credit card debts. And you’d be converting score-damaging revolving debt (credit card debt) to score-benign installment debt (personal loans), so you’d likely see a score boost while your monthly payments go down. That’s a wise financial move.

How to Check Your Reports and Scores

While macro-level statistics about the impact of making timely payments or missing payment deadlines are interesting, you’re probably more interested in learning how your credit scores are affected once payments resume. There are a variety of ways you can check your credit reports and credit scores.

First, if you have student loans coming out of forbearance, you should pull all your credit reports now to see what they look like. You can do that for free at AnnualCreditReport.com once per week. After you’ve resumed making payments (or not), you can pull your reports again from the same website and review the new activity.

If you’d like to check your scores, there are various ways to do so at no cost. Websites where you can pull free FICO and VantageScore credit scores abound.

For example, if you have a Chase or Capital One credit card, you can check your VantageScore credit scores in your Chase or Capital One app. If you’d like to check your FICO credit scores, you can do so for free at Experian’s website or through your bank if it participates in FICO’s Open Access program.

The point is, whether you resume making your student loan payments in October or not, you shouldn’t be in the dark about how your choice will be represented on your credit reports or how it will affect your credit scores.