Mobile homes. Manufactured homes. Modular homes. Factory-built homes have been with us for a long time, yet many consumers don’t understand how the various types differ, why someone would consider living in one, and how they can finance their purchase.

That’s a shame because this type of housing provides an affordable alternative to stick-built homes. Builders have greatly improved mobile homes since they emerged in the 1950s. You can buy a brand-new, good-quality mobile home today for less than $100K, and you can occupy it in as little as two months.

In an era when a site-built starter home can easily cost $260K, it’s wise to consider all your manufactured home financing options, especially if you have bad credit. In this article, we cut through the confusion surrounding factory-built homes and review the best loans to finance their purchase.

You may come away with a new appreciation for this housing option and consider joining more than 17.5 million Americans who currently live in manufactured homes.

Best Government-Insured Mobile Home Loans

The following government-backed loans are available for mobile homes attached to a permanent foundation.

- Offers 100% Financing, Low rates and Affordable Payments.

- Helps lenders work with low and moderate income families living in rural areas to make home ownership a reality.

- Loans can be used for repairs and rehabilitation; physical disability equipment; connection fees, assessments or installment costs for utilities; and essential household equipment.

- Loans can include closing costs and reasonable/customary expenses associated with the purchase

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1897 | 9 Minutes | 9.0/10 |

USDA Rural Housing Loans can guarantee financing for mobile, manufactured, and modular homes. The USDA guarantees units that a manufacturer has built within the last 12 months and that the buyer purchased from an approved dealer or contractor.

Manufactured single-wide homes must be at least 12 feet wide and have a minimum of 400 square feet of living space. Double-wide homes must be at least 20 feet wide.

USDA home loans allow you to have a debt-to-income (DTI) ratio as high as 41%. With no down payment requirements, looser credit and income restrictions, and affordable PMI (i.e., private mortgage insurance) rates, a USDA loan may save you thousands of dollars in the long term.

- For military veterans, service members, their spouses, and other eligible beneficiaries only

- No down payment and no monthly mortgage insurance

- The basic entitlement available to each eligible veteran is $36,000

- Lenders generally loan up to 4 times a veteran’s available entitlement without a down payment

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies by Applicant | 1944 | 9 Minutes | 7.5/10 |

The VA-Guaranteed Home Loan Program guarantees mobile home loans to service members and veterans. The loan’s term can be as long as 25 years for larger units and 20 years for smaller ones.

Units must have a minimum floor area of 400 square feet if it’s single-wide or 700 square feet if it’s double-wide. Buyers must permanently affix the unit to the home site. The VA guarantees 25% to 50% of a manufactured home loan, depending on the loan amount.

VA-backed loans may waive the down payment and PMI requirements. These loans don’t require a minimum credit score, although the direct lender may impose one. The interest rate on a VA loan will be lower than that for a conventional loan.

3. FHA Title I Program

You can use the FHA Title I Program to guarantee a loan for a mobile home and/or lot. Generally, the loan term is 20 to 25 years, with maximum loan amounts of $69,678 for the house alone and $92,904 for a home and lot.

Unlike other government-backed loan programs, this one doesn’t require you to permanently attach the mobile home to the land.

- $69,678 maximum loan amount, $92,904 for home and lot

- 20-25 Year loan term

- Scores as low as 500 approved with 10% down, but scores below 580 require you to put 10% down.

Borrowers must occupy the financed mobile home as their principal residence.

The FHA also offers the Title II Program for permanently affixed mobile homes. The financed unit must comply with Model Manufactured Home Installation Standards and all applicable state and local requirements.

Best Conventional Loans For Mobile Homes With Fixed Foundations

Conventional mortgages aren’t government-backed. This mobile home financing option may take less time to close and offer benefits unavailable from backed loans. The following lenders offer conventional mortgages for mobile homes directly attached to their sites.

