In a Nutshell: The journey into adulthood can be daunting. Young people are often faced with making decisions about their finances and their future that school didn’t prepare them for. The Realworld app guides young adults through these challenges and gives them the tools and knowledge they need to begin adulthood on the right foot. The app addresses a wide range of important topics, including budgeting, understanding credit, saving for retirement, renting an apartment, choosing healthcare providers, and much more in a collection of convenient and accessible playbooks.

The story is all too common — a person graduates from high school or college and is ready to embark on their career only to run into a number of challenges they didn’t anticipate. Obstacles like learning how to budget money, avoiding debt, choosing the right healthcare option, and building a good credit history.

I’ve heard this story many times over the years, and I even ran into some of these issues myself after earning my undergraduate degree. While schools provide knowledge and resources that can be applied adeptly to the career field of our choosing, they don’t always teach us the practical skills to navigate the real world.

That’s where the Realworld app comes in.

The platform was founded by CEO Genevieve Ryan Bellaire who also experienced these kinds of challenges when she was ready to strike out on her own.

The platform was founded by CEO Genevieve Ryan Bellaire who also experienced these kinds of challenges when she was ready to strike out on her own.

“After I graduated from college I went straight into law school — I’m a lawyer by trade — and I did a JD MBA program,” Bellaire explained. “So it was another four years of graduate school, essentially, before I actually started working. So my entrance into the real world was delayed in the sense that I actually started working on my first real job when I was 26, as opposed to 18 or 22.”

Bellaire said she began to try to navigate the world of choices that were being put in front of her, and not always making the best decisions.

“I realized very quickly that, despite all that education and how blessed I’d been from that perspective, I just had never really learned a lot of the practical real-world skills in school,” she said. “And I just made a bunch of mistakes. And they were similar mistakes that a lot of people make across everything from finances, to not getting renter’s insurance to choosing the wrong health insurance plan, and wasting a lot of money there.”

A Single, Comprehensive Platform for Navigating the Challenges in Early Adulthood

Bellaire said that when she began running into these kinds of challenges, she initially turned to Google, which presented her with so much varying information that she didn’t know which sources to trust.

“You have to know what you’re looking for,” she said. “It’s very hard to know the things you don’t know. So the idea behind Realworld was to create a single platform that is a comprehensive playbook to navigating early adulthood.”

With Realworld, people can begin their journey into adulthood with the right tools to understand things like how to start out on firm financial footing and not fall into debt, or how to choose a credit card that’s right for you.

Genevieve Ryan Bellaire is the Founder and CEO of Realworld.

“It can help you set yourself up across your finances proactively, help you figure out health insurance, help you understand your living situation, help you understand how taxes work — all of these things you didn’t learn in school,” Bellaire said.

Realworld also provides a place where users can keep track of their various accounts and obligations and manage them over time.

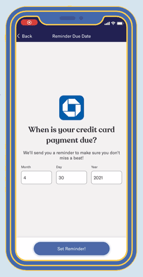

“The product, which is primarily a mobile app that has a web component, can remind you every month to pay rent or remind you to check your credit score,” Bellaire said.

These kinds of simple reminders can be invaluable when it comes to establishing a solid financial track record and being able to stay away from the pitfalls of debt during early adulthood. Debt is difficult to manage at any stage, but when someone is just beginning their journey and they are already in debt, it can take a lot of work to climb out.

Bellaire said Realword also provides all the information and access to service providers and other important resources that can help them make those important decisions.

“It’s really almost like a customized playbook for adulting,” she said.

The Realworld Starter Pack Offers a Collection of Essential Playbooks that Help with Finances

Bellaire discussed Realworld’s strategy of presenting valuable information compiled into playbooks to help users along their adult journey. Many users begin with the Realworld Starter Pack, a digestible collection of playbooks designed to address some of the most common challenges young adults face.

“The Starter Pack is comprised of the top 15 playbooks that we found that people need to get to level one of adulting,” she said.

The Realworld app helps young adults navigate life decisions they aren’t prepared for during school.

The Realworld Starter Pack addresses important topics like budgeting, checking accounts, credit scores, emergency savings, and retirement in the finance realm. And it also provides playbooks for health-related issues, including dental insurance, health insurance, and mental health. The pack addresses other common issues like finding an apartment, searching for jobs, and understanding renters insurance, as well.

Bellaire said the company offers the Starter Pack because it gives users a convenient place to start that helps them take those important first steps into adulthood.

Realworld offers plenty of other playbooks as well.

“Once you’ve got the basics down, the idea is to then add the next categories,” Bellaire said. “That may be something like moving to a new state and knowing what things you’ll need to do, like obtaining your driver’s license, voter registration, etc.”

Users can search Realworld’s playbook library to find just what they need.

“First day paperwork due? Medical bill arrive in the mail? Search for what you need, when you need it. We’re on standby with the 411 for those adulting 911s,” according to the company.

Bellaire said new users can share what’s most important to them and what areas they need help with during onboarding, ensuring that Realworld can get them on the right path.

And it’s all available in the convenience of a mobile app, which also serves as a kind of day planner for adulting.

“Keep track of accomplishments, organize products, and schedule reminders with our mobile app,” according to the company. “Realworld is in your pocket whenever, wherever you need us.”

Budgeting and Understanding Credit are Important Lessons for People Starting Their Careers

Here at BadCredit.org, we’re always diving into the ins and outs of how innovative companies are able to help people with their finances, whether that’s building credit, getting out of debt, or learning about saving for retirement.

Bellaire agrees that the financial component of Realworld is one of the most crucial aspects of the app.

Realworld can remind users about important dates, including when credit card payments and rent is due.

“One thing that’s most relevant right now — because it’s graduation season — is just generally thinking about credit and budgets,” the CEO said. “It’s so important to do that proactively. So, for people who are graduating from school, it’s the perfect time to actually get your life together across these topics so you’re not playing catchup later.”

And this underscores what Realworld as a product is all about, Bellaire said.

“Let us introduce you to these fundamentals and help you get set up so that, at the very least you know what you don’t know and can get set up in those areas,” she said. “I think graduation is one of those times where it’s really overwhelming for people. They’re experiencing a lot of new things — even just starting a new job or whatever it might be. We hope that we can be a tool to be really helpful during that time.”

When recent graduates are embarking on their journey into the real world, it’s a great time to think about credit and understand what their baseline is and how they can improve, Bellaire said.

“Or maybe they graduated with limited or no credit because they didn’t have a credit card in school. It’s a great opportunity to start building that,” she said.

Bellaire said she hopes that Realworld can serve as a kind of sidekick for adulthood.

“More than just teaching people about these things, we really want to be that trusted partner that’s helping you navigate these different questions over time,” she explained. “And, hopefully it can be something that helps the next generation be smart across all of these different areas going forward.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.