In a Nutshell: Covering unexpected expenses can be a challenge for people without adequate savings. That’s why HonestLoans presents a convenient option for those who need fast access to funding. In a few easy steps, borrowers can apply for loans and cash advances, get approved, and receive their loan in about 24 hours. Millions of Americans rely on small loans to meet expenses, and HonestLoans offers options for covering immediate financial needs. What’s more, responsible repayment of these loans can often improve a borrower’s credit score and help them qualify for better products in the future.

From broken-down vehicles to costly medical problems, emergencies can happen to anyone at any time.

About half of US adults said they had less than $400 set aside for emergencies at the start of 2017, according to a MarketWatch report. Which explains why about 15 million Americans resort to taking out a small loan, like a payday advance, to cover unexpected expenses. According to Finder.com, 34% of Americans took out a personal loan in that same year.

In urgent situations — like the ones experienced by the 85.3 million people who took out personal loans in 2017 — consumers lacking savings often need timely access to funding. Relying on a network of trusted lenders, platforms like HonestLoans help consumers whose credit issues prevent them from qualifying for prime lending products.

![]() “It typically doesn’t matter if you have no credit, bad credit, or good credit — we try to work with everybody,” said an HonestLoans spokesperson.

“It typically doesn’t matter if you have no credit, bad credit, or good credit — we try to work with everybody,” said an HonestLoans spokesperson.

“Consumers can connect with many lenders through HonestLoans. We have lenders who cover the majority of the United States,” the spokesperson continued.

The platform helps consumers find the offer they qualify for and quickly gain access to funding. Loan amounts range between $100 and $2,500, and in some cases, more. It only takes a few minutes to apply, and clients can usually gain access to the money they need in as little as a day.

Many Americans Rely on Personal Loans To Meet Expenses

The typical American consumer has an average FICO score of 700, according to a Money magazine report. Most scores fall between 660 and 720, which the Consumer Financial Protection Bureau considers as fair — not bad, but not great, either. According to Experian, 21.2% of US credit scores sat below 600 in 2017. This is considered subprime, and a consumer with a score in this range will likely have difficulty accessing the most optimal financial products.

The research FICO conducted for Money magazine shows a higher proportion of subprime scores among younger generations. People who are now in their 30s were reaching adulthood around the time the recession hit in late 2007. After the crash, good jobs were hard to come by, income was low, and credit became increasingly difficult to access and build.

Now, this age group is entering a phase of life when they’re getting married, taking out mortgages, raising families — and incurring significant expenses. Access to personal loans can help consumers cover their financial obligations in the interim and move on with their lives.

But the situation for the 14% of the US population considered to be credit invisible is more strained. These people have no credit history and no score by which to be judged. This further restricts the loans they qualify for and limits their options when faced with a need for emergency funding.

For people in these and other less-than-ideal positions, HonestLoans offers people alternatives to prime products normally outside their financial reach. “You can get an installment loan or cash advance loan, depending on what you qualify for,” the spokesperson said.

Timeliness and Peace of Mind for Online Applicants

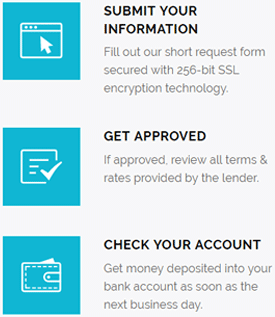

Applying for loan product through HonestLoans is secure and simple; you can do it on any device at any location. To get started, potential borrowers need only fill out their basic personal and financial information.

“Usually, it takes about five minutes or less,” the spokesperson said. “Once they submit their information, they’ll typically know within five minutes whether they’ve been accepted or rejected for a loan.” This is much faster than getting a loan from a bank, which can sometimes take days.

Consumers are under no obligation to accept any offers HonestLoans presents to them.

But, if they apply and find one with the terms and conditions that match their needs, they can get approved in minutes and receive their funding within a day.

The exact time to delivery can vary by the lenders available through the HonestLoans network. Additionally, some lenders may do a hard credit check on applicants. Many lenders report repayments to the credit bureaus, and in these cases, responsible repayment habits can improve a borrower’s credit score. This helps put the consumer in a position to access better financial products in the future.

Security is an important factor for anyone filling out personal information online, and HonestLoans has got consumers covered. “We have a 256-bit SSL encryption technology for all of our forms,” the spokesperson said. This bank-level encryption scrambles information en route from a user’s device to the HonestLoans servers, and it is only decrypted once it safely reaches its destination.

With HonestLoans, borrowers can enjoy fast access to funds when the need arises. And thanks to the platform’s security measures, users can rest assured their information is protected, letting them focus on more pressing matters.

HonestLoans Matches You With Your Best Possible Offer

HonestLoans product offers allow consumer to receive a loan in as little as 24 hours. But, even if they don’t qualify for a personal loan, HonestLoans provides them with other options.

“HonestLoans is a blended offer. Underneath the personal loan tree, it entails installment loans and cash advance,” the spokesperson said.

Installment loans are paid back over a set term and a set number of payments. Cash advances, on the other hand, typically have higher rates and a shorter term.

“That’s why we have the hybrid offer: Honestloans attempts to match each applicant with an installment lender first, and if the applicant does not qualify, then we attempt to match the applicant with a cash advance lender,” the spokesperson said.

If a borrower chooses a cash advance, HonestLoans will take them through the offers and help them find one that fits their situation. And, if they don’t qualify for any of these, HonestLoans will present them with partner offers that may meet the borrower’s needs.

“You’re not going to get that by just going and applying to a direct lender by themselves,” the spokesperson said.

Access to Funds When Consumers Need it Most

When the need for emergency cash arises, you must act quickly.

HonestLoans is committed to helping match consumers with loan offers from partners who can approve and disburse funding in a timely manner. The platform accommodates this pressing need for cash, giving people access to the money they need and when they need it most.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.