- America’s largest mortgage lender

- The entire process is completed online

- Options for new mortgages and refinancing existing mortgages

- Award-winning customer service and cutting-edge digital platforms

- More than 90% of clients would recommend us

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

Rocket Mortgage offers mobile home financing for units on permanent foundations. It does not finance mobile homes built before June 15, 1976, or manufactured homes that the buyer has not attached to a permanent foundation.

The lender requires a minimum down payment of 5%. JD Power has named Rocket Mortgage as Number One in customer satisfaction for 12 of the last 13 years.

5. Fannie Mae MH Program

The Fannie Mae MH Program provides manufactured home financing and requires a minimum credit score of 620. You can get a mortgage loan on units ranging from affordable single-wide homes to ones with site-built features. You can remove the required mortgage insurance once you reach 20% equity ownership.

- Minimum credit score of 620

- Up to 30-year loan term

- Fixed-rate and adjustable-rate mortgages are available

To be eligible for a Fannie Mae loan, a manufactured home must be at least 400 square feet in size and 12 feet wide, and constructed to the HUD Code for manufactured housing. That means it must be built on a permanent chassis, installed on a permanent foundation system, and titled as real estate. Fannie Mae offers mobile home mortgages with loan-to-value (LTV) ratios of 80% to 95%.

6. Freddie Mac

Freddie Mac offers manufactured home mortgages for low- and moderate-income borrowers who want conventional financing terms. It provides fixed- and adjustable-rate loans for primary and secondary residences.

- 640 minimum credit score with a LTV 75%

- Up to 30-year loan term

- Mortgage insurance coverage required

The lender charges closing costs of 0.5% on its manufactured home mortgages and requires borrowers to buy mortgage loan insurance.

Eligible properties must be at least 12 feet wide and have a minimum gross living area of 600 square feet. Units must attach to a permanent chassis. Freddie Mac offers manufactured home loans for terms of up to 30 years with a maximum LTV ratio of 95%.

Best Conventional Mobile Home Loans

The following lenders offer conventional loans for mobile homes that the buyers have not permanently attached to their sites.

- Options for home purchase or refinance

- Get 4 free refinance quotes in 30 seconds

- Network of lenders compete for your loan

- Trusted by 2 million+ home loan borrowers to date

- Interest rates are near all-time lows

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2004 | 4 minutes | 8.5/10 |

The FHA Rate Guide is an online source for editorial content and directory information on mortgages and refinancing loans. The company’s lender network can offer multiple mobile home loan offers in minutes. It is neither a part of the Federal Housing Administration nor an FHA loan provider.

Each FHA Rate Guide direct lender sets its loan APRs, fees, and payment schedules. Before approving a manufactured home loan, a potential lender must verify the property’s location and type, and the borrower’s credit history, income, debts, and other factors.

- Easy to OwnSM programs give options for those with lower income, limited credit history, and low down payment needs.

- Provides the potential for minimal out-of-pocket expenses with seller contributions.

- Offers loans that don’t require monthly mortgage insurance.

- Requires less cash upfront for your down payment and closing costs.

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1852 | 6 Minutes | 8.0/10 |

Wells Fargo Home Mortgage offers conventional and government-backed mortgages for single-wide and double-wide manufactured homes. The bank promises a competitive interest rate and flexible loan terms, but be on the lookout for high closing costs.

You can apply online and receive guidance from the bank’s experienced loan officers.

What Is a Mobile Home?

Homebuilders construct mobile homes in factories and deliver them to customer sites. Using a factory allows homebuilders to optimize manufacturing without contending with site conditions or the weather. The builder prefabricates the home in one or more sections attached to a permanent chassis.

People often use terms such as “house trailer” or “park home” to refer to mobile homes, a term that manufacturers introduced in 1956 for homes at least 10 feet wide. But don’t confuse mobile homes with recreational vehicles on wheels that you can drive or tow at will.

Mobile homes have frames and joinery made of steel. They must conform to federal housing regulations. Buyers can place mobile homes on a stable foundation or posts.

Most mobile homes are single-wide (up to 18 feet wide) or double-wide (widths exceeding 20 feet). Triple-wides are also available but are a small part of the market. The typical length of a mobile home is 60 to 90 feet. Mobile home sizes range from less than 1,000 square feet to more than 2,000 square feet.

