In a Nutshell: Each year, 30% of renters engage in disputes with their landlords or property managers over withheld security deposits. That situation can lead to higher expenses and even debt. RentCheck offers guided self-inspections to help both parties avoid those situations by providing accurate, reliable photographic evidence of an apartment or home’s condition. It helps prevent more costly issues by identifying problems early and offers convenience and safety for tenants, property managers, and landlords.

Lydia Winkler decided to find a new place to live after her first year of law school. After she moved, she didn’t get her security deposit back from her previous landlord. As a law student, Lydia was in a unique position to take her landlord to small claims court — which she did, and she won.

But not every renter has such an in-depth understanding of the legal system, and they may lack the funds to hire a lawyer who can get their money back. Unfortunately, many renters will find themselves in this situation at some point.

“Thirty percent of all renters will have a dispute with their landlord or property manager over a deposit each year, which equates to a $6 billion tug of war over deposit deductions,” Lydia said.

Lydia won her case because she’d taken meticulous photos of her apartment before moving out. This evidence proved that she’d complied with her contract and was due the return. And as the Co-Founder and COO of RentCheck, Lydia gives renters the same advantage she had in her case with additional convenience.

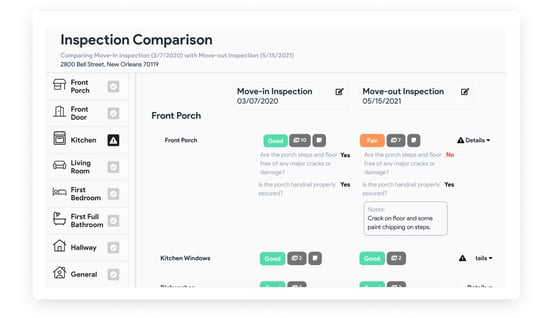

“We enable anyone to do property inspections — whether that’s property managers, people that work with or for property managers, or landlords, or residents — all from their smartphone,” Lydia said. “That increases resident satisfaction by eliminating disputes over deposits because there’s full transparency about the unit condition.”

Security deposit disputes leave billions of dollars in limbo each year, and many consumers could use that money. Losing out on deposit funds can make it harder for renters to make ends meet in the short term, especially with all the extra expenses of moving. In the long term, it can lead to burdensome debt.

Renters Can Conduct Inspections on their Mobile Devices

RentCheck markets its product directly to landlords and property managers. When a landlord requests an inspection — whether tenants are moving or renewing their leases — they enter the tenant’s email address, and RentCheck handles the rest.

Although it’s designed with landlord convenience in mind, RentCheck is built primarily to cater to the tenant’s best interests. It carries no direct cost for renters, and they can quickly and easily conduct detailed inspections using the mobile app.

“The resident just logs in to complete the inspection on their phone,” Lydia said. “And then the property manager can approve and sign off on it.”

RentCheck provides a guided experience. It includes prompts for users to photograph key details, taking them point by point through the inspection to ensure they cover all bases.

Users take photos within the app’s interface, and it tags them with a date and geolocation to ensure total accuracy. Once uploaded, they are stored securely in the cloud.

“Most of the market is still using a paper checklist to do inspections,” Lydia said. “It’s impossible to use written words to accurately verify what you’ve seen with your own eyes because it’s subjective. And that creates disputes, lawsuits, and the experience I had.”

Guided Processes Save Money and Provide Peace of Mind

The stress of that experience is only half the trouble. The other half is the financial hardship and debt potentially incurred when a tenant loses a security deposit.

“By not getting that security deposit back, it inhibits you from moving,” Lydia said. “Most people need that deposit back to move into their next place.”

Tenants can download and use RentCheck for free when they either move in or move out. They get the same guided experience as when a landlord or property manager requests the inspection. And with their photos stored safely in the cloud, they’ll have evidence on hand should a dispute arise.

Landlords pay a monthly fee based on the number of units they own with no long-term contracts.

“We have heard from residents who have used this on their own,” Lydia said. “They’ve been able to get more of their deposit back because they had documentation of what the condition of a certain item or appliance was when they moved in.”

When used at move-in or for lease renewals, RentCheck saves stress and money for tenants and landlords alike. If a problem is developing — a leaky pipe or a crack in the wall — it can be documented, noted, and taken care of before it becomes a problem for the renter. It also protects landlords from issues becoming bigger and more expensive, leading to debt on their end.

Inspection time varies based on the size of the apartment or home. But Lydia said it takes, on average, about half an hour to complete — and it is time well spent.

“It just adds peace of mind for all parties involved,” Lydia said. “Residents, property managers, and property owners.”

Digital Inspection Protects Tenant and Landlord Health

RentCheck was founded in 2019, and one of its most significant features is convenience. Landlords and managers don’t have to visit properties to conduct inspections, they can just use RentCheck. They also don’t have to coordinate with the tenant to be there and let them in. And tenants can conduct inspections on their own time.

In 2020, RentCheck’s convenience offered even more value amid the COVID-19 pandemic. Inspecting properties in person during the pandemic wasn’t just an inconvenience for landlords or managers; it was a potential health hazard for them and their tenants.

“We weren’t built with a pandemic in mind,” Lydia said. “But it just so happens our product enables social distancing.”

At the height of the COVID-19 pandemic, RentCheck allowed property managers and renters to collaborate to conduct inspections and maintenance checks. Thanks to its digital nature, RentCheck removed any need for landlords or managers to enter properties.

Lydia said RentCheck’s user base grew more than 1,000% during the pandemic. This was positive from a public health and safety standpoint, but it also established a foundation for post-pandemic inspections. RentCheck is already established with tenants, landlords, and property managers, so all parties are already situated for fast, convenient, and reliable inspections in the future.

RentCheck: Ensuring Fairness and Transparency in Renting

After renters complete an inspection and all parties sign off on its accuracy, RentCheck prompts them to rate and comment on their experience. Lydia said renters and landlords give the company a rating of between 4.4 and 5 stars, on average, and renters most frequently comment on its thoroughness and ease of use.

RentCheck also asks its users if they’d like to see any improvements to the system. That offers the RentCheck team valuable insights for ongoing development.

“Our entire product road map is informed by our customers, both residents and property managers,” Lydia said. “We care about our customer, which is ultimately the resident, and also the property owner. Because if those two parties are happy, then the property manager is going to be successful.”

In addition to end-user satisfaction, RentCheck has a larger goal within the housing industry: to make renting more fair and transparent. Convenience and ease of use are essential for any successful app, but RentCheck doesn’t streamline inspections for their own sake. It helps protect renters from expense and debt.

“Renting a home is one of the most intimate and expensive consumer experiences,” Lydia said. “People spend more than 30% of their income on rentals. It’s your home.

You want to feel safe in it, and how do you feel safe in it? You want to make sure you’re protecting your security deposit, and you do that by ensuring an accurate and thorough inspection.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.