In a Nutshell: RiskSpan helps lenders rest a little easier with advanced metrics that reduce loan risk. The company’s technology parses information that would take hours or days to comb through and analyzes it so lenders can properly adjust pricing to maximize revenue. That fast, thorough process has earned RiskSpan our Editor’s Choice™ Award for reducing lender risk and identifying revenue opportunities.

Automation is becoming more impressive by the day. I used to think setting my air conditioner to automatically turn on and off when I left or returned home was exciting. Today, we are starting to see cars that can drive themselves.

The phenomenon is helping us in the workspace, as well. Tasks that typically take hours or days now only take a few minutes using computer power. Automation is also the key to RiskSpan’s innovative financial technology.

RiskSpan helps investors reduce their risk by finding and creating valuable data points on large amounts of information. Investors use the data to make informed decisions on when to purchase mortgage loans.

RiskSpan started with consultancy 20 years ago. Now, it uses its knowledge and access to information to help all investors. Its products fit the needs of several loan offices across the country.

RiskSpan offers a prospective product that takes in all of the data from Fannie Mae, Freddie Mae, and Ginnie Mae and turns it into a research tool for users. It also offers a predictive product that allows investors to upload and analyze their own data, so they more accurately determine the credit risk of their mortgage loan and MSR investments.

“From a time-saving component, the impact is twofold,” said Joe Makepeace, Product Owner for Loans and MSR at RiskSpan. “One is that all of the information is in the same place. And the second is the flexibility we provide for users to make adjustments on the fly and run analytics on demand.”

For using technology to reduce investor risk and identify revenue opportunities, RiskSpan has earned our Editor’s Choice™ Award.

Building Data Profiles to Predict Market Trends

Investors today use systems that allow money-making opportunities to fall through the cracks. RiskSpan’s technology will enable investors who purchase existing mortgage loans to look very closely at every opportunity and show how they can make money.

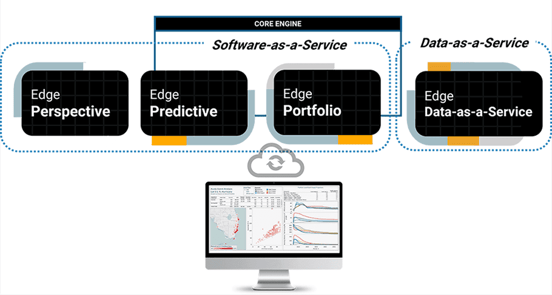

RiskSpan offers these services through its Edge Platform which encompasses cloud-native solutions that provide access to information from anywhere in the world.

Clients can see prepayment speeds for agency collateral throughout history with its perspective product. RiskSpan also has a predictive offering to show what to expect with markets from the industry data. Investors can incorporate climate risk for properties in specific zip codes to see whether it is wise to invest in an area.

“We incorporate climate risk through a third-party climate forecasting company,” Makepeace said. “That’s an example of how we’re incorporating information and using that may not be done in traditional credit modeling.”

RiskSpan can pull information from different sources to create on-demand analytics for its clients, similar to its climate risk data. Its historical platform, which all clients have access to, updates monthly by the agencies that disclose them. Clients always have the most recent information at their fingertips.

Tools Automate Insight Aggregation and Organization

Investors do not have to comb through all of their data by themselves or by hand. With RiskSpan’s automated information aggregation, clients only need to upload their available information. RiskSpan takes care of the rest.

Investors can upload their loan tapes or pools of securities to RiskSpan’s platform. The technology runs through the information and can run cash flow models or prepaid credit models against the securities to understand projected behavior.

This information is critical for investors to determine how much they should spend on mortgage loans so they are not paying too much and losing money.

RiskSpan works with more than 20 banks to improve their service. Bigger banks can use RiskSpan’s portfolio batch service to run overnight risk analytics across the entirety of their structured finance and fixed income book.

Mortgage loans and mortgage servicing rights (MSR) differ from equities in that most mortgage assets continue to trade in a way that is basically emailing spreadsheets. There is no standardized clearinghouse, and many negotiations and transactions happen between the processes.

The process of reading these spreadsheets involves the transfer of Excel files, reading them, cleaning them, and transforming the data into a usable format for banks and investors. RiskSpan’s Smart Mapping tool through the Edge Platform automates all those processes and puts them into the client’s system.

“All those components, the tape cracking, the prepay, the credit, the cash flow engines, are all in the same system,” Makepeace said. “They’re all web-based and in the cloud. Our smart mapping tool certainly saves a lot of time.”

Scaling Systems and Tailoring Information for Clients

The cloud-native system on which RiskSpan bases its technology allows the platform to scale to the client it is working with. Products on the Edge Platform are available for purchase separately or combined.

Setup is straightforward and takes only a few minutes. Lenders log in for easy onboarding once negotiations are complete and contracts are signed. The entire platform is web- and cloud-native, with no software installation needed on the client’s property.

“Onboarding is very easy to navigate,” Makepeace said. “Once all negotiations are complete, it’s effortless for us to turn on the environment and get people up and going.”

RiskSpan’s database will update with new information as soon as the relevant agency releases it. For banks that upload new information to the system daily, RiskSpan can run new risk assessments at any frequency, including daily updates.

RiskSpan’s clients range from large blue chip companies to new clients just starting out. The company focuses on transparency and showing institutions how they can dig and find their own data.

RiskSpan experts personally work with clients so they get what they want from the company’s products. The company develops its offerings based on what its clients need. And Makepeace said RiskSpan is excited to continue to develop enhancements for its MSR product.

“The team is very, very excited about where the platform is,” Makepeace said. “It’s an inspiring time at RiskSpan. I would say we are thrilled about the product and the platform.”