On the surface, credit reports and credit scores are pretty straightforward. You can quickly find important and accurate information from widely published material. But some information is a little more puzzling, and getting the answers takes some digging.

Here are 10 vexing credit report and credit score questions answered.

1. Why do I have 3 credit reports?

Companies that gather information about consumer credit behavior and then share it with other businesses are hardly a recent phenomenon. An early version was the “Society of Guardians for the Protection of Trade Against Swindlers and Sharpers,” established in London in 1776.

Today, there are three major credit bureaus in the United States that create consumer credit reports. They are separate and private companies, and each has its own backstory:

- TransUnion began as a holding company for rail transportation equipment.

- Equifax was started by a merchant to identify creditworthy customers.

- Experian was started in England by tailors who began swapping information on customers who didn’t pay their bills, then became TRW, and finally in 1996 became what it is today.

While these are the big three bureaus, there are far more credit reporting companies. A number of smaller credit bureaus exist, including CoreLogic Credco, SageStream, Innovis, LexisNexis Risk Solutions, and MicroBilt.

2. How do I know which credit report my lender will pull?

You don’t! That’s up to the lender, which has the right to access whichever report it wants. It can pull reports from multiple bureaus, too. But if you ask, the lender will probably tell you which credit report they are using.

Since Experian is the largest credit bureau (as Chase reports, it maintains credit information for over 220 million consumers in the US), odds are the lender will choose to use that report.

3. I pay my household bills on time and make good money — why doesn’t that make me a good credit risk?

You may be a great credit risk based on those two factors. And when you apply for a credit product — especially a mortgage — that will be assessed.

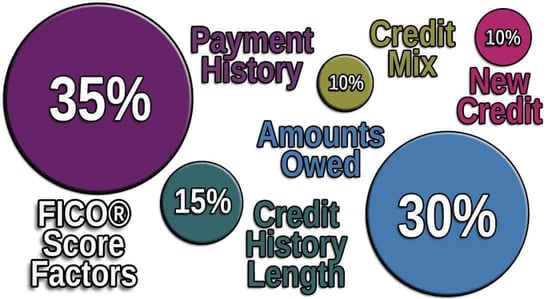

But a credit report is designed to include credit and debt information. That’s because a lender is most interested in your past pattern of using credit cards and taking out loans, with your payment history and amounts owed being the most critical information.

Lenders are protecting their interests. If your report shows many years of borrowing and repaying responsibly, the presumption is you will continue to do the same with them.

4. What do credit scores really mean?

A credit score is a numerical representation of your credit risk. It’s based entirely on the data listed in your credit report. The information is weighted for what is more and less important to a lender, and it’s all inputted into the credit scoring company’s proprietary algorithm.

Lenders and other businesses use credit scores so they can make quick, objective decisions. They don’t have to pull and read an entire credit report and then try to fairly decipher what they see.

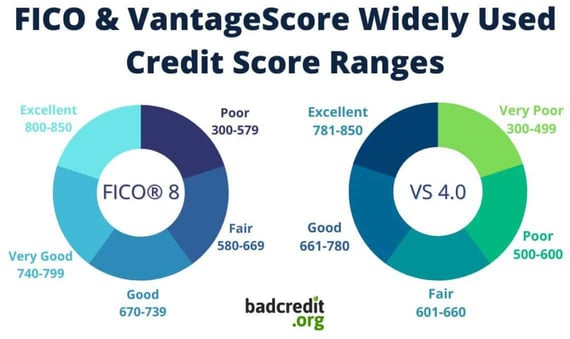

FICO Scores are the most-used credit scores, but VantageScores are also becoming popular. Each of the models range from 300 to 850, with higher numbers indicating less risk.

And remember, your credit score will change when your credit report is updated. Each month those numbers can be very different.

5. When I get my first credit card, will my credit score start at 300?

It stands to reason that your credit scores would begin at the very bottom, but that isn’t the case. Depending on how you use the new card, chances are your credit score will start somewhere in the middle of the credit scoring scale.

