When you’re short of cash, time counts. What you need is a no-headache way to borrow the money as soon as this afternoon. Relief can come from several sources, including online payday loans available the same day.

Online payday loans are available without a credit check or impact on your credit score. Although they charge painful interest rates, their short durations limit the financial damage when used occasionally. The most important consideration is to choose a reputable lender, including the ones in this review.

Same-Day Online Payday Loans For $255 or More

The following are lender-finding services, not direct lenders. They may prequalify your loan request and find multiple loan offers in minutes. After wrapping up the loan agreement, you can expect your money to arrive in your bank account quickly, sometimes as soon as the same day. Some lenders offer expedited deposits for an additional fee.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual is our highest-rating lending network, offering multiple loan options without minimum credit score requirements. You can request a loan in minutes and receive a credit decision — and possibly a payday loan offer — soon after.

This network has lenders willing to work with just about any borrower — even if you have credit difficulties. You must earn at least $800 monthly to qualify for a MoneyMutual loan.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com can find you a payday loan without credit checks, relying instead on your income to determine loan approval. Lenders must ensure you can repay the loan on time and will use your bank account for automatic repayment.

While these online loans may be easy to get, SmartAdvances can’t guarantee final loan approval. It also may solicit offers tailored to your financial needs, such as credit repair or debt relief services.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com helps workers with poor credit find payday loans online of $250 and up. It has facilitated online loans for more than 750,000 customers since 1998.

CreditLoan concentrates on helping people with bad credit. You can use loan proceeds for any purpose without harming your credit history or score.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Submitting InstallmentLoans.com’s quick payday loan application lets you know whether a direct lender will work with you. Submitting the form to see if you prequalify won’t impact your credit history or score.

You must supply specific information about yourself and your income, employer, and paycheck frequency to get a loan. If approved, you can review the loan term, accept the loan, and quickly collect your funds.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% – 2,290% | Varies | See representative example |

CashAdvance.com helps people find fast cash loans of $100 to $1,000. Quick approvals do not require credit checks and won’t impact your credit score.

To qualify, you must have a monthly income of at least $1,000 and 90+ days on the job. CashAdvance.com provides customer support via email or phone to help borrowers through every step of the lending process.

What Is an Online Payday Loan?

A payday loan is a small personal loan that requires repayment on your next pay date. These short-term loans can help you when you need extra cash for the next one to four weeks.

Because of their high interest rates, you should consider payday loans as emergency cash sources, not as regular additions to your wages.

While a payday loan is not secured by property as is the case with an auto title loan, your next paycheck backs the loan. Typically, online payday lenders collect electronic repayment directly from borrowers’ bank accounts.

You can arrange payday loans online through a matching service that works with a network of direct lenders. You can fill out a short loan request form on any of the reviewed websites, which they use to prequalify your loan. If you successfully prequalify, the service forwards you to a direct lender, where you can complete the payday loan application process.

The reviewed loan-matching services do not charge fees, and you don’t have to accept a loan offer. If a direct lender approves your loan and you e-sign the loan agreement, the proceeds will appear in your bank account as soon as today, but more likely on the next business day.

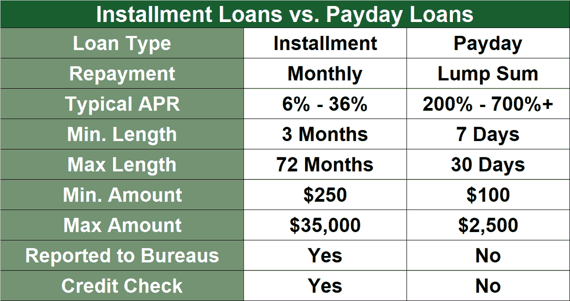

You must repay your loan lump sum on your next pay date. The interest rates on payday loans range from 300% to 700% or more. The cost is high, but the loan period is short unless you can’t repay on time.

There are many reasons to use a payday loan for emergency cash. It is often the only source of funds for workers with poor, limited, or no credit. The only requirement is a documented source of income.

