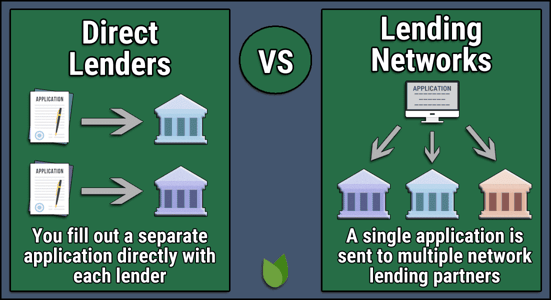

Generally speaking, the best auto loans for bad credit in Texas (or anywhere) can be found through a handful of reputable lending networks.

Of course, we know more than just three good options for auto loans in Texas exist, but with the auto lending networks we recommend below, you can submit a single prequalifying form that will connect you with several reputable dealerships near you.

This allows you to obtain auto loan financing the same day you apply, which means you can drive off the lot in your new or used car in no time. So why waste time going from car lot to car lot when you can be matched online with the best options in the Lone Star State?

Online Auto Loans in Texas

We like the following three lender networks because they offer a large selection of car buying and financing resources for consumers of all credit types. These lender networks are especially ideal if you have bad credit because they partner with specialized finance teams that won’t let your bad credit score prevent you from getting loan approval.

Every lender or dealer you work with will offer a unique car loan term, interest rate, and monthly payment — so be sure to carefully read every loan offer you receive before making your selection.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

Auto Credit Express is simple to use and has many happy customers. The service has an “Excellent” Trustpilot rating based on more than 2,700 reviews. It partners with CarsDirect, Motor Authority, Green Car Reports, and The Car Connection, among others, to bring the best deals to car buyers based on the information they provide in the prequalifying form.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.com doesn’t settle for same-day approvals. In most cases, this network can preapprove you for a car loan in three minutes or less. That means you can start shopping right away for your new car and possibly leave the lot with it that same day.

This network will connect you with dealers in your area trained in special financing and have several sources to look to when searching for your loan. In many cases, these dealers can find auto financing options with a great loan rate for a borrower who can’t qualify for a traditional bank or credit union auto loan.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

With MyAutoLoan.com, you can receive up to four loan offers from multiple lenders within minutes of submitting your single loan request. This network teams with private lenders, loan officers, and in-house car dealership financing teams to find the best possible loan option for you.

Even if you have poor credit, MyAutoLoan can help you find bad credit car loans — and can even find refinancing and lease buyout loans with a lower interest rate than that of a bank or credit union auto loan.

How Do I Get an Auto Loan in Texas?

Texas’s flexible online lending laws make it easy to find a bad credit auto loan from several sources. You can work directly with a car dealer for in-house financing or consider private financing options to purchase a new or used vehicle. You can also refinance a current auto loan or obtain a lease buyout loan.

And with so many options to choose from, you can almost always find a loan option from a financial institution, whether you have excellent credit or a poor credit history.

Online lending networks, like those listed above, specialize in bad credit car loans. These networks forward your loan request to their partner lenders and car dealers. This means that you can often connect with a dealer in your area — or multiple lenders from around the U.S. — and receive loan offers within minutes.

The loan application is quick and easy to submit, and you can see which types of loans you’re preapproved for.

If the network partners you with a local car dealership, you’ll hear from the dealership within 24 hours — but often much sooner. The dealer will walk you through your loan application and each financing option to help you find the best possible loan. They will also help you find vehicles that fit your needs and price range.

If you’re paired with a private lender (or multiple lenders), you could receive more than one offer to choose from. Each offer will have a different auto loan rate loan term, and monthly payment amount based on your credit score and other factors.

You may even qualify for an auto loan with no payments for the first 90 days — which is a great way to fit your new purchase into your budget.

Whichever loan option you choose, you’ll have to complete a formal loan application and agree to allow a loan officer to check your credit history. But even if you have poor credit, many lenders can still find a vehicle loan for you.

Once you’ve completed the credit check and chosen which car you’d like to purchase, you’ll begin the vehicle’s purchase paperwork. This typically takes one hour or less — and ends with the keys to your new ride in your hands.

In most cases, you can go from your online loan request to driving your new vehicle on the same day. This may not happen if you apply late on a business day, during a weekend, or on a holiday.

Who Has the Best Auto Loan Rates in Texas?

