In a Nutshell: When you’re an immigrant to the US, whether as an international student or in the US on a visa, getting approved for a loan can be difficult — if not impossible. This is primarily because most financial institutions rely on traditional criteria like credit score, earnings, residency status, length of credit history, and other factors that work against an immigrant population. Stilt is a relatively new lender started by two international students from India, Rohit Mittal and Priyank Singh, who shared the belief that people from other parts of the world are a valuable resource worth supporting financially, and who understood from personal experience the need for specialized loan products. Using data on employment status/employability, education, and past financial behavior, Stilt is able to identify low-risk loan applicants and helps them build a positive credit history through responsible repayment.

As with most high-achieving teenagers, Dulce studied hard in high school, and, after graduating, she was accepted into a state college.

Also, like many other college-bound youths, she had no idea how she was going to pay for tuition or books, let alone living expenses. But Dulce’s situation was different. Her parents had brought her to the US when she was 6 years old to escape the desperate poverty and warring drug gangs of their home in southern Mexico. Fortunately, just as Dulce and her family were wrestling with how to pay for school, she received DACA (Deferred Action for Childhood Arrivals) status, which allowed her to work while still taking a full class load.

Near the end of her final semester, Dulce needed to stop working to devote all of her time to studying for her finals. With no income, she needed money to meet her basic expenses. That’s when she heard about a new loan program for immigrants just like her.

While most traditional loans were outside the reach of a DACA recipient with little credit history, one lender was willing to help. Stilt is a recently established online lending platform focused on providing loans to newcomers and visa holders in the US, as well as others who are underserved by traditional lenders.

While most traditional loans were outside the reach of a DACA recipient with little credit history, one lender was willing to help. Stilt is a recently established online lending platform focused on providing loans to newcomers and visa holders in the US, as well as others who are underserved by traditional lenders.

With her loan from Stilt, Dulce was able to graduate and receive her teaching credentials. She is the first in her family to attend college, and now works as an educator.

We recently spoke with Rohit Mittal, CEO and a Co-Founder of Stilt about the idea behind this unique lending platform.

“More than 80% of our borrowers don’t have any other loan options because of their visa status and limited credit history,” Mittal said. “Since DACA went into effect in 2014, many people were able to go to school and work for the first time. They were able to get a Social Security number and access to limited products like secured credit cards.”

Immigration is a hot-button issue in the US, with equally passionate arguments from both supporters and detractors. One thing that can’t be argued, though, is people who are new to the US often have a difficult time navigating the complex American economic system. Stilt is making life a little easier for this population by providing them access to loans with fair rates and helping them build credit in the process.

Using FinTech Advancements to Improve Loan Access

Stilt is the brainchild of Columbia University roommates Mittal and Priyank Singh, themselves very familiar with the financial struggles immigrants and visa holders face. They had set out to test the idea of a better credit risk data model they could apply to borrowers who didn’t fit the typical approval criteria. When they first presented the idea, it won top honors at a startup event.

Rohit Mittal, CEO and a Co-Founder of Stilt.

“We use advanced analytics based on cash flows and non-credit data to determine ability to repay,” Mittal said. “Data analytics is at the core of our business. We developed internal technologies to automate the loan application and decision-making process. Our data-driven decision-making also removes any biases in making loan approvals.”

The alternative financial and other data Stilt uses in the loan approval process can include employment or employability, education or school performance, and records of financial behavior such as paying rent or other bills.

All of this technology is aimed at discovering the creditworthiness of borrowers using non-standard data and converting it into something quantitative. The fintech algorithms developed by Mittal and Singh help Stilt accurately identify the individuals most likely to repay their loans and also helps set the interest rate they will be charged.

“We can make instant decisions on loan applications using proprietary machine learning algorithms,” Mittal said. “Banks still use a lot of paper documents and need back and forth to make decisions, while we’re able to process an application with any documents.”

Building Credit Scores from Scratch

Many US newcomers encounter the Catch-22 of borrowing money: You need a credit score and credit history to get a loan, and you need a loan to build your credit score and credit history. Most foreign-born US residents are unable to access traditional lending products, which prevents them from setting the foundation for a positive credit history.

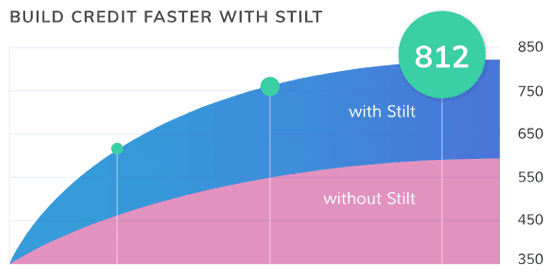

Stilt aims to fix this problem by not only providing the loans these people need, but also by reporting payment history to the three major credit bureaus, Equifax, Experian, and TransUnion. This helps to establish a credit history and can also help build a good credit score through responsible repayment. Plus, one of the factors in the FICO credit scoring model is credit mix. So having a loan in addition to a credit card — even if it’s a secured card — can rapidly begin building credit.

Stilt users benefit from the credit-building aspect of taking out a loan through the platform.

“As a user pays off a loan on time, irrespective of the amount, it helps them build credit,” Mittel said. “A loan also increases the credit mix score of borrowers, as most borrowers have never had a loan in the US before Stilt.”

Beyond gaining access to needed funds, perhaps one of the biggest benefits to people who take out a loan with Stilt is what comes after. By establishing a consistent payment history and beginning to build credit, these folks are opening up the door to more traditional loans and can begin applying for credit cards that don’t require a security deposit.

Why Helping Immigrants Also Helps America

Regardless of where you fall in the debate, most Americans recognize that fairness and the pursuit of a better life are principles this country values and has defended here and abroad. Without access to opportunity, many of the most prominent US businesses we rely on today would not be here.

For example, Bank of America was founded by Amadeo Giannini, an Italian-born banker, in 1904. AT&T was started by Alexander Graham Bell, who hailed from Scotland. Sergey Brin moved to the US from Russia to avoid persecution, and along with Larry Page, founded Google. Elon Musk, who was born in South Africa, is behind innovative companies like PayPal, Tesla, and SpaceX, among others.

America is better because of the opportunities it provides all its residents — including those born outside US borders. Stilt is following in a long tradition of companies that recognize these important contributions and is working to make these opportunities available to more people like Dulce.

“Our products help people build credit, get settled in the US, and have a better financial future,” Mittal said. “Our mission is to build a bank for immigrants. Stilt will be the go-to financial company for immigrants to start a life in the United States.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.