In a nutshell — Wallaby is an easy-to-use app that analyzes your credit cards’ rewards and recommends the best card for any purchase. Its intuitive design takes the headache out of maximizing rewards and helps you earn back more of your hard-earned money.

If you’re one of our many visitors suffering from bad credit, it’s a safe bet you have more than one credit card in your wallet.

Maybe you’ve picked up a few at retail stores trying to get discounts at the register, or maybe you’re using credit cards to fund everyday purchases while you work to get your finances in order.

The founders of Wallaby: CTO Todd Zino (left) & CEO Matthew Goldman.

However, many people simply use credit cards for their perks — cash back, airline miles and rewards, just to name a few. But if every card has unique terms and specific deals, how are you supposed to keep track of it all? How do you optimize those rewards without driving yourself crazy?

That’s exactly the problem CEO Mattew Goldman and CTO Todd Zino hope to solve with Wallaby, an innovative app that uses complex algorithms to recommend the best credit card for any purchase.

The Inspiration Behind Wallaby

“My moment of inspiration was in early 2011,” Goldman said. “I was just buying gas and I swiped my card, something rather mundane. Then the TV screen on the gas pump comes on and says ‘Hey, if you have Chase Freedom, you could be earning 5 percent.’ I was like ‘Shoot, I do have a Chase Freedom. Why can’t I keep track of this?'”

Drawing on his experience as YP.com’s executive director of product management and Zino’s background in data management, the duo launched Wallaby soon after Goldman’s gas pump inspiration.

As for the name “Wallaby,” Goldman cites two reasons: 1) “It sounds like wallet and it’s kind of playful. We’re not a bank and we don’t want to be a bank,” and 2) “I think Australian animals are cool.”

Simplifying Credit Card Rewards

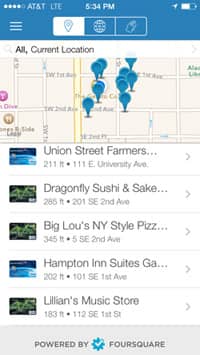

Wallaby’s “Best Card” feature will detect nearby businesses and tell you which card would get the most rewards.

Whenever a golfer hits the links, they rely on a caddy for advice on which club to use in any particular situation. Wallaby works much the same way, as a sort of caddy for your credit cards.

Whenever you visit a restaurant, store, gas station or other place of business, Wallaby will tell you which credit cards will receive the greatest rewards.

For example, if you’re at a gas station, you may want to use a card with gas rewards. If you’re at the grocery store, you’ll want to use the card that gets you 5 percent back as opposed to 2 percent.

But instead of trying to keep up with those details yourself, Wallaby will take care of it for you.

“What’s the incremental benefit, on a percentage basis, we can provide each person?” Goldman asked. “We found we can improve the amount of rewards the average user receives by about 50 percent just by helping them use the right card at the right time.”

“We found we can improve the amount of rewards the average user receives by about 50 percent just by helping them use the right card at the right time.”

Wallaby also offers WalletBoost, an in-app feature that analyzes your spending habits and existing cards in order to recommend new cards for your wallet. According to Goldman, users received around $600 a year worth of rewards through Walletboost’s recommendations.

The Wallaby Database

Wallaby’s database of credit cards is one of the largest in the country, containing constantly updated information on new and recurring deals for more than 2,000 cards from more than 450 financial institutions.

Chances are every card you own will be compatible with Wallaby’s optimization features.

But in the rare case your card type isn’t already in their database, you’ll get direct support from Wallaby’s customer service staff — you may even see your previously unlisted card appear in the next two business days.

However, keep in mind Wallaby works exclusively for credit cards. They do not accept debit, prepaid or international cards yet.

On Aug. 20, Wallaby announced the release CardBase and The Card Guide, bringing consumers “the single most comprehensive set of credit card data and resources ever made available to consumers free of charge.”

Users can review Wallaby’s extensive database of cards and rewards to see how their own match up.

The Wallaby Card will not only streamline your rewards, but also add a new level of security to all your transactions.

The Future of Wallaby

One of Wallaby’s most innovative upcoming developments is the Wallaby Card, a sleek smartcard linked to all of your existing credit cards. Every purchase made with the Wallaby Card will go through the same algorithms to determine which card is best for the purchase.

The Wallaby Card will serve as a kind of Swiss-army credit card, acting as a relay to every account you own without having to pack your wallet full of plastic.

It’ll also beef up your financial security.

“It becomes like a proxy for the other cards in your wallet,” Goldman said. “We scan every transaction that comes to us for fraud prior to sending that transaction to your underlying credit card company. Then they apply their own anti-fraud algorithms.”

And even if you lose your card, don’t fret — the card itself won’t contain information about your other credit cards. A member of Wallaby’s staff also will be able to deactivate the card remotely.

Beyond that, Goldman said Wallaby’s long-term goals are “ultimately mobile payments. We believe smart decision-making is going to be critical to mobile wallet adoption. We intend to participate in whatever that emerging standard is.”

For now, you can find Wallaby free on iOS and Android devices, as well as Google Glass/Chrome and other wearable smart devices.

Photo credits: Wallaby Financial Inc.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.