The best auto loan rates in Texas may not even come from a lender in Texas. Although many consumers tend to think of a bank or credit union when looking for an auto loan, they may find a lower annual percentage rate, a more affordable monthly payment, and flexible credit approval if they apply through an online lending network.

Whether you’re looking for an auto loan or a personal loan to buy a car, lending networks give the borrower power by pitting lenders against one another to compete for your business. This ensures that every interested lender will submit their best possible loan offer.

These lenders and dealerships often have substantially lower overhead costs than a traditional financial institution, which means they can afford to give you a more affordable loan — whether you’re looking to purchase a new or used vehicle or if you’re refinancing or attempting a lease buyout.

The auto lenders and dealers that partner with these networks all work with consumers who have poor credit to help them obtain bad credit loan options that work for all parties involved. And since an auto loan is a form of secured loan, you may qualify even if you have very poor credit.

These lenders are licensed to work with borrowers in specific states throughout the U.S. Fortunately for Texans, all of the networks listed above are approved to work in Texas.

Even if the network doesn’t pair you with a direct lender, the free service may still match you with a dealer in your area that can walk you through the car-buying process and help you find a loan.

What Credit Score Do I Need to Buy a Car in Texas?

Auto lenders rarely publicize their minimum credit score requirements for loan approval — simply because your credit score isn’t the only thing that factors into your approval decision.

Beyond your simple credit score, lenders look at other important factors when considering your loan application. These include:

- Your income: This shows whether you can afford your monthly payment. Your income doesn’t have to come solely from employment. Any recurring money you receive from government benefits, retirement plans, Social Security, alimony, child support, and student aid, among other sources, qualifies as income.

- Your current debts: You may bring home $10,000 every month in income, but if you have $9,000 in monthly debt payments, you won’t find a lender willing to take a risk on you. Your debt-to-income ratio is the most important factor in determining your loan eligibility.

- Your payment history: Lenders will likely shy away if you have a recent history of late payments or defaults. After all, if you can’t make your current payments on time, you’ll likely struggle to keep up with a new payment.

- Your employment history: Working at the same place for a long period can help your approval chances because it shows you have a reliable income source. On the other hand, if you jump from job to job every few months, a lender may see you as a risk who may not be able to afford your payments when you’re between jobs.

- Your residency history: You may not think this is important, but your living situation is just as important as your employment history to some lenders. If you’re constantly moving around, a lender may have a hard time locating you if you stop making payments. That’s a red flag.

These are just a few of the many things a lender considers when reviewing your loan application. While your credit score is certainly a factor, it isn’t the sole decision-maker in the auto loan process.

That’s why it’s important to research your loan options and not count yourself out if you have bad credit. Many lenders want your business and will work with you to find a loan that makes you both happy.

Is It Better To Finance a Car Through a Bank or Dealership?

A bank typically charges higher interest rates than independent lenders or dealerships. This is because large chain banks have many physical locations to maintain and higher overhead costs to pay. Most banks are also publicly traded, which means that each financial institution has shareholders to answer to if it doesn’t turn a profit.

Those costs are handed down to borrowers and account holders. This also means that banks try to avoid risk as much as possible. That’s why you’ll have a hard time qualifying for a loan with a bank or credit union if you have bad credit.

Independent lenders often have fewer employees and facilities to keep up. That lowers their operating costs and improves the lender’s rates and fees. Dealerships typically have long-standing relationships with many different lenders and can steer your application toward a lender likely to accept your loan request.

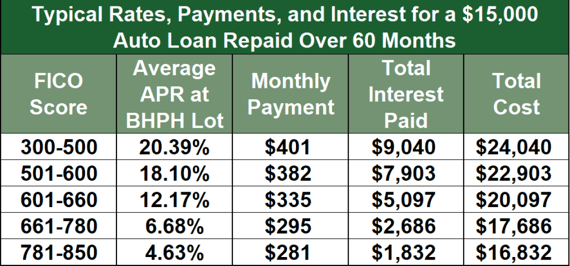

But even if your dealer doesn’t find a loan option for you, there’s always the possibility of a buy here, pay here (BHPH) dealership that offers in-house financing. With this option, your dealer acts as your lender, and you make your monthly payments directly to the dealership.

Buy here, pay here dealers often have very flexible approval standards, but can sometimes charge higher fees than do traditional lenders.

How Much of a Down Payment Do I Need For a Car?