The credit card issuer will send the credit bureaus information about your account after you have applied and the card was granted. A FICO Score will be generated after one credit account is open and reported to at least one of the major credit bureaus for at least six months.

So if you used the account well by paying your bills on time and paying the debt in full or keeping it very low, your first credit score should be well above 300.

A VantageScore will generate a score as long as one month’s worth of data is reported. And while that’s not a long time to make a prediction about your credit risk, as with the FICO Score, you won’t start off at the very bottom — unless you have misused the account, such as by making a payment 30 or more days late.

6. I paid off my debt, so why did my score go down?

Sometimes, credit scores don’t make a lot of sense, and this is one of those times.

Deleting debts most often helps improve your credit scores, yet under some circumstances, those numbers can drop after satisfying your payment obligations on a loan or credit card.

This can happen when it affects such factors as your credit utilization ratio, the length of your credit history, and your credit mix.

For example:

- You have one installment loan that you just paid off in full. Your credit scores may drop a little if the closed account affects the diversity of your credit mix.

- You pay off a credit card balance and close the account, but are carrying other credit card debt. Your scores could drop because your total available credit has decreased. Additionally, if the card you closed was your oldest line of credit, it could negatively impact the length of your credit history, causing your scores to go down.

7. Can anyone pull my credit reports and scores?

The rules are slightly different for credit reports and credit scores. As a consumer, you have the right to access both.

- Credit reports: For a free copy of your credit report from each of the bureaus, go to AnnualCreditReport.com.

- Credit scores: You can get your credit scores directly from the company’s websites, myFICO.com and VantageScore.com. They may also be provided by your creditor.

Lenders, credit card companies, insurance companies, government agencies, and utility providers can all access your credit reports. Landlords and employers can too, but you have to give them permission first. All but employers have the right to pull your credit scores.

8. If I file a credit report dispute, what does it mean when they are investigating the matter?

The credit bureaus have an automated process for investigating credit report disputes. Using the credit bureau’s online dispute form, you will explain why the information is inaccurate, including supporting documentation if you have it.

The bureau will confirm to you that it received your dispute and will send your dispute reason and supporting materials to the source of the information for review. If the source concludes you are right, all of your credit reports will be updated.

Credit bureaus must complete the investigation within 30 days (or 45 days in certain circumstances). But investigations are usually completed sooner than that.

9. Does negative information stay on my credit reports forever?

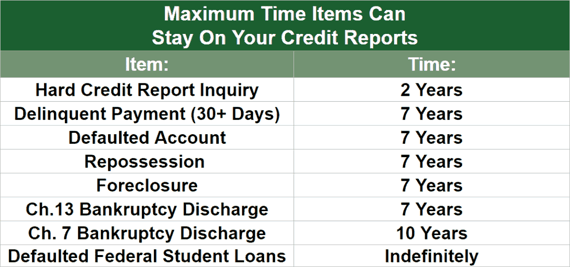

No, the Fair Credit Reporting Act limits the amount of time certain things can remain on your credit reports. The time frame differs based on the information:

A quick caveat: While the credit bureaus won’t report negative information after the time limits in most circumstances, they may keep your information on file (but not have it appear on your reports). In a couple of instances, however, they can still report it.

According to the Consumer Financial Protection Bureau, the credit reporting time limits for negative information don’t apply if the credit report will be used in connection with applications for:

- a job that pays more than $75,000 a year.

- $150,000 or more of credit or life insurance.

10. I charged up my card but paid it off before the due date. Why did my score go down?

Your card issuer reported your account – including the balance – before you paid it off. Card issuers generally report accounts every 30 days, but they don’t tell you when that occurs.

To avoid a sagging score, consider paying the debt off early or in installments before the due date.

Another option is to add more credit to your portfolio. You could request a higher credit limit on your existing accounts, or apply for a new credit card (which can initially lower your average credit age but will quickly bounce back with the increased available credit).

More Mysteries to be Solved

As you dive deeper into credit reports and credit scores, more questions will most likely arise. The world of credit doesn’t always follow logical patterns. Just be sure to get the facts from expert sources. Otherwise, you may make decisions that result in a bad credit report and low credit scores when you deserve better.