Home equity loans for bad credit can make big expenses such as remodeling your home or sending your children to college possible if you have poor credit.

Not everyone has the necessary credit score to qualify for a low-interest loan or enough savings in the bank to pay outright for remodeling work. But if you have equity in your home, you can make your home work for you by borrowing against the value of your home.

Lenders | How to Qualify | FAQs

Best Home Equity Loans For Low Credit Scores

Some lenders specialize in providing loans to people with bad credit, including home equity loans. These may have higher interest rates than those for homeowners with good credit. But they give people with bad credit a chance to borrow against their home’s equity to make home improvements or other big purchases they want.

Here are the best home equity loan companies we’ve found for people with bad credit:

- America’s largest mortgage lender

- The entire process is completed online

- Options for new mortgages and refinancing existing mortgages

- Award-winning customer service and cutting-edge digital platforms

- More than 90% of clients would recommend us

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

You’ve probably heard of Rocket Mortgage, America’s largest mortgage lender. It can also help you get a home equity loan if you meet its requirements, which will include a look at the amount of equity you have (determined through an appraisal), your credit score, and your debt-to-income ratio.

The lender says that even if you’re weak in one area — in this case, credit score — the other two factors can “help boost your qualifications.” So, if you have sizable equity and a DTI ratio below 45%, your poor credit score shouldn’t disqualify you from getting a home equity loan through Rocket Mortgage.

- Best for cash-out refinance

- Utilize your home equity with America’s #1 lender

- eClosing allows customers to close electronically, greatly speeding the process

- A+ rating with the BBB

- Receive cash for home improvements, college tuition, or paying off debt

- 24/7 access to your loan through the Rocket Mortgage app

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

Quicken Loans is a part of Rocket Mortgage. It helps borrowers secure various types of home loans, including home equity lines of credit. A home equity line of credit, or HELOC, is like a credit card that you can use as needed rather than a large lump sum payment you would get with a home equity loan.

HELOCs still use the equity of your home to provide you with a secured credit line. There’s usually a withdrawal period of a few years, followed by several more years — usually 10, 15, or 30 — of repayments. HELOC interest rates are comparable to home loan rates rather than those of credit cards.

3. eMortgage

- Get today's mortgage rates from the top mortgage lenders and banks

- Easily compare and choose mortgage lenders with no obligations or fees

- Review current mortgage rates side by side

- Pick mortgage lenders that meet your specific needs

- Compare rates from pre-qualified and approved mortgage lenders — 100% online, 100% free

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1979 | 4 minutes | 8.5/10 |

eMortgage helps consumers shop for loans from its vast lender network. Simply fill out the home equity request form by providing your home’s worth, remaining mortgage balance, how much you want to borrow, and your contact details. It will send your request to its lender network, after which up to five competing offers will be sent to you within minutes.

You select the loan you want and can talk with loan officers if you have questions or want to haggle over the price, or you can apply online.

- Easy to OwnSM programs give options for those with lower income, limited credit history, and low down payment needs.

- Provides the potential for minimal out-of-pocket expenses with seller contributions.

- Offers loans that don't require monthly mortgage insurance.

- Requires less cash upfront for your down payment and closing costs.

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1852 | 6 Minutes | 8.0/10 |

Wells Fargo Home Mortgage has online mortgage calculators to help you determine how much of a home equity loan you qualify for. The loan can be used to repair or maintain your home or to renovate or remodel it.

Just enter the amount you want to borrow, the value of your home, your current monthly mortgage payment, existing mortgage balance, and the current interest rate you’re paying, and it will calculate offers for you. You’ll also need to provide your credit score as well as the state and county where your home is. But don’t think that a good or great credit score is required — Wells Fargo has bad credit loan options, so it’s worth checking to see what you may qualify for.

- Loan programs include down payment and closing cost assistance.

- Variable and Fixed-Rate loans available with flexible qualification guidelines.