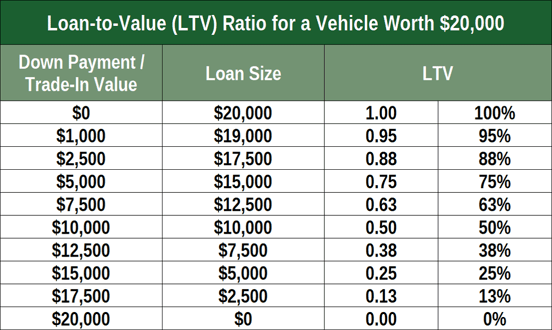

Years ago, lenders appreciated borrowers who provided at least 20% of the vehicle’s purchase price as a down payment. But as cars and trucks have become more expensive, the expected down payment has decreased.

Today, lenders like to see a borrower have at least 10% or $1,000 as a down payment — whichever is lower. This shows that you have some skin in the game and are less likely to default on your loan if times get tough.

In many cases, a lender may consider your application with a smaller down payment. Some dealerships may provide in-house financing with no down payment at all.

Just remember that your down payment lessens the amount of money you borrow and your loan-to-value (LTV) ratio, which lessens the amount of your monthly payment. A larger down payment also decreases the amount of money you’ll pay in interest over the life of your loan.

While you may qualify for a loan with a low down payment, you should always provide as much money down as you can comfortably afford to spend. Doing so may cost you more upfront, but it will save you more over the life of your loan.

You can use an auto loan calculator to play with the numbers and see how a downpayment and different loan terms affect your total loan cost. And, of course, don’t forget to factor in the cost of auto insurance when determining how much you can afford.

Comparing the Best Auto Loans in Texas

Texas is a big state with a lot of roads to explore. Whether you’re roaming through the big cities or cruising the backroads of the country, it’s always better to travel the Lone Star State in your own vehicle.

Thanks to online lending networks, including those listed above, you can find the best auto loans in Texas without leaving your couch. These lending networks are free to use and can connect you with multiple lenders or car dealerships specializing in bad credit auto loans with affordable monthly payments.

And since several lenders may compete for your business, you can take advantage of that competition to make sure you’re getting the best deal possible. If you prequalify with a network — which typically takes less than five minutes — you can often complete your loan application and have your new ride in your driveway the same day.

In-Person Options for Auto Loans in Texas

A variety of in-person options for auto loans in Texas offer the flexibility of a face-to-face conversation with a loan officer who can answer questions directly, weigh intangibles regarding your financial situation, and deliver same-day cash. Here are some in-person options for auto loans in Texas:

713 Car Loan

7070 Southwest Fwy #C

Houston, TX 77074

DriveTime of San Antonio

2890 Cinema Ridge

San Antonio, TX 78238

DFW Auto Financing LLC

10845 Ferguson Rd Ste A

Dallas, TX 75228

Central Union Auto Finance LLC

16403 Farm to Market Rd 1325

Austin, TX 78728

DriveTime of Fort Worth

3333 Alta Mere Dr

Fort Worth, TX 76116

DriveTime Used Cars

8750 Gtwy Blvd E

El Paso, TX 79907

Vsc Auto Finance

3939 W Green Oaks Blvd

Arlington, TX 76016

PFS Auto Finance

4444 Corona Dr Suite 116

Corpus Christi, TX 78411

DriveTime

1030 N Central Expy

Plano, TX 75074

Thunderbird Auto Finance

6302 Sinatra Pkwy

Laredo, TX 78041

DriveTime of Lubbock

6540 82nd St

Lubbock, TX 79424

McAllen Auto Sales, LLC

3700 N McColl Rd

McAllen, TX 78501

Fidel’s Auto Sales

1475 S, Frontage Rd

Brownsville, TX 78521

Killeen Auto Brokers

805 E Rancier Ave

Killeen, TX 76541

11th Street Motors

1355 N 11th St

Beaumont, TX 77702

Vamos Auto

1601 S Valley Mills Dr

Waco, TX 76711

Tyler Auto Finance

206 S Palace Ave

Tyler, TX 75702

Brazos Valley Imports

3405 Frontage Texas Ave S

College Station, TX 77845

Auto Sales and Finance

1745 SE 10th Ave

Amarillo, TX 79102

Twin City Motors

10549 Memorial Blvd

Port Arthur, TX 77640

David’s Auto Sales

307 W Marshall Ave

Longview, TX 75601

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.