Move over pizza and doughnuts — it’s time to celebrate a day dedicated to something more important than junk food.

National 401(k) Day was established to shine a spotlight on the importance of preparing for the future through retirement savings plans. Falling on the first Friday after Labor Day, 401(k) Day is the perfect time to review your retirement plan, assess your progress, and learn how to maximize your 401(k) to ensure you have adequate funds for those later years.

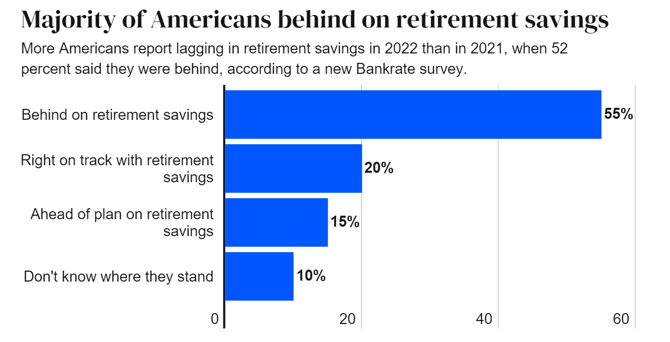

Roughly 55% of Americans Are Behind On Their Retirement

The reality is that many Americans are behind on their retirement goals. According to a 2022 Retirement Study from Bankrate, more than half of US consumers are struggling to save for the future, blaming inflation as a primary hurdle in their quest to increase retirement funds.

According to the study, 55% of Americans surveyed said their retirement savings were not where they needed to be, and almost 35% of respondents said they were significantly behind on their goal.

Using a 401(k) strategically can help grow your retirement fund so you can meet your goal with less effort and less stress. Of course, the sooner you start, the less you will have to put away to reach your goal, but it’s never too late to get started.

Here are seven simple things you can start doing now to make your retirement savings work harder for you.

1. Leverage Your Company Match

Many employers offer to match your 401(k) savings contributions, typically between 3% to 6% of your salary, which is like free money your future self will thank you for. Taking advantage of this match is the fastest way to grow your retirement funds without having to deplete yourself later in life, so make sure you’re putting away at least the amount your company offers to match. This way, you don’t miss out on free money.

2. Know When You’re Fully Vested

A 401(k) match is a nice perk, but it comes with some strings attached. In fact, many companies require you to be employed for a certain number of years to keep these contributions. Quitting your job before you are fully vested could mean losing some or all of the company match you acquired.

Therefore, find out how your employer has structured your retirement plan and how long you need to be employed to be fully vested before you decide whether it’s time to move on. While some people may be willing to forfeit the retirement match for a better-paying job, others may want to think twice before making a lateral move to avoid losing any funds.

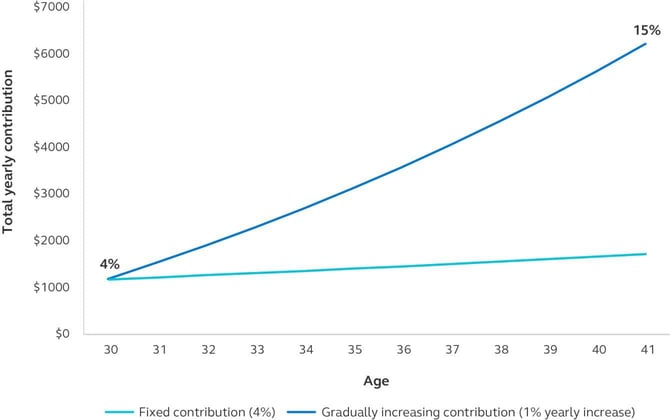

3. Increase Your Savings Rate Every Year

Living on less than you earn may seem impossible at first, but you can trick yourself into adjusting to a smaller budget over time by slowly increasing your retirement contributions once a year. Even a small 1% increase to your 401(k) contributions can have a meaningful impact, allowing your money to have more time in the market to grow thanks to compound interest.

Meanwhile, if you earn a raise or bonus, resist the urge to splurge on something you don’t need. Instead, invest the extra money you earn toward your retirement plan to see a bigger impact on your savings.

If you’re still struggling to find extra room in your budget to put away in your retirement plan, think about how you can boost your cash flow by taking on a side hustle, such as renting out a spare bedroom or your car when it’s not in use.

4. Take a Tax Break

Eligible taxpayers can offset the price of saving toward retirement by leveraging the Retirement Savings Contributions Credit, commonly referred to as “saver’s credit.” According to the IRS, you can take a tax credit for eligible contributions to an IRA or employer-sponsored retirement plan like a 401(k), depending on your adjusted gross income and filing status.

Review the 2023 Saver’s Credit chart to see if you qualify and how much credit you can get.

5. Keep Fees to a Minimum

Investment plans come with fees that can eat away at your bottom line. There isn’t much you can do about administrative or investment plan fees, other than asking your employer to shop around for a more reasonably priced option. But you can keep some costs to a minimum by simply selecting cheaper investment options, including ETFs and index funds.

6. Diversify Your Investments

Retirement plans can lose money depending on various environmental and economic factors, but you can mitigate this risk by diversifying your investments. According to Ramsey Solutions, it’s recommended that workers split their 401(k) portfolios into four types of mutual funds, which include growth, growth and income, aggressive growth, and international funds.

In some cases, it may be worthwhile to work with a financial professional who can help you navigate these options to find the best funds and investments based on your target retirement date and risk tolerance.

7. Avoid the Urge to Cash Out

Whether you’re changing jobs and don’t know what to do with your current retirement plan or you need some cash for a home renovation or big purchase, avoid the urge to take money out of your retirement account. Doing so before the designated retirement age of 59½ means you will face a 10% early withdrawal penalty, and you’ll be on the hook to pay income tax on the amount you cashed out.

Not to mention, you will miss out on the value of compounded interest that grows your nest egg for you.

Take Action to Achieve Your Retirement Goals

Follow these seven simple steps to increase your 401(k) savings and boost your retirement fund. Learning how to maximize your retirement savings may seem overwhelming at first, but taking the first step will put you in the right direction, and you can grow from there.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.