- Up to 100% financing—with as little as zero down payment for qualified borrowers.

- No maximum income/earning limitations.

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2008 | 5 Minutes | 7.0/10 |

Another big lender that you’ve probably heard of, Bank Of America Mortgage, also offers home equity loans to people who have a lower credit score.

To apply, it asks customers enrolled in online banking to finish their request more quickly by signing in to its portal and prefilling their request with account information. If you’re not already an online customer at Bank of America, you can still apply online, though it will require filling out more information online.

How to Qualify and Apply For a Home Equity Loan

The first part of qualifying for a home equity loan is checking your credit score. A good score will make it easier to be approved for a loan. If your score is below 620 and you can put off the big expense for now, it can be worthwhile to improve your credit score before you apply.

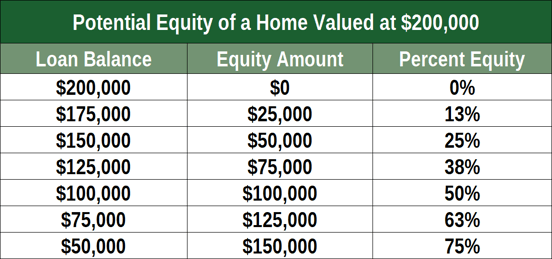

The next application step is checking if you have enough equity in your home. Equity is the difference between your home’s value and how much you still owe on the mortgage.

You build home equity by paying down your mortgage balance over the years. Rising real estate values help equity grow faster.

A loan officer will generally require home equity of at least 15% to 20%. Loan amounts vary by lender, but up to 85% of a home’s value can be borrowed against, minus what’s owed on the mortgage.

You can do a little math to figure out the maximum amount of equity you can borrow:

Suppose your home is worth $350,000, your mortgage balance is $200,000, and your lender allows you to borrow up to 85% of your home’s value. Multiply your home’s value ($350,000) by the percentage that can be borrowed (85% or .85). That gives you up to $297,500 that can be borrowed, however, you owe $200,000 on the mortgage. Subtract that $200,000 and you’ll see that you can borrow up to $97,500 through this second mortgage.

Home Value x Percentage that Can Be Borrowed – Mortgage Balance = Maximum Loan Amount

You should next check your debt-to-income ratio, or DTI, which we’ll get into detail later. Paying down a large debt before applying for a loan will improve your chances of approval.

Next, research home equity loan rates at banks, your local credit union, and other lenders. Check with the bank or credit union you already have an account with, or shop online from a network of lenders, such as through eMortgage. Compare loan rates, fees, and qualifications from multiple lenders.

Applications usually take two to four weeks to process. To make sure your application goes smoothly, you can help by gathering pay stubs, the deed, tax returns, and other information the lender may need.

What Is a Home Equity Loan For Bad Credit?

Using your home as collateral, a home equity loan lets you borrow against the equity you’ve built up in your home. You receive the cash as a lump-sum payment that you pay back at a fixed interest rate for a set period. Equity is the difference between your home’s value and what you owe on the home loan.

A home equity loan for bad credit is provided by a lender that specializes in helping borrowers with bad credit. However, having a bad credit score reduces your approval chances. If you’re approved for a loan, a lower credit score can cause lenders to give you less favorable terms, such as home equity loan rates.

The money you borrow can be used for anything, from paying for college to medical bills. It’s most commonly used for home renovations.

A home equity loan is a second mortgage that doesn’t affect the payment on your main mortgage. Your current mortgage won’t change.

Payments during the loan term of the equity loan include principal and interest at a fixed rate, so you won’t be surprised by a changing amount due each month and can budget for repaying the loan.

The loan is secured by your house, so missing a payment or paying late can lead to the lender foreclosing on your home. Also, if you sell your home before you’ve paid back the loan, the balance of the home equity loan is due.

What Is the Minimum Credit Score For a Home Equity Loan?

