In a Nutshell: When some friends in a pub complained about how much they spent on cocktails, they did something positive and sketched an idea for a solution on a napkin. That idea became the PocketGuard app, which tracks spending and bill payments, and shows users how much extra money they have available. It also creates practical debt repayment plans and provides constructive feedback to improve spending habits. As an all-in-one budgeting powerhouse packed with conveniences and security features, PocketGuard earns our Editor’s Choice™ Award.

Sound money management is always about balancing what you want with what you need and somehow ending up with a positive balance to achieve long-term goals.

That’s the philosophy behind the PocketGuard app, which combines all the features consumers need to get ahead and stay ahead with their money without bogging people down in minutiae. It’s in the name — PocketGuard sits on your phone, in your pocket, guarding your spending and ensuring users can keep their priorities straight.

PocketGuard is the brainchild of friends who were spending too much money on cocktails. One night, they sketched an idea for an all-in-one spending and savings app on a napkin. The main goal was to help people better manage their money and check their status in a few seconds, any time of day or night.

That was the beginning of a long journey of development and refinement for PocketGuard. Responding to user feedback and their own needs as typical consumers, the PocketGuard team created a practical application that manages accounts, tracks cash and bills, and builds budgets using tried-and-true spending strategies.

PocketGuard also helps users uncover savings opportunities they may not have known they had. The app’s smart system uses sophisticated algorithms to analyze bills and spending patterns, and update users on how much they’ll have to put toward the future at the end of every month.

“We listen to every customer and work diligently to solve problems and make PocketGuard better,” said Dmitry Savransky, Head of Product at PocketGuard.

For continuing to improve its budgeting features and addressing needs for more effective financial planning and education, PocketGuard earns our Editor’s Choice™ Award.

Manage Money and Achieve Budgeting Goals

Compared to some competitors in the financial management space, PocketGuard doesn’t skimp on free features. The free version of the app offers everything users need to make money work for them without compromising functionality.

Everyone understands the key to successful personal financial management is spending with intention. Not surprisingly, budgeting is at the heart of PocketGuard. With PocketGuard budgeting tools, users can plan and reach any financial goal.

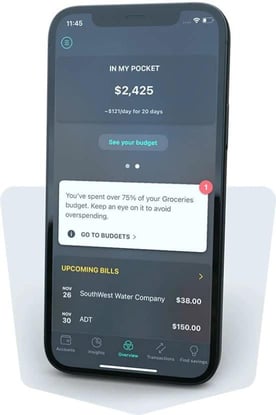

Free users can track up to three budget categories to monitor what matters to them, set priorities, and avoid buying things they don’t need. Notes and hashtags help group expenses for easy reference. Users may wish to group utilities with other home expenses, for example, or eliminate categories that encompass counterproductive spending on friends and social events.

Another feature that helps overspenders stick to their budgets tracks recurring payments such as bills and income. “The system enables users to set a particular bill frequency and due date, and the app notifies them to ensure they make their payments on time,” Savransky said.

The app’s flagship feature, IN MY POCKET, crunches numbers to a single figure to show customers how much they’ll have to save or spend each month after covering necessities. IN MY POCKET works like a financial caretaker that takes into account recurring bill payments, spending in various budget categories, long-term debt payments, and savings contributions to remind users where they stand on a 24/7 basis.

“Our team of developers and product managers used math and business analytics to create the logic behind the feature,” Savransky said. “We’ve gone through several iterations to make it work as planned, and we continue to make adjustments to expand the usefulness of the feature.”

Premium Features Add Power and Flexibility

PocketGuard uses spending reports, pie charts, lists, notes, and hashtags to help users visualize their financial status. The app also tracks net income and net worth.

It’s easy to connect bank accounts, hide accounts and transactions, and refer to a transaction history stretching back three months. Modifying budget categories and switching merchants is also possible. Notifications are available and manageable.

But the story doesn’t end there — another advantage of using PocketGuard is that even the premium tier is a reasonable reach for most users. PocketGuard Plus enables users to benefit from advanced budgeting features and get more long-term value.

PocketGuard Plus enables users to set unlimited savings goals for consumers with more than one iron in the financial fire. It also allows unlimited category budgets and custom budget categories.

“While the free version of PocketGuard enables consumers to easily track their spending and know where their money goes, PocketGuard Plus provides a more detailed picture and shows the way to financial freedom,” Savransky said.

Premium features also expand the flexibility of the app. The free version of PocketGuard allows users to modify dates for cash transactions only, but PocketGuard Plus lifts those limits. Transaction history expands to six months and becomes cumulative.

Cash is also easier to use in PocketGuard Plus — the app permits unlimited cash accounts, duplicate cash transactions and transfers, auto-repeat cash transactions, and transaction imports.

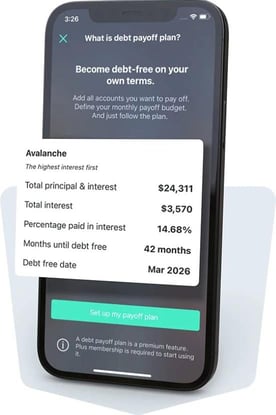

Topping off the additional functionality available in PocketGuard Plus is a debt payoff plan feature that helps people with multiple debts set up a payoff budget that fits their cash flow needs and chooses a payoff strategy.

“PocketGuard will notify which payment has the highest priority based on the strategy and build a personalized payoff schedule with payment cycles, so our customers can see how much remains until the debt-free date,” Savransky said.

PocketGuard: Your Personal Financial Assistant

PocketGuard uses bank-level security and includes free anti-fraud protection to protect against suspicious transactions. The app is available for iOS and Android and offers a robust website for users who prefer financial planning on their desktops.

Savransky’s emphasis on payoff strategies highlights PocketGuard’s commitment to financial education and literacy. PocketGuard works like a personal financial assistant to help users navigate the pitfalls of saving and spending, and learn to prioritize wants and needs constructively because all consumers must have a starting point on their journey to financial independence and success.

On the web, budget and debt payoff calculators take users from start to finish. And a how to get started page delves deeply into the hows and whys of budgeting.

Users learn a step-by-step method for budgeting. Budgeting techniques available in PocketGuard and explained on the web include 50/30/20 budgeting, where 50% of income goes toward needs, 30% to desires, and 20% to savings and emergency funds.

That strategy may not be for everyone. The page also explains zero-based budgeting, which allocates every dollar of income to meet a specific financial goal, and envelope budgeting, which assigns a set cash amount to each monthly category no matter what comes in.

To help users understand the big picture in finance, PocketGuard also offers a money management short course. There, the team shares tips and tricks, and teaches users how to make good decisions about money. Meanwhile, a blog acts as a news site for banking and finance — with more to come.

“Ultimately, our goal is to help users decide what to do next and keep self-educating,” Savransky said. “We plan to add even more educational context to enable users to complete a basic personal finance course, determine why they need PocketGuard, and how we can help.”