Buyers must prepare the delivery site where the home will be located and, if desired, allow the installer to affix it to a permanent foundation. States tax mobile homes as real estate rather than as vehicles. They also set rules governing the construction, zoning, and transport of mobile homes.

How Do You Buy a Mobile Home?

There are about a dozen major manufacturers of mobile homes, including Clayton, Champion, Fleetwood, and TRU. You can view different models online and in showrooms.

Most sellers offer online tools to filter your selections. For example, you may want a set number of bathrooms or at least 1,200 square feet of floor space. Seller websites may allow you to virtually tour select models.

Sellers usually quote the price of bare-bones models and then upsell various options that may double the final cost. Manufacturing and delivery times vary with demand and location but may take as little as two months.

After you negotiate a home’s final configuration and price, you make a down payment and sign a purchase agreement. Many buyers arrange loan preapproval from mobile home lenders to establish a budget and minimize financing delays.

How Do Mobile Homes Compare to Manufactured and Modular Homes?

While still in everyday use, the term “mobile home” refers to factory-built structures that manufacturers constructed before 1976 when the Department of Housing and Urban Development (HUD) created new regulations.

These Manufactured Home Construction and Safety Standards address various concerns related to mobile home construction, fire resistance, structural integrity, and energy efficiency.

The industry adopted the term “manufactured home” to replace “mobile home” after the Housing Act of 1980. In the common vernacular, people use the two terms interchangeably.

Builders construct, assemble, and deliver manufactured homes in one or more sections that comply with HUD standards. Builders then affix the manufactured home to a steel frame before transporting it to the home site. Installers perform only minimal site work upon delivery of the manufactured home.

You can move a manufactured home if it sits on a pier and beam foundation. But you can also permanently affix a manufactured home to a foundation, basement, or crawl space.

Builders also construct factory-built structures they call modular homes that consist of multiple sections they transport and assemble on-site without first attaching a steel frame. Every modular home must comply with state and local building codes that apply to traditional site-built homes. Those codes set specific standards, including foundation wall requirements, minimum roof pitch, and overhang length.

Some localities require installers to place modular homes on permanent foundations without a steel frame, while others allow on-frame foundations and lower-pitch roofs.

The average modular home costs more than the equivalent manufactured home due to its higher building standards, greater design flexibility, and better resale value.

In 2016, the Manufactured Housing Institute created a new prefabricated home category — CrossMod® — to add site-built features to manufactured and modular homes. These include garages, covered porches, permanent foundations, and high roof pitches, among other features.

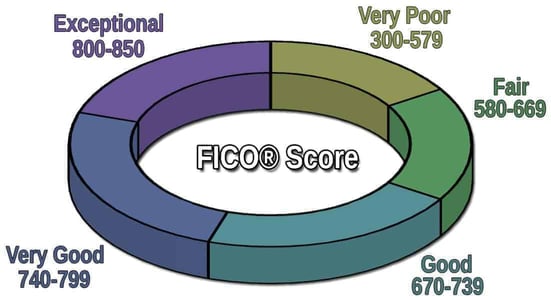

What FICO Score Do I Need to Finance a Mobile Home?

Many conventional mobile home lenders prefer borrowers to have FICO scores of 620 or higher. But some will lend to borrowers with lower scores.

FHA Title 1 loans require a score of at least 500, which is a relatively low credit score. Some government agencies that guarantee mobile home loans do not require a minimum credit score.

Nonetheless, the lenders that issue the guaranteed loans may set a minimum FICO score requirement.

Finance a Mobile Home With the Best Loan

When it comes to manufactured home financing, you have choices. You can get a conventional loan from a bank, credit union, or specialized mobile home lender. If you prefer, you can apply for a government-backed loan that favors consumers with low income or subprime credit.

The good news is that prefabricated homes are usually less expensive than the block or stick-built variety, allowing more Americans to participate in the dream of home ownership.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.