Your credit score is one of the key factors in qualifying for a home equity loan or a home equity line of credit (HELOC). The lower the score, the more likely you are to be charged a higher interest rate.

A FICO score of at least 680 is typically required to qualify for home equity loans, according to Experian, one of the three major credit bureaus. FICO scores range from 300 to 850.

A score of at least 700 gives you the best shot at a loan with good terms, according to Experian. If your score is between 660 and 700, you’ll be charged a higher interest rate, and other factors — such as your overall debt — may need to be in good shape.

Debt-to-income ratio is another key factor lenders may look at for people who have a low credit score. DTI measures total monthly debt payments, calculated as a percentage of your gross pay.

Lenders typically want a borrower’s DTI ratio, including the home equity loan, to be no more than 43% of monthly gross income. A low DTI means your debt is less than your income, and less debt is a good thing.

Another way to overcome a low credit score is to have a higher equity stake in your home.

Equity is the appraised value minus the remaining balance on the mortgage. Having at least 20% equity in your home is generally required to qualify for a home equity loan. Having more equity can help overcome a poor credit score. The lender will request an appraisal of your home to calculate your combined loan-to-value ratio.

More equity reduces a lender’s risk and gives you extra incentive to stay on top of your payments. The lender’s risk is reduced because, if you don’t repay the loan and the home goes into foreclosure and is sold, there would likely be enough money after paying off the mortgage to cover the outstanding equity loan.

What Is the Difference Between a Home Equity Loan and a Home Equity Line of Credit?

Home equity lines of credit, called HELOCs for short, also allow homeowners to borrow against the equity they have in their home, just like home equity loans do. The loan amount for each depends on your equity and home’s market value.

A loan and a line of credit, however, are different in a few ways.

An equity loan is an amount of money paid in a lump sum. The upfront amount of money is usually set at a fixed interest rate based on how much you borrow.

The loan term is set for a certain amount of time at a fixed interest rate, much like your first mortgage. An equity loan is sometimes called a second mortgage and is subordinate to your first mortgage.

Equity credit lines are lines of credit that you can draw on as you need money. The draw period is for a set amount of time, and you’ll have ongoing access to the cash as needed. For example, this can come in handy if a home remodeling project goes over budget and you need more money to pay a contractor.

The payment made on a home equity line is based on the amount of money you transferred. HELOCs usually have a variable interest rate, which can make them more expensive than the fixed interest rate of an equity loan.

But a HELOC loan can be advantageous, too. It provides flexibility by allowing you to borrow what you need, and then pay it off and borrow again. Paying off the amount you use can result in a lower monthly payment instead of borrowing a lump sum.

A HELOC will have a variable interest rate that’s often low at the beginning of the loan. That’s great for the typical introductory phase of six to 12 months, but after that, the rate usually goes up.

What Is the Minimum Loan Amount For a Home Equity Loan?

Whatever you need a large loan for, lenders usually don’t make small loans because they’re not as profitable as large loans. The smallest home equity loan available is about $10,000. Some banks have minimum loan amounts of $25,000, and others require borrowing at least $35,000.

A home equity loan is meant for a single major expense. Renovating your kitchen or another big project at home is typical and will require paying a contractor $10,000 or more. Often much, much more.

Home renovations and remodels average $48,443, with most homes falling between $18,071 and $79,108, according to July 2022 data from HomeAdvisor. Kitchens are the most expensive costing $25,000 on average for a remodel.

And don’t forget budget overages. Unseen problems will probably pop up, so adding 20% to all home renovation budgets is smart.

With all of that in mind, it’s easy to see how a home renovation can end up costing a large chunk of money. A visit to the emergency room or a college education is also costly, and a HELOC or equity loan can help pay for those big bills.

If you only need $20,000 and the minimum loan amount is $35,000, there’s no reason to borrow $15,000 extra. The interest rate on the full amount borrowed takes effect immediately, so you’re paying interest on the $35,000 loan whether you use the full amount or not.

