Lenders offer a variety of account types that can end up on your credit reports if your application is successful. When you apply for financing, those newly opened accounts will fall mainly into one of two categories: secured or unsecured.

Although the terms of each account type may sound somewhat similar, there’s a considerable difference between the two. One category represents a larger risk to the lender. The other represents more risk for you, the borrower.

Secured Credit Requires Collateral to “Secure” Financing

Lenders rely on your credit reports and scores to help predict their risk when loaning you money. An effective method for lenders to mitigate their risk is by asking you to put skin in the game. This is known as secured credit.

Secured credit is a type of account that’s backed by something of value, commonly called an asset or collateral. Lenders may accept collateral in the form of real estate property, vehicles, cash, investments (IRA, bonds, stocks, etc.), or something else.

If you secure financing with an asset and can’t repay the debt as agreed, the lender has the right to take whatever you pledged to back the loan. If you’ve ever heard of a foreclosure or repossession, those are examples of lenders taking back an asset that the borrower pledged.

Some common examples of secured credit include:

- Secured Credit Cards

- Home Equity Loans & Lines of Credit

- Mortgages

- Auto Loans

- Motorcycle & Boat Loans

- Loans for Large Equipment

Because secured credit cards and loans pose less risk for lenders, they may be willing to do business with you even if your credit isn’t in the best shape.

A secured credit card, for example, can be a great way to rebuild credit after a financial setback or to establish credit for the very first time. Putting up collateral may also help you to secure a lower interest rate on certain types of financial products, like home equity loans or lines of credit.

In most cases, the loans are secured by the asset that is being financed. This is the case with mortgages, auto loans, and the other above-listed loans. Just keep in mind, secured credit equals more risk for you as the borrower. Regardless of what you pledge to secure a credit card or loan, you’re agreeing to let the lender take possession of that asset in the event you don’t repay as agreed.

Unsecured Credit is Issued on Your Promise to Repay

If your credit rating is in decent (or better) shape, you will likely be able to qualify for unsecured credit. Unsecured credit is sometimes referred to as a signature loan or credit card.

It’s called this because it’s a type of financing that’s typically issued based on the strength of your credit profile and your promise to repay. The lender’s security is limited to expectations based on your credit history.

A few common examples of unsecured credit include:

- Unsecured Credit Cards

- Student Loans

- Personal Loans

Because the loan or credit card is not backed by an asset, there’s more risk involved for the lender. The lender can’t seize an asset — such as your house or car — to offset its losses if you don’t pay.

However, even though an unsecured debt isn’t tied to an asset, that doesn’t mean you’re going to be off the hook if you can’t afford to pay it back. A lender may not be able to seize a cash deposit if you default on an unsecured credit card, but it could opt to sue you in court to collect what you owe. If a judge allows it, your wages could even potentially be garnished.

The added risk with unsecured credit explains why the interest rates are typically higher than with secured credit. And, from a credit scoring perspective, the actual debt associated with unsecured credit is more problematic than debt associated with secured credit.

How Secured and Unsecured Debt Affect Your Credit Score

The fact that you have a secured credit card or an unsecured personal loan isn’t material to your credit scores. You’re never going to have a lower credit score and get an explanation that “you chose to use unsecured credit over secured credit.”

Credit scores, like FICO and VantageScore, don’t penalize you one way or the other because you’ve chosen secured or unsecured accounts.

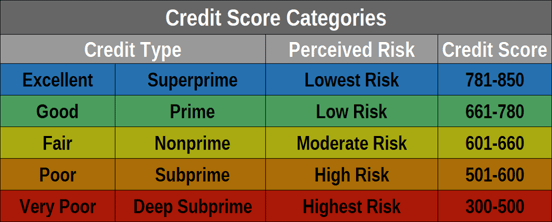

The graph shows the credit score ranges for the two main scoring models used by credit bureaus.

Having said that, the actual debt associated with the two account types is treated very differently in the two commonly used credit scoring systems — again, because one type of debt is more predictive of elevated credit risk than the other.

Secured debt, and all installment debts for that matter, are less predictive of credit risk. As such, when you take on secured debt, there’s less impact to your credit score. That means there’s less of a credit score benefit when you finally pay it off, as well.

I’ll give you a personal example. I used to have a rental home with a $250,000 mortgage balance. When I sold the home, the proceeds paid off the loan and it was subsequently updated to show a zero balance on my credit reports. My scores went up four points.

Revolving debt — unsecured credit card debt specifically — is much more predictive of credit risk. That’s why your scores are much more susceptible to score impact as your credit card balances increase and decrease.

Therefore, charging up large balances or even small balances across multiple cards will often lead to lower credit scores. This is also why paying down a credit card balance often leads to higher credit scores.

Which Account Type is Right for You?

Depending on why you need to borrow money, you may not have much choice when it comes to secured versus unsecured credit. If you want to purchase a home or a vehicle, for example, the asset you’re financing will be tied to the loan no matter what.

However, you may have the opportunity to choose with other types of financing. You should weigh several factors when considering secured or unsecured financing options, including:

- What is the condition of your credit? If you have little credit history or past credit problems, putting up a deposit or other assets could make it easier to qualify for a loan or credit card.

- How much do you want to pay for financing? If you’re willing to put up some collateral for a personal loan or take out a home equity loan or line of credit, you may be able to land a more affordable interest rate. And, you may even have a tax benefit because some secured loans allow you to deduct the interest.

But most importantly, consider the risk. With a secured credit card, you risk losing your cash deposit if you default. A secured loan is another story.

Although a secured loan could save you money or make it easier to qualify for financing, remember that you’re putting something valuable on the line in exchange for that benefit. Defaulting on secured loans normally means your car gets repossessed or your home gets foreclosed.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.