In a Nutshell: White Jacobs & Associates is a modern credit repair firm that helps clients on many fronts. Rather than simply sending out dispute letters — which individuals can do themselves — the agency developed an attorney-backed process of auditing negative items on client credit reports. Each White Jacobs & Associates client also partners with a credit repair advisor who can teach them more effective ways to reach their financial goals.

Individuals with bad credit may feel like their financial futures are ruined. But they have access to processes that can improve their credit — they may just not know about them. Credit repair firm White Jacobs & Associates understands those methods and uses them to help clients improve poor credit scores.

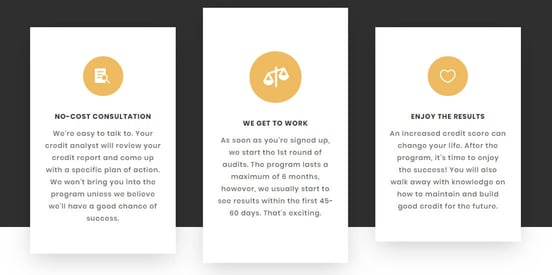

First, clients visit with a credit analyst who examines negative marks on their credit reports. Sometimes, advisors find inaccurate items they can quickly dispute.

Next, the team starts its own audit, which typically takes around six months, though many clients begin to see their credit improve within the first 45 to 60 days. Individuals who come to White Jacobs & Associates with credit scores around 500 see an average of 70% of the negative information removed from their credit reports.

“Everything is variable, but within three to six months, most people can get pre-approved for a mortgage — that is around a 620 score,” said Andrew Bell, Education Director and Senior Consumer Credit Analyst at White Jacobs & Associates.

The credit repair firm goes well beyond credit dispute letters. Though traditional credit repair agencies primarily focus on sending those letters, that process doesn’t always produce results.

And traditional credit repair agencies can charge between $50 and $150 a month to dispute those marks with credit bureaus.

White Jacobs & Associates offers a refreshing alternative. It focuses on an attorney-backed process, and disputing negative marks with credit bureaus is only one aspect. Its lawyers also use federal and state laws to audit creditors that report negative items on clients’ credit reports.

Not everyone is an ideal candidate for White Jacobs & Associates’ services, and the firm only takes on clients who can benefit from its in-depth process.

Offering a More Comfortable Credit Repair Experience

White Jacobs & Associates was founded in 2013 in response to the pitfalls its owners saw in the traditional credit repair process.

“The owners didn’t like what they saw in the landscape of credit repair. There are a bunch of companies in the space, but the majority of people don’t have good experiences,” said Andrew.

The first step was making the process affordable for the average consumer. Next, the firm wanted to ensure that clients understand their credit scores and manage them better.

White Jacobs & Associates also decided it would only take clients it can help, rather than working with those who wouldn’t have successful outcomes.

“It’s amazing to see leadership from the owners. They’re here every day, working side by side with all of our analysts. They want to go above and beyond to get results for clients,” Andrew said. “We want to exhaust our options even when it’s more expensive on our end.”

One client, Jason W., explained in a testimonial how the White Jacobs & Associates process helped him improve his credit.

“For the past three years I have been subject to crazy high interest rates on automobiles, denied home loans, and even (been) unable to move into a decent apartment all because of a broken lease that should not have existed. With the aid of White Jacobs and Steve, after a few months I have been absolved of my blemishes,” Jason wrote.

Focusing on its Clients’ Financial Goals

The attorneys at White Jacobs & Associates say they prioritize building personal relationships. Clients meet with a personal credit repair advisor who designs a unique program for their situation.

“We want to have that personal approach with people. It’s intimidating to talk about financial matters with a stranger, so it’s important that we level with people and have genuine conversations,” said Andrew.

If the agency thinks it can’t help someone, an advisor will let them know rather than going through the process and failing to improve their credit.

“We set realistic expectations. We don’t want to mislead someone and say their credit is going to be perfect in 60 days,” said Andrew.

Approximately 90% of the clients who turn to White Jacobs & Associates want to purchase a home but don’t have the credit score necessary to qualify for a mortgage. Most clients are not particularly interested in improving their credit in the abstract. They want to qualify for a car, home, or boat loan but their credit score is a barrier.

White Jacobs & Associates has partnered with more than 9,000 loan officers and real estate partners to help clients meet that pre-approval threshold.

“We focus on making a symbiotic meld between mortgage professionals and our process. Our clients want a home loan and, most of the time, their first home loan,” said Andrew.

Sometimes, credit repair advisors may need to explain the impact of poor credit to clients in real terms. For instance, Andrew said he notices that many people with bad credit essentially pay double for their vehicles.

“Paying that extra interest — how would it feel to put that money back into your pocket? Maintaining credit above 600 is crucial, but good credit affects everything in your life,” Andrew said.

White Jacobs & Associates: Improving Credit Education

One of the key aspects of the White Jacobs & Associates client experience is understanding how to manage credit. The firm educates clients on improving their credit scores enough to meet loan thresholds and positively impact their lives.

For instance, if clients want to understand a home loan, their advisor may explain how closing costs and down payments work. Advisors may also help clients develop budgets to manage their finances and save money.

One client named Amy M. had 13 accounts in collections, one charge-off, and a few profile inaccuracies. Her goal was to purchase a new home and a car with a better interest rate. After working with White Jacobs & Associates, Amy made enough positive changes to boost her TransUnion credit score from 544 to 708.

“Credit education is a lot of what we do. We put ourselves in the client’s situation. We use a lot of analogies and allow them to become excited about something they didn’t understand. We start with the reason why you should pay attention to the boring stuff,” Andrew said.

In addition, White Jacobs & Associates also provides a library of videos on Facebook and YouTube for individuals seeking to improve their credit.

White Jacobs & Associates has proven it can positively impact client credit in a way that traditional repair companies can’t. That is why so many individuals continue working with the company to meet their financial and life goals.

“We can meet their needs as they change. If they want to buy a house a year from now, but then their car breaks down, we can shift along with the client’s priority to make sure we’re making people happy,” said Andrew.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.