In that case, a HELOC may make more sense because you only borrow the money you need when you need it. If your contractor needs $10,000 this month and $15,000 when the job is finished in a few months, then a line of credit can be a better choice.

But remember that a HELOC only has a lower interest rate than an equity loan for a certain period, such as six to 12 months, so use the credit line before the low interest rate expires.

Will I Have a Variable Rate or a Fixed Interest Rate?

Home equity loans come with a fixed interest rate. It’s an installment loan that’s paid with regular monthly payments for a set period of time, just like the first mortgage on a home. Terms range from five to 30 years.

A home equity line of credit, however, will likely have a variable interest rate that can change from month to month. Some HELOCs have a set rate for six months to a year, so you can have a steady payment amount for a while.

Payments may change based on your balance and interest rate fluctuations and can drop if you make additional principal payments. The variable interest rate is usually tied to the U.S. Prime Rate.

Some lenders, including Bank of America, allow a portion of the outstanding variable-rate balance on a HELOC to be converted to a fixed rate.

How Much Are Closing Costs?

Fees are one way that lenders make money, and they also cover some of their expenses in processing a loan.

Expect to pay from 2% to 6% of the loan amount in closing costs. Borrowing $100,000 in home equity, for example, can cost from $2,000 to $6,000 in closing costs.

A loan estimate that’s required by the federal government will be provided to you by the lender and will detail all of the fees and estimated amounts.

Below are some fees to expect when closing a home equity loan, most of which are similar to when you took out your original mortgage:

- Origination fee: Cost of initiating the loan. Varies by lender but may be $125. Lenders that don’t charge this fee may call it an application fee.

- Appraisal fee: From $300 to $400, an appraisal is done by a third party to determine the value of your home.

- Credit report fee: Some lenders will charge to check your credit, usually around $25.

- Title search: To identify any issues of ownership or rights to your property, around $100.

- Title insurance: This may be required if there are potential title issues or the amount borrowed is high. The cost of title insurance is based on the size of the loan and can vary widely.

- Floodplain determination fee: May be needed if your property is in a flood zone and will require flood insurance.

- Notary fee: An in-house notary that lenders have may be free, or a third-party one may cost you a fee.

- Attorney or document preparation fee: If a lawyer is needed to close the loan, some lenders charge $100 to $400.

- Tax stamp fee: Your local government may charge a recording fee for tax purposes that is based on the amount of your loan.

Also keep an eye out for other costs associated with a home equity loan, such as a prepayment penalty, hazard or flood insurance, and, of course, the interest rate.

The FTC also warns of some costs that can continue during the life of the loan. These may include an annual membership or participation fee, which is due whether you use the account, and/or a transaction fee that’s charged each time you borrow money.

To minimize your closing costs, look for a lender that covers these costs or waives them. Closing costs may be waived under certain conditions, such as keeping another account open with the bank or setting up automatic payments for the loan.

And just like you would for an original mortgage when buying a home, shop around for the best interest rate. Some lenders allow closing costs to be rolled into the loan. This reduces your initial expenses but can cost you more in the long run by paying interest on the closing costs.

Closing costs can drop dramatically — as the loan payment amount will — by borrowing less money. Borrow only as much money as you need for the renovation project or other large expense, and try to cut it back if you can’t afford the loan.

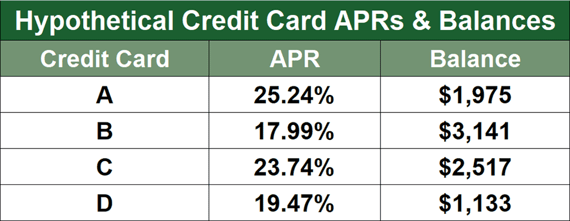

Can I Use a Home Equity Loan For Debt Consolidation?

Yes, you can consolidate your debts and pay them off with a home equity loan. Most lenders won’t ask what you’re using the money for, but some may require that it only be used for certain expenses, such as home renovations. If that’s the case, then you’ll have to find another way to consolidate your debts, such as through a personal loan.

