In a Nutshell: WECU is a credit union founded by a group of schoolteachers. Since its start, the financial institution has evolved to offer innovative products and services but hasn’t strayed from its educational roots. It provides programs and guidance to help members learn about managing their finances. WECU has earned our Editor’s Choice™ Award for its commitment to bettering the communities it serves.

Credit unions serve the needs of their members, offering products and services that can help members reach their financial goals. Many credit unions also provide financial education to their members and communities. WECU is a credit union with a history that uniquely positions it to offer educational services.

In 1936, a teacher from Bellingham, Washington, traveled across the country to attend an education conference in Boston. The U.S. was in the midst of the Great Depression, and a presenter at the conference spoke of the virtues of credit unions. The presentation inspired the teacher, and she returned home motivated to start a credit union.

The teacher held a meeting with 11 of her colleagues in a Bellingham classroom in June of 1936. They passed around a shoebox, and each attendee put money into it. The teachers recorded the amounts they’d deposited and placed the shoebox in a closet in the classroom.

Together, the teachers formed a credit union now known as WECU, which stands for Whatcom Educational Credit Union. Whatcom is the name of the county in which Bellingham sits. We spoke with Keith Mader, WECU’s Director of Public Relations, to learn how the credit union has evolved while remaining true to the principles of its founders.

WECU operates 10 branches and one loan center. Mader said the credit union has 170,000 members, $2.8 billion in assets, and more than 400 employees.

WECU operated exclusively in Whatcom County for the first 87 years of its existence. In 2023, the credit union expanded to open a branch in a neighboring county.

“Our expansion is actually a pretty big story for us,” Mader said. “Because the idea behind credit unions is to serve our members. And credit unions can struggle to decide whether growth serves its members’ interests. That’s what differentiates us from banks. From our chairman of the board to our CEO to our tellers, we’re always making sure our actions are in the best interests of our members.”

Helping Members Build Credit Responsibly

Mader said Whatcom County is in a unique location — Canada is directly north of the county, and the ocean and mountains are to its west and east, respectively. WECU’s expansion opportunities lie south of Whatcom County, where the credit union opened two new financial centers in Skagit County in 2023.

Mader said WECU grows to keep pace with the expectations of its members, and the credit union has focused on improving its suite of products and services since 2018.

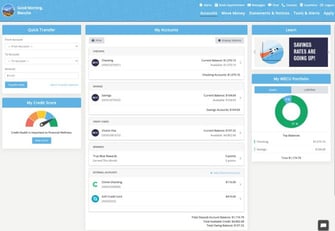

“Ever since 2018, we’ve been constantly improving our offerings with improved online and mobile banking products,” Mader said. “We’ve also rolled out new online account opening and chatbot capabilities. We’ve entered into partnerships with fintechs and other organizations that have allowed us to enhance our products and meet member expectations, which is awesome.”

Mader said WECU’s products can help members improve their financial standing. The credit union’s secured credit card has no annual fee and allows members to earn rewards, including cash back, gift cards, and merchandise.

WECU offers credit cards to members who are 16 or 17 years old. The credit union provides a program for teenagers that teaches them to use credit responsibly and avoid accumulating bad debt. Mader said proper credit card use can help young people establish sound credit habits.

“If you have this credit card, then, by the time you’re 21, you’re not necessarily going to need a cosigner for your apartment or your first car,” Mader said. “We’re actually trying to expand our program because parents are telling us how much they love it and how their kids are asking them all these questions about money that they’ve never asked before.”

A Multifaceted Approach to Community Education

WECU offers a savings account to members ages 19 and under. Mader said WECU provides competitive savings account rates to help members grow their money and learn about the impact of compound interest.

WECU launched an emergency savings account in 2023 that offers no monthly fees and access to rewards. In addition, WECU offers members a high-yield savings account and savings certificates. Mader said the credit union encourages members to save for a rainy day.

“Cars need repairs eventually, and appliances break,” Mader said. “Having an emergency savings account means you’re ready to face unexpected expenses. And members with long-term savings goals, like funding their retirement, can open a high-yield savings account. We designed our savings programs to work in progressive steps. It’s really cool to get people thinking about saving and give them the logic behind how saving should work.”

Mader said WECU’s background as an institution founded by educators makes financial education of particular importance to the credit union. Mader said WECU provides its members access to a third-party program that offers practical guidance on managing money, debt, and building credit.

Mader said WECU’s internal training team ensures that each of the credit union’s employees understands the principles of financial wellness.

“When a member is completing a transaction with one of our tellers, the teller’s training leads them to look for opportunities to educate the member and help them improve their financial standing,” Mader said. “They’re not looking to sell products, but they’ll suggest actions that can help our members. Our training team helps make that a part of our culture.”

Mader said WECU employees conduct financial education seminars to teach the community lessons about budgeting, building credit, and managing debt.

WECU Gives Time and Money to Support Local Causes

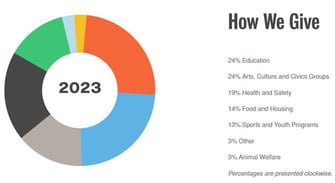

WECU financially supports numerous community causes. Mader said the credit union donated approximately $490,000 to nonprofit organizations in 2023.

WECU also provides scholarships to members who are full-time students attending a local college or university. Mader said the credit union awarded $98,000 in scholarship funds in 2023.

WECU’s community grants assist nonprofits in Whatcom and Skagit Counties.

“We provide grants to nonprofits that focus on advancing education in its various forms,” Mader said. “That could include music programs and even daycares. The idea behind that is that education is central to our brand, history, and values, and we want to promote educational opportunities in our communities.”

WECU allows employees to take a paid day away from work to volunteer with local nonprofits. Mader said the credit union’s employees volunteered at 18 nonprofit organizations in 2023.

WECU also makes financial contributions to increase the vibrancy of its community. Mader said WECU sponsors community gatherings such as movies in a local park, food truck rallies, concerts, and local sporting events. Mader said WECU’s support of community initiatives is central to the credit union’s mission.

“Being community-focused is part of what we want to be as an organization,” Mader said. “But it also has a lot to do with giving back to the regions we serve. We’ve had different program leaders and event coordinators tell us they couldn’t do what they do without our support. And that’s exactly what we’re looking for and who we want to be. We enjoy a stellar reputation in the counties we’re in. Our members know us, and they trust us.”