Tax season may be over, but many people are still waiting for refunds. And, thanks to the new Tax Cuts and Job Acts passed in December 2017, filing was more confusing than ever for many people. Although consumers generally were supposed to see bigger paychecks throughout 2018, the average tax return has decreased. In fact, the IRS reported that refunds dropped more than 8% during the first week of tax filing season for 2018.

Regardless of how much you’re expecting to get back, it’s important to think carefully about how to use this money. While you may be tempted to go on a shopping spree at your favorite retailer, there are far better ways to use your tax refund than to blow it on a new television or wardrobe. Here are nine strategies that can put your tax refund dollars to good use while helping to improve your financial health.

1. Demolish Your Debt

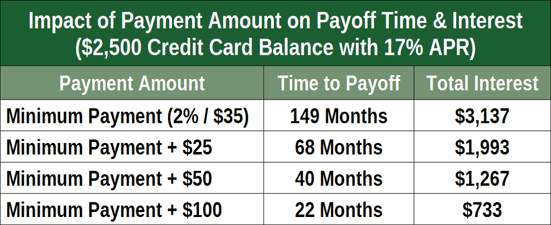

Paying down existing debt, whether student loans or credit card balances, may not seem like much fun now, but doing so can lead to a life with fewer financial restrictions in the future.

Not only can paying down your debt improve your credit score, but you’ll have more money each month once minimum payments are behind you instead of throwing away money on interest rates each month.

If your tax refund is not enough to wipe away all your debt, at least try to double or triple the minimum required payment to help get your balance down faster. Paying more than the minimum payment each month allows you to pay down your principal faster, reducing the amount of interest you have to pay overall.

2. Prepare for Emergencies

Travel snafus, car accidents, and medical illnesses are inherently unpredictable, and having the peace of mind that you can pay for unexpected expenses during stressful situations can be priceless.

However, 4 in 10 Americans don’t have enough money to cover a $400 emergency, according to a report from the Federal Reserve Board. Unfortunately, those who don’t have adequate savings will often rely on high-interest credit cards or borrow money from family and friends to pay for such unexpected life moments.

Give you — and your family — the security of knowing you aren’t without the means to handle the unexpected by building an emergency fund with your tax refund. A good goal is to have between three and six months of living expenses set aside in a separate account that you only use for emergencies, but even having $1,000 in case of car trouble or an emergency dentist visit can be extremely useful.

3. Open a Roth IRA

Contributing your income tax refund to any retirement fund is likely a smart move, but a Roth IRA can be a good supplement to your retirement savings. In addition to being more flexible than other plans relative to investments, Roth IRAs grant tax breaks when money is withdrawn during retirement and won’t penalize you for withdrawing early either.

However, there are contribution and income limits. Anyone under 50 can contribute up to $5,500, while individuals 50 or over can contribute $6,500 for the 2018 tax filing year. This is a great way to also lower your taxable income and reduce your bill.

Keep in mind, the IRS imposes income limits to contribute to a Roth IRA. For instance, single individuals must have a modified adjusted gross income under $135,000 and the limit for those who are married filing jointly is $199,000.

4. Plan for Your Kid’s Education

If you hope to pay for some or all of your child’s higher education when it’s time for him or her to go to college, you better get started. According to SavingForCollege.com, the cost of a college education roughly triples over any 17-year period from birth to college enrollment.

But, you can get a start by using your tax refund to open a 529 college savings account or a custodial account. Both types of accounts can help you plan for your child’s financial future, but a custodial account can be used for more than just education—it can be used for any expense that benefits your child. If you’re not sure how much you need to save, you can use a college cost calculator to begin planning.

Just keep in mind that you shouldn’t prioritize your child’s education over your own retirement. Make sure you’re making big strides in your retirement accounts before funneling money to an education account for your child.

5. Invest in Yourself

Think beyond the stock market when it comes to investing. The best asset you have is your earning potential. Put your tax refund toward improving your professional skills or learn something completely new. This can set you up for a promotion and raise or lead to better-paying job prospects.

You can look for classes at your local community college or take an online course to gain new skills. Then, supplement coursework by reading or listening to podcasts on topics relevant to your industry.

Online education sites, like Coursera, can offer a convenient way to gain important career skills.

Networking is also key to learning about new opportunities for jobs or growing your clientele. Consider putting your refund toward a useful industry conference or networking event where you can interact with people who may help you in your field.

6. Tackle a Home Improvement Project

Now is the time to tackle those home improvement projects you’ve been putting off. Remodeling your kitchen or bathroom, updating appliances or redoing your floors can be wise investments if they will ultimately lead to an increase in your home’s value, especially if you’re thinking about selling your home.

Stretch your tax refund dollars further by purchasing gently-used building materials such as cabinets, fixtures, tools, hardware, and home decor for your improvement project through your local listings. You can also save by bidding through online auction sites that get items from builders and other businesses that have overstock items or that are going out of business.

7. Improve Your Health

Researchers found that moderate to vigorous exercise done for 150 minutes a week is associated with significantly lower healthcare spending. However, a whopping 77% of people aren’t engaging in the amount of physical activity recommended by healthcare professionals and are missing out on the financial benefits of getting in shape.

Spring is a great time to revamp your diet and exercise regimen. Plus, you can use your tax refund toward a health club membership or one-on-one personal training sessions. Even a small refund could be enough for a basic gym membership to help you get motivated.

Using your tax refund to improve your health can have significant long-term benefits.

Scheduling nutritional coaching or signing up for a healthy food delivery service are other great ways to kick-start your journey toward a healthier lifestyle. Keep in mind, some health insurance companies will give you a credit for going to a gym. Just call your provider to see if you qualify.

8. Get a New Bed

Right up there with exercising, clocking in seven to eight hours of shut-eye per night is crucial for your physical and mental health. Unfortunately, many people overlook the importance of improving their sleep. In fact, 42% of American adults say they get less than seven hours, as reported by the 2014 Gallup-Healthways Well-Being Index.

Poor sleep not only has an impact on your mood, but it also affects your memory, focus, and productivity which can lead to less than stellar job performance. So, if you have a cheap mattress and toss and turn all night, consider purchasing a quality bed with your refund.

Although a good-quality mattress can be a little expensive, they tend to last a lot longer — and keep their quality a lot longer — than cheaper mattresses. Most mattresses should be replaced after seven to 10 years.

9. Make an Extra Mortgage Payment

If you’re already on top of our other suggestions — good job! But that doesn’t mean you should let that tax refund go toward a shopping spree after all. Instead, consider making an extra payment on your mortgage or another long-term debt. Making an extra payment toward your principal even just once a year can help you save thousands of dollars on the back of your mortgage.

Or, if you’ve recently been thinking about refinancing your mortgage to benefit from a lower interest rate, consider using your refund to pay the closing costs and other fees (assuming that you’ll save from refinancing after the fees; be sure to do the math before refinancing any debt).

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.