If it is allowed, you’re in luck. Home equity loans often have lower interest rates than other types of debt consolidation, which will make monthly payments easier.

Paying off your credit cards and other debts by merging them into a single debt that’s paid off by a loan or debt management program is an effective way to avoid high-interest credit card debt. Debt consolidation lowers the interest rate on your bills and is something you can do yourself with a large enough loan to pay off the cards with the highest interest rates first.

Just be sure you want to do it with a home equity loan. The loan will increase your debt and requires making monthly payments. If you can’t limit your spending and rack up more debt, you could be in a worse position than you were before taking out the loan.

Your home is also the collateral for the loan. This is good news in one sense: a secured loan often has a lower interest rate than other types of loans, including credit cards.

The biggest potential downside, of course, is losing your home to foreclosure because you missed a monthly payment on the second mortgage while still trying to pay off credit card debts. And, as mentioned above, a home equity loan comes with closing costs. Make sure these extra costs are worthwhile to consolidate your debts.

Is a Home Equity Loan Considered a Second Mortgage?

Yes. It’s considered a second mortgage when your home is used as collateral for the loan, just like the first mortgage.

That’s what helps make a home equity loan cheaper than other types of loans. It’s a secured loan that’s backed by your home. Worst case, if you don’t make payments on the second loan, the lender can foreclose on the loan and repossess your house.

The first loan from your original lender, however, takes legal precedence, so any proceeds from selling the home would first go to pay off the first loan before the second loan is paid. If anything is left, you would receive it.

With up to 30 years to repay, a home equity loan can be equal to or even longer than your first mortgage. If you don’t borrow too much, it may take a lot less time to pay it off than the first mortgage.

This is one reason why it’s important to make sure you can afford both mortgages. Find out how much the monthly payment and other possible costs are of a second mortgage and make sure it fits in your budget. Having a new kitchen or living room remodeled is great, but won’t be so enjoyable if you can’t afford the loans.

A home equity loan is not a cash out refinance loan, though that is another option for tapping into your home’s equity. A refinance loan is your primary loan, whereas an equity loan is a second loan on your home, hence the term second mortgage.

What Can Disqualify You From Getting a Home Equity Loan?

While bad credit can make getting a home equity loan more difficult, a recent bankruptcy can sink your chances altogether. Bankruptcy can be a life-altering financial event, so lenders have good reason to shy away from consumers who have recently experienced one.

But that reluctance certainly doesn’t last forever, especially if your home makes it through the proceedings unscathed. Lenders will feel comfortable if you can secure the loan with your home — and it has no liens against it.

If you can keep your finances in order and make on-time payments to all of your creditors, your bankruptcy should fall off of your credit report in seven (Chapter 13) to 10 years (Chapter 7). After that, you could be eligible for much better interest rates and terms.

Easily Compare Home Equity Loans For Bad Credit Online

Home equity loans for bad credit aren’t as out of reach as you may think. Some lenders specialize in providing loans to people with bad credit and are easy to find online and see if you qualify for a loan.

Online forms can take mere minutes to fill out, and some companies will have a list of lenders for you to choose from within minutes. They may require talking to a loan officer to get more information, such as your proof of income and other documents.

As with any type of loan, shop for the best interest rate and other loan terms. This can pay off in thousands of dollars saved in interest.

For example, check what the annual percentage rate, or APR, of the loan is. This is the interest you pay each year as represented as a percentage of the loan balance. A loan with an APR of 10% means you’re paying $100 annually for every $1,000 borrowed. Search for the lowest APR you can find.

Your home’s equity is something you should tap into wisely. You’ve probably spent years paying into it, and your home is likely to be one of the biggest expenses you’ll ever have.

An equity loan is a good funding source for home improvements or to pay for other big expenses. It should only be used with caution and the knowledge that you’ll be paying a second mortgage for years to come.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.