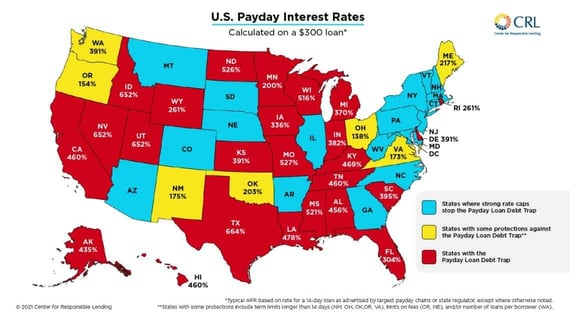

Because of the dangerously high APRs for payday loans, some states have enacted laws that control the availability and cost of fast cash loans. States may prohibit or limit payday loans, including capping payday loan rates.

What Credit Score Do I Need to Get a Payday Loan?

You don’t need a credit score to get a payday loan, just a credible income from wages, government benefits, annuities, alimony, or other reliable sources. Because payday lenders don’t check credit or report payments, you can’t use these loans to establish or rebuild credit.

But if you fail to repay your loan for a month or longer, the lender may notify the major credit bureaus, which will hurt your scores.

The payday lender may turn over an unpaid account to a collection agency or file a lawsuit if the delinquent loan amount snowballs into a large sum. Either action will significantly damage your credit score and may send you to bankruptcy court for protection.

How Much Will I Pay For a $255 Payday Loan?

The cost of a $255 payday loan depends on its APR (typically 200% to 700%) and duration (one to four weeks). For example, you will pay a loan financing fee of $29.35 for a 14-day payday loan with a 300% APR. The cost balloons to $68.47 for a 700% APR.

Costs can exponentially rise if you fail to repay your loan on time. In this case, the payday lender will roll over your loan by adding the previous financial fee to the loan principal, tacking on a new, larger fee, and resetting the repayment date to your next pay date. Repeated failure to repay can cause your debt to reach thousands of dollars.

What Other $255 Loans Can I Get On the Same Day?

The following loans can provide $255 or more on the same day:

- Pawnshop Loan: You must provide the pawnbroker with collateral — cameras, jewelry, collectibles, etc. — to receive a loan. Loan-to-value ratios are about 50%, meaning you must hock an item worth $510 to borrow $255. Interest rates are high: 20% to 25% monthly. You’ll forfeit your property if you don’t redeem or renew your pawn ticket by the due date.

- Auto Title Loan: You can get immediate cash in exchange for the title on your fully paid-up vehicle through this type of loan. The average APRs are around 300% (i.e., 25% per month).

- Credit Card Cash Advance: If your credit card permits, you can take a cash advance at a bank branch or ATM. The maximum interest rate is 36% plus a 3% to 5% transaction fee. Interest accrues daily until fully repaid.

- Cash Advance App: These apps tie into your bank account and work timesheet to provide immediate cash advances of up to $500. The app automatically takes repayment from your bank account on your next payday. Loans are usually interest-free but may include other services.

- Loan From Family and Friends: You may be able to borrow $255 from a friend or family member without fuss or interest. But beware of damaging your relationship should you fail to repay the cash loan as agreed.

Consider taking a personal loan if you need to borrow large sums. This is an installment loan, usually with an APR under 36%, that you repay over a three-month to six-year period.

Are Online Payday Loans Legit?

The payday loan industry has its share of rotten apples, but the reviewed lending networks have withstood the test of time. We consider them reliable.

Before taking a payday loan, ensure the lender has a license to operate in your state or county. You can check with your state’s Secretary of State or Attorney General for enforcement actions against the lender.

In addition, see the Consumer Financial Protection Board for information about payday loan protections.

Get a $255 Payday Loan Today

A fast loan can help bridge a cash shortfall until your next payday. You may qualify for a $255 online payday loan available on the same day you receive approval. Be sure to pay on time, lest you fall into a debt spiral that may be impossible to repay.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.