In a Nutshell: Whether it’s paying off student loans or starting a new online business, today’s young professionals have a lot on their financial plates. To help guide their way, many have turned to XY Planning Network (XYPN), an organization of advisors who understand modern financial goals. XYPN works on a flat-fee payment system, with no pushy commission sales or sketchy investment plans. Each advisor is a Certified Financial Planner, offering virtual services that focus on comprehensive planning and your long-term financial goals. The advisors at XY Planning Network understand what the modern generations need — and want — from their financial futures, and have the experience to help them get there.

Walking into the offices of a traditional financial planning firm can be intimidating. They usually house a lot of somber colors, serious faces, and really “experienced” advisors who look like they should be hanging out with your grandparents.

While no one wants a financial advisor that looks too young — if they hardly look old enough to vote, chances are they’re a little wet behind the ears — that same notion can swing the other direction. It’s hard to imagine that someone three times your age can truly empathize with your modern financial challenges; few in your grandparents’ generation are paying back a pile of student loans.

Kali Hawlk is Director of Marketing for XY Planning Network.

Young professionals in need of a financial advisor who can truly understand them are looking to the XY Planning Network (XYPN). Founded by Alan Moore and Michael Kitces, the company brings together highly qualified experts from all over the country with a focus on financial planning for the “X” and “Y” generations.

“People in their 20s, 30s, and 40s are going through periods of massive change in their lives,” said Kali Hawlk, the Director of Marketing for XYPN. “That means a lot of decisions to be made around your finances and investments.”

According to Kali, the younger generations have different goals from those of their Boomer predecessors and more complicated financial situations. Financial advisors can offer guidance and support, as well as much-needed expertise.

Reach Financial Freedom (Or Traditional Retirement) With No-Commission Experts Who Understand Your Generation

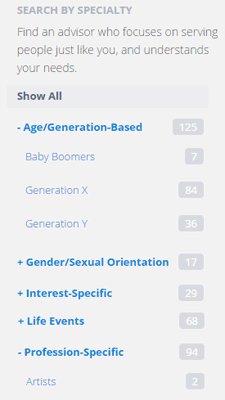

Finding the perfect advisor all starts with knowing what you want. XYPN offers a searchable listing of their available advisors, which can be filtered by specialty, including generation-based or profession-specific areas of expertise. Are you a generation Y technology entrepreneur? There’s an advisor for that.

“While people who are older are more established and may be working toward retirement, younger generations have multiple goals,” said Kali. “Young advisors just really get the needs of younger clients. They understand not only tangible goals — such as paying off student debt — but the intangible goals that many younger clients want to work toward, like financial independence.”

Search XYPN advisors by specialty, such as age or profession, or by fee structure.

Of course, that’s not to say that you can’t find a great advisor at XYPN if you’re a Boomer looking to retire. XYPN has advisors that specialize in just about any stage of life, whether that’s traditional retirement or the modern idea of financial freedom.

Regardless of specialty, though, all of the advisors at XYPN have a few things in common. To start, they are all Certified Financial Planners (CFPs), not brokers or bankers. “All of the members of XYPN focus on comprehensive financial planning, which takes the big picture into account,” Kali explained.

XYPN’s CFPs want to help you plan a future, not sell you products you don’t need, or push you into investments you don’t want. In fact, when working with an XYPN advisor, you’ll never pay commission. “It’s a flat monthly fee,” said Kali. “You pay your financial planner just like you would any other bill.”

Kali says fees vary by advisor and specialty, and can range from around $50 a month to upwards of $200. “Clients with more complicated situations, like entrepreneurs who are buying and selling a business, may require more services, and we often see an advisor’s monthly fee reflect that added complexity.”

Virtual Financial Planning & Advice for the Modern World

Because it offers a variety of specialties and price points, it’s likely that you’ll find an advising match with one of XYPN’s more than 300 members. But what happens when your perfect XYPN pick is on the other side of the country? You take advantage of virtual advising.

“Everyone has their own philosophies and processes to help their clients achieve their financial goals,” said Kali. “[That’s why] all of our members offer virtual services, so you can work with your ideal advisor. You’re not bound by location because these planners can work with anyone, anywhere, at any time.”

The XYPN blog is a great place for a little free advice on the financial topics that impact you.

Additionally, XYPN offers a consumer financial planning blog that gets updated each week with helpful articles and guides. Covering topics such as funding education expenses and forming a budget, the blog is a great place to go for a little free advice.

Originally Developed to Support & Encourage Successful Financial Advisors

If you’re looking for a career that allows you to help other young people improve their financial health (or already have your own advising firm) XYPN wants to help you become a (more) successful financial planner. In fact, according to the site, that’s the very reason XYPN exists. “XYPN was developed to create a network that supports and encourages financial advisors who want to forge a new path in the industry.”

XYPN offers comprehensive resources for financial planners looking to reach more clients, and better serve all of their current clients. There is also help for new planners, including assistance in launching your firm and ongoing support to keep it running well. “The network aims to provide turnkey solutions for planners before they launch a business, for firms in their first year, and for businesses that have existed for multiple years.”

In addition to support, XYPN will help you stay updated on the latest news and professional advice. The industry blog contains articles and guides for both new and established planners, and the company offers regular advising webinars. The XYPN podcast, hosted by company Co-Founders Alan and Michael, gives listeners access to their personal experiences in finances.

Connect with your advising peers through network study groups or XYPN events, such as the annual conference. Just want to know a little bit more about working with XYPN? Join one of the monthly open calls with current network members who are happy to answer any of your questions.

XY Planning Network — Innovating Financial Futures

With a little bit of innovation, XYPN has taken the intimidation out of finding a great financial advisor, removing the drab walls and stern scowls in favor of helpful virtual advisors who understand your modern financial problems. XYPN is working to change financial advising for the better with their combination of transparency and technology.

The company isn’t stopping there, either. Virtual services are only the tip of the technology iceberg when it comes to possible innovations in personal finances, and XYPN is determined to unearth a lot more.

“We can’t find good technology solutions for some of the problems we are facing,” explained Michael. “If we can’t find the technological solutions because they’re not out there yet, the next best thing is to create an environment to build the solutions.”

To accomplish their goal, XYPN has put out the call to fintech startups in the form of its first technology competition. So far, they have six finalists with software designed to solve problems faced by advisors, and their clients, every day.

While official winners won’t be determined until XYPN’s next annual conference, more innovation in planning technology can only be a win for everyone looking for a